Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd And 2 Other Asian Penny Stocks To Watch Closely

As global markets navigate a complex landscape, Asian stocks remain a focal point for investors seeking opportunities beyond traditional boundaries. Penny stocks, despite their somewhat outdated moniker, continue to capture interest due to their potential for growth and affordability. This article explores three Asian penny stocks that exhibit financial strength and the potential for long-term value.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.62 | THB1.1B | ✅ 3 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.53 | HK$2.1B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.47 | SGD13.66B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.77 | HK$2.04B | ✅ 3 ⚠️ 2 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.82 | HK$21.32B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$137.01M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.32 | HK$50.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.89 | NZ$243.04M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 952 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd (SEHK:1349)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd. focuses on the research, development, manufacture, and sale of bio-pharmaceutical products in China with a market cap of HK$7.87 billion.

Operations: The company's revenue primarily comes from its pharmaceuticals segment, which generated CN¥711.63 million.

Market Cap: HK$7.87B

Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd. has a market cap of HK$7.87 billion and primarily generates revenue from its pharmaceuticals segment, with CN¥711.63 million reported recently. Despite being debt-free, the company is currently unprofitable, with losses increasing over the past five years by a significant rate annually. Recent developments include receiving acceptance from China's NMPA for a Phase II clinical trial application of FZ-P001 Sodium for Injection in lung cancer patients, potentially enhancing its product pipeline. The board underwent changes with the dissolution of its Supervisory Committee, transferring oversight responsibilities to the audit committee.

- Click here to discover the nuances of Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd with our detailed analytical financial health report.

- Explore historical data to track Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd's performance over time in our past results report.

Boyaa Interactive International (SEHK:434)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Boyaa Interactive International Limited is an investment holding company that develops and operates online card and board games in the People’s Republic of China and Hong Kong, with a market cap of HK$2.78 billion.

Operations: The company's revenue is primarily derived from its Mobile Game Related Business, generating HK$438.55 million, complemented by HK$61.78 million from its Web3 Related Business.

