European Stocks That Could Be Trading At A Discount

As the European market continues to thrive, with the STOXX Europe 600 Index reaching new highs and closing out 2025 with its strongest performance in years, investors are increasingly on the lookout for stocks that may be trading at a discount. In this environment of economic improvement and index growth, identifying undervalued stocks can offer potential opportunities for those willing to explore companies whose current market prices do not fully reflect their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Streamwide (ENXTPA:ALSTW) | €73.00 | €142.93 | 48.9% |

| Recupero Etico Sostenibile (BIT:RES) | €6.56 | €12.99 | 49.5% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.465 | €4.88 | 49.4% |

| NEUCA (WSE:NEU) | PLN835.00 | PLN1647.82 | 49.3% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.60 | NOK66.30 | 49.3% |

| Jæren Sparebank (OB:JAREN) | NOK380.00 | NOK751.23 | 49.4% |

| Fodelia Oyj (HLSE:FODELIA) | €5.48 | €10.72 | 48.9% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.13 | 49.1% |

| Benefit Systems (WSE:BFT) | PLN3615.00 | PLN7101.03 | 49.1% |

| Atea (OB:ATEA) | NOK153.00 | NOK300.33 | 49.1% |

Let's explore several standout options from the results in the screener.

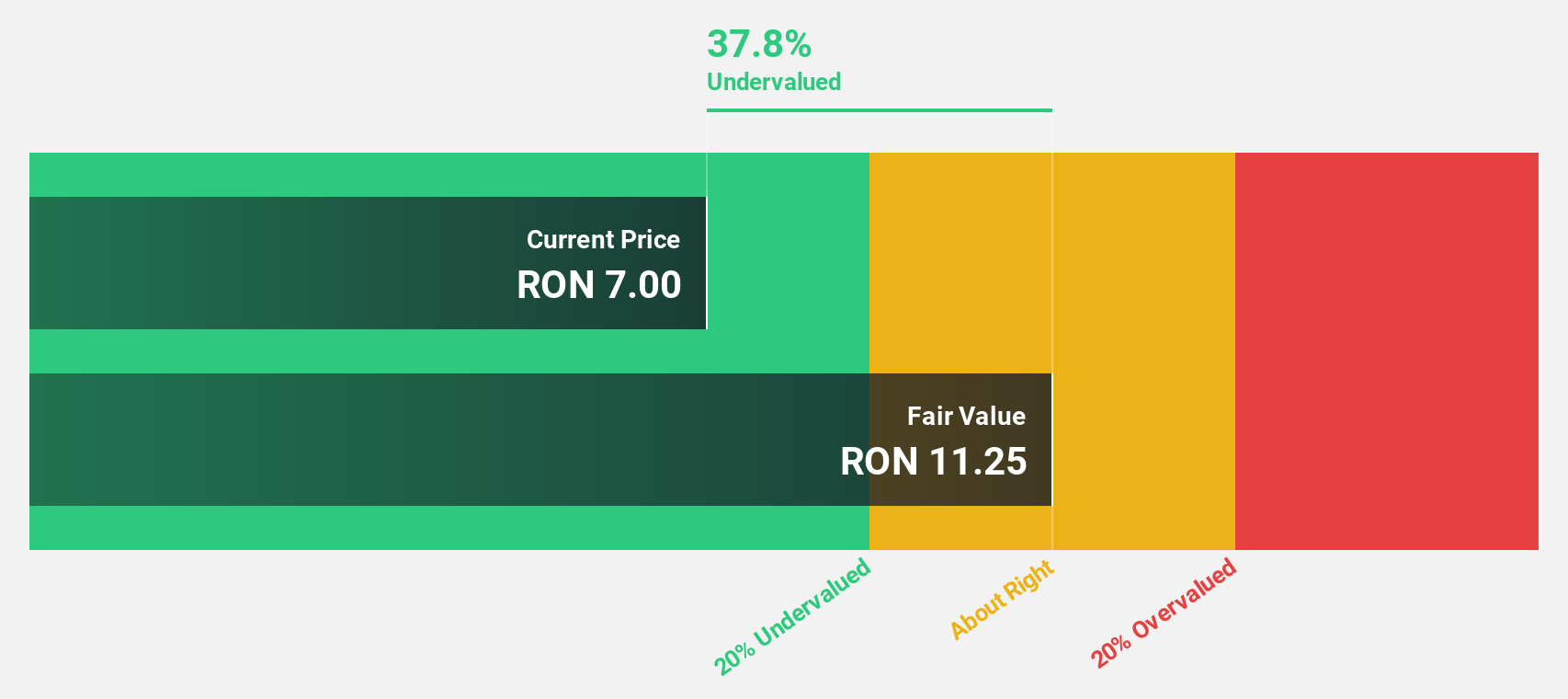

SNGN Romgaz (BVB:SNG)

Overview: SNGN Romgaz SA is engaged in the exploration, production, and supply of natural gas in Romania with a market capitalization of RON39.70 billion.

Operations: The company's revenue segments consist of RON7.85 billion from upstream activities, RON614.59 million from storage, and RON485.92 million from electricity.

Estimated Discount To Fair Value: 21.7%

SNGN Romgaz is trading at RON10.3, significantly below its estimated fair value of RON13.15, suggesting it may be undervalued based on cash flows. Its earnings are forecast to grow by 11.23% annually, outpacing the broader Romanian market's growth rate of 8.7%. Recent financial results show strong performance with third-quarter net income rising to RON755.09 million from RON436.44 million year-on-year, highlighting robust cash flow generation despite a high level of non-cash earnings.

- Our comprehensive growth report raises the possibility that SNGN Romgaz is poised for substantial financial growth.

- Dive into the specifics of SNGN Romgaz here with our thorough financial health report.

