Assessing Williams Companies (WMB) Valuation After Recent Share Performance And Analyst Expectations

Williams Companies (WMB) has been drawing investor attention after recent share performance data showed a 1 day return of 0.5% and a roughly 2.6% decline over the past month.

See our latest analysis for Williams Companies.

Set against a relatively flat year to date share price return of 0.5%, Williams Companies’ 13.9% 1 year total shareholder return and very strong 3 and 5 year total shareholder returns suggest momentum has been built over a longer horizon. Recent weakness hints at some cooling in sentiment as investors reassess growth prospects and risks around the current US$61.16 share price.

If Williams Companies has you rethinking your energy exposure, this could be a useful moment to broaden your search and check out fast growing stocks with high insider ownership

So with a 13.9% 1 year total return, solid multi year gains and shares around US$61.16, is Williams trading below what its fundamentals justify, or is the current price already factoring in future growth?

Most Popular Narrative Narrative: 9.7% Undervalued

With the narrative fair value at US$67.70 versus the US$61.16 last close, the story points to a gap the market has not closed yet.

The analysts have a consensus price target of $63.684 for Williams Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $74.0, and the most bearish reporting a price target of just $44.0.

Want to see what is driving that higher fair value range? The narrative leans on cash flow growth, rising margins and a future earnings multiple that stands out. Curious how those pieces fit together into that valuation story?

Result: Fair Value of $67.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if permitting setbacks delay key projects or if long term natural gas demand falls short of current expectations.

Find out about the key risks to this Williams Companies narrative.

Another View: Market Pricing Looks Richer

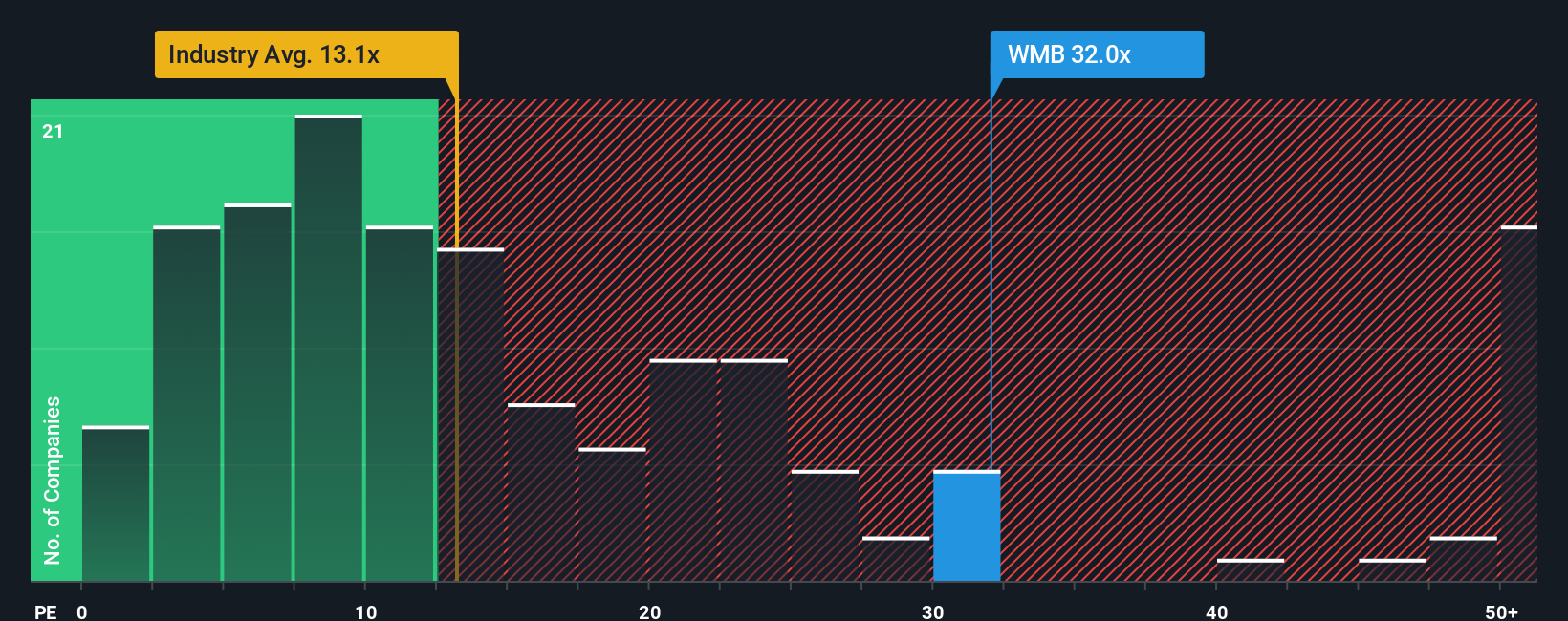

The narrative points to a 9.7% undervaluation, but the current P/E of 31.6x tells a different story. It is more than double the US Oil and Gas industry at 13.2x and above peers at 14.8x, while also sitting higher than the 23.1x fair ratio our work suggests the market could move toward.

In plain terms, you are paying a premium price relative to both the sector and that fair ratio, even though forecasts call for earnings and revenue growth that are not especially high versus the wider US market. Is that premium something you are comfortable paying for this cash flow profile?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams Companies Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a fresh Williams story yourself in just a few minutes, starting with Do it your way

A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Williams does not fully fit what you want right now, do not stop here. Broaden your watchlist and put fresh options on your radar.

- Target potential bargains by reviewing these 878 undervalued stocks based on cash flows, where prices sit below what underlying cash flows may support.

- Identify thematic exposure by scanning these 25 AI penny stocks that link artificial intelligence trends to listed companies.

- Emphasize income by checking these 14 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com