Assessing Air Lease (AL) Valuation After Strong Multi Year Returns And Steady Share Price

Air Lease (AL) shares were little changed in the latest session, giving investors a chance to reassess the aircraft lessor’s mix of growth metrics, recent returns and current valuation signals without a fresh headline driver.

See our latest analysis for Air Lease.

While the share price has been relatively steady in the latest session at $64.17, the 1 year total shareholder return of 35.96% and 5 year total shareholder return of 53.58% point to momentum that has been building rather than fading over time.

If Air Lease has you looking closer at transport and defense exposure, it could be worth widening your watchlist to include aerospace and defense stocks.

With Air Lease posting a 1 year total return of 35.96% and trading close to a US$66 analyst target, the key question now is whether the current price underestimates its aircraft leasing franchise or already reflects future growth.

Most Popular Narrative Narrative: 4% Undervalued

With Air Lease last closing at $64.17 against a narrative fair value of about $66.67, the current pricing sits only slightly below that reference point and puts the focus on what is built into those assumptions rather than on a big valuation gap.

The analysts have a consensus price target of $65.667 for Air Lease based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $72.0, and the most bearish reporting a price target of just $50.0.

It may be worth examining what justifies that fair value when earnings are expected to shrink while revenues still grow and margins reset lower. The key is how profit levels, future P/E and discount rate all interact. Want to see which earnings path and terminal multiple are doing the heavy lifting in this narrative?

Result: Fair Value of $66.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could be tested if rising interest costs squeeze earnings or if the timing of aircraft sales and OEM delivery issues disrupt expected cash generation.

Find out about the key risks to this Air Lease narrative.

Another View: Market Ratio Sends A Very Different Signal