Market Cap: HK$2.78B

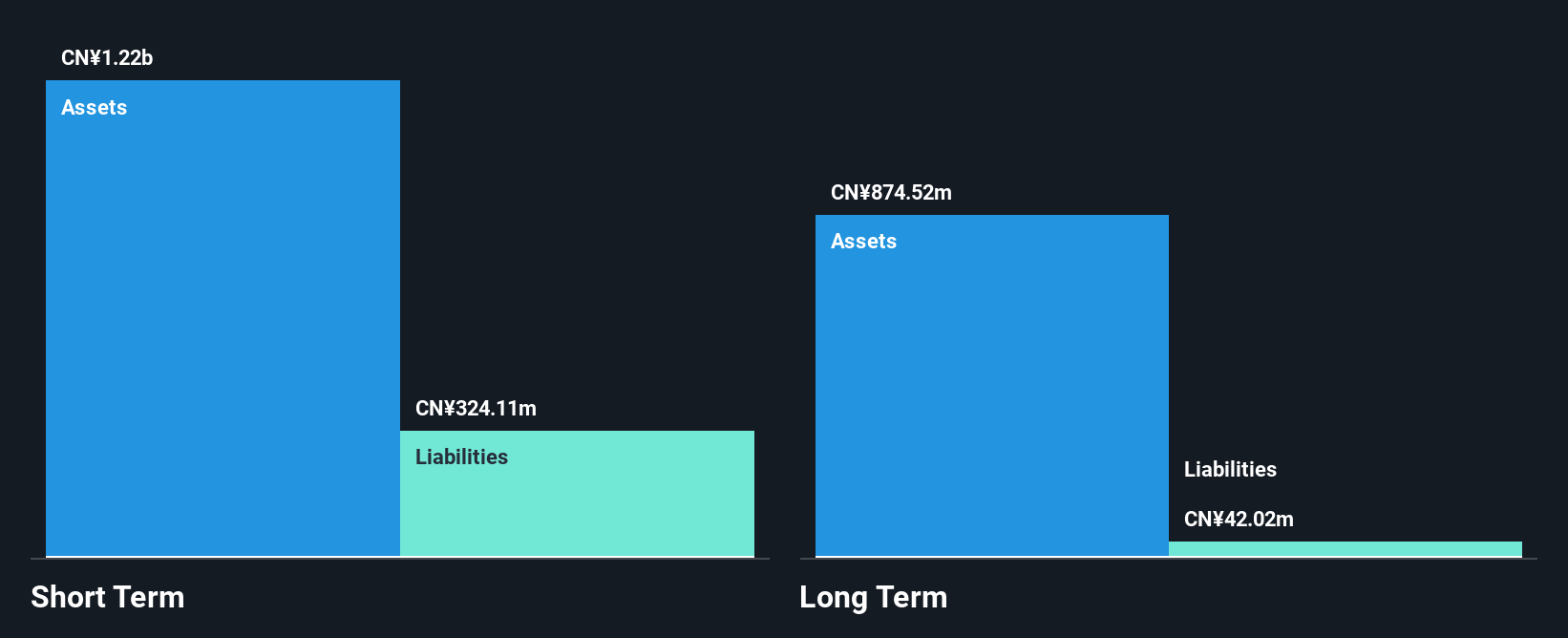

Boyaa Interactive International, with a market cap of HK$2.78 billion, shows strong financial health as it operates without debt and maintains high liquidity with short-term assets of HK$3.9 billion exceeding its liabilities. The company has experienced significant earnings growth, notably 353% over the past year, surpassing industry averages. Despite recent guidance indicating a potential decrease in core profit due to reduced bank deposits and increased tax expenses, Boyaa's Return on Equity remains robust at 33.8%. Trading at a low P/E ratio of 2.3x compared to the market average suggests potential value for investors seeking opportunities in penny stocks within Asia's gaming sector.

- Navigate through the intricacies of Boyaa Interactive International with our comprehensive balance sheet health report here.

- Understand Boyaa Interactive International's earnings outlook by examining our growth report.

Zhongzhu Healthcare HoldingLtd (SHSE:600568)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhongzhu Healthcare Holding Co., Ltd focuses on the research, development, production, and sale of drugs in China with a market cap of CN¥4.87 billion.

Operations: The company's revenue is primarily generated from its operations in China, totaling CN¥570.62 million.

Market Cap: CN¥4.87B

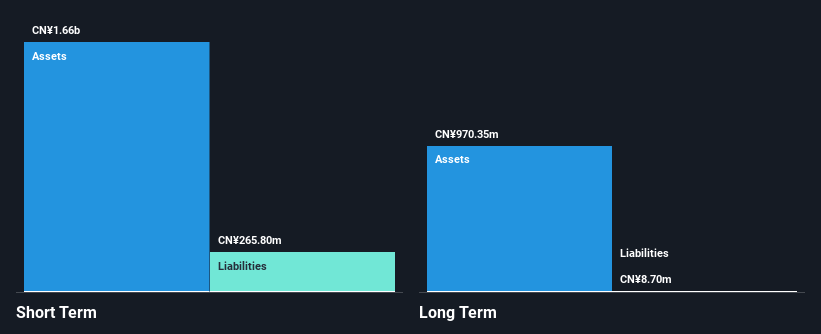

Zhongzhu Healthcare Holding Co., Ltd, with a market cap of CN¥4.87 billion, operates without debt and has robust short-term assets of CN¥1.2 billion, comfortably covering its liabilities. Despite being unprofitable with a negative Return on Equity of -32.97%, the company has managed to reduce its net loss from CN¥92.42 million to CN¥33.79 million year-over-year for the nine months ending September 2025. Revenue increased to CN¥433.13 million from CN¥383.9 million in the previous year, reflecting some positive momentum amidst challenges such as an inexperienced management team and board of directors with an average tenure of 1.1 years each.

- Dive into the specifics of Zhongzhu Healthcare HoldingLtd here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Zhongzhu Healthcare HoldingLtd's track record.

Summing It All Up

- Discover the full array of 952 Asian Penny Stocks right here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com