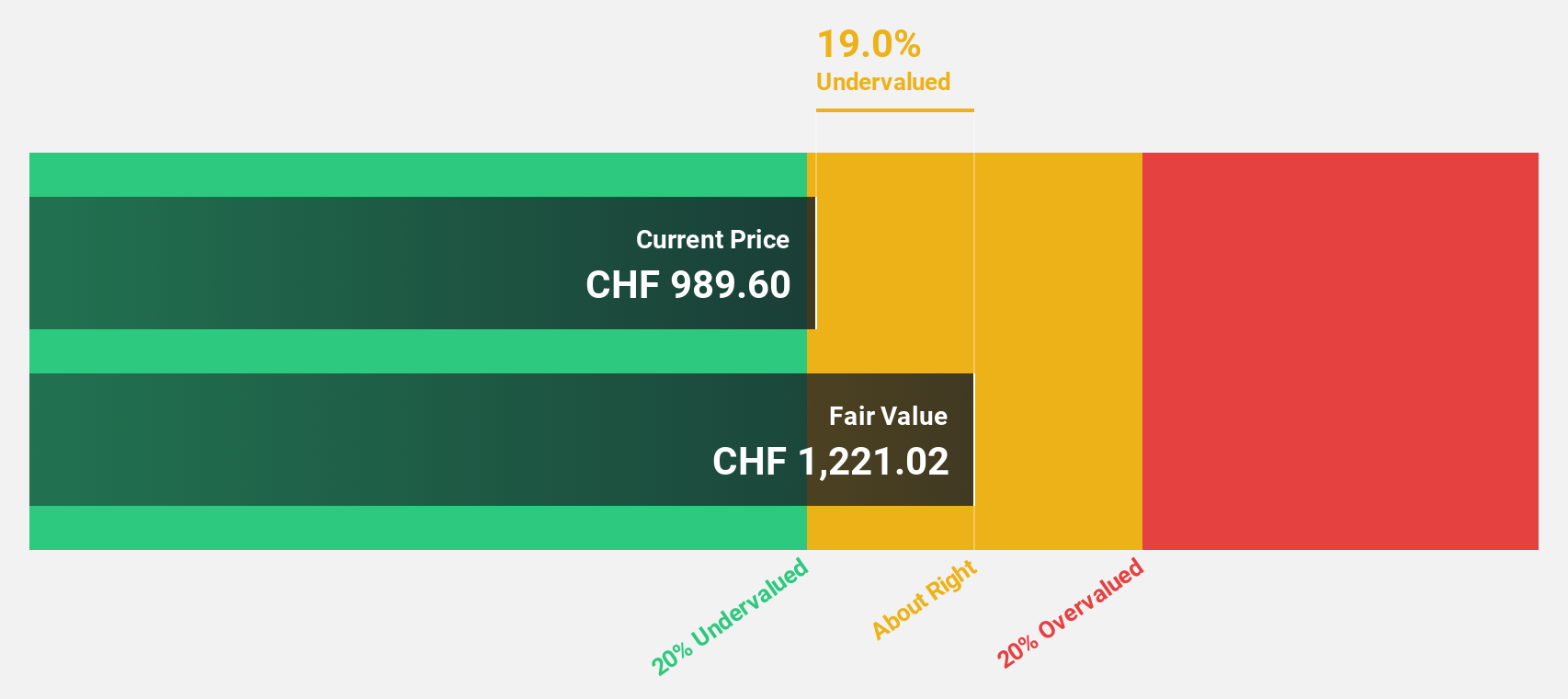

Partners Group Holding (SWX:PGHN)

Overview: Partners Group Holding AG is a private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt with a market cap of CHF26.72 billion.

Operations: The revenue segments for Partners Group Holding AG include CHF1.43 billion from Private Equity, CHF471.40 million from Infrastructure, CHF215.80 million from Real Estate, and CHF207.40 million from Private Credit.

Estimated Discount To Fair Value: 23.2%

Partners Group Holding, trading at CHF1030, appears undervalued with a fair value estimate of CHF1340.99. Despite high debt levels and unsustainable dividends, its earnings are projected to grow annually by 10.6%, surpassing the Swiss market's growth rate. The firm recently expanded its hospitality real estate portfolio by acquiring The Hoxton Poblenou in Barcelona, capitalizing on tourism growth and limited hotel supply in the city center, which may enhance future cash flows.

- Insights from our recent growth report point to a promising forecast for Partners Group Holding's business outlook.

- Take a closer look at Partners Group Holding's balance sheet health here in our report.

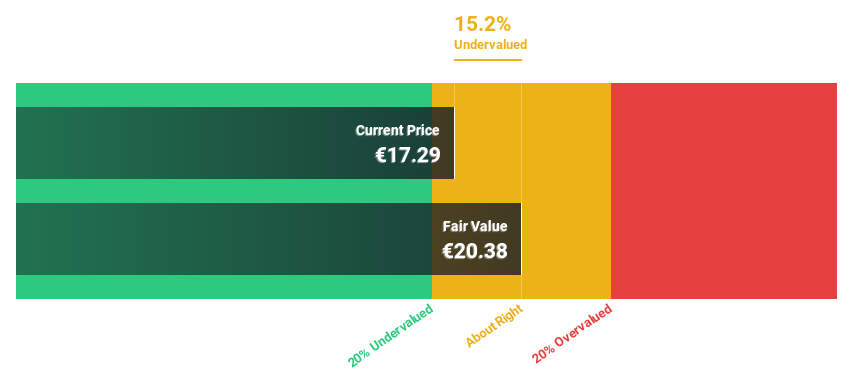

Nordex (XTRA:NDX1)

Overview: Nordex SE, with a market cap of €7.39 billion, develops, manufactures, and distributes multi-megawatt onshore wind turbines globally through its subsidiaries.

Operations: Nordex SE generates revenue from the development, manufacturing, and distribution of multi-megawatt onshore wind turbines across global markets.

Estimated Discount To Fair Value: 17.5%

Nordex, trading at €31.36, is undervalued compared to its estimated fair value of €38.03. Despite a highly volatile share price recently, its earnings are forecast to grow significantly at 32% annually, outpacing the German market's growth rate. Recent contracts in Germany and Canada enhance future cash flow prospects through long-term service agreements and repowering projects that improve efficiency and energy output, supporting Nordex's strategic expansion in renewable energy markets.

- The analysis detailed in our Nordex growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Nordex's balance sheet health report.

Summing It All Up

- Discover the full array of 199 Undervalued European Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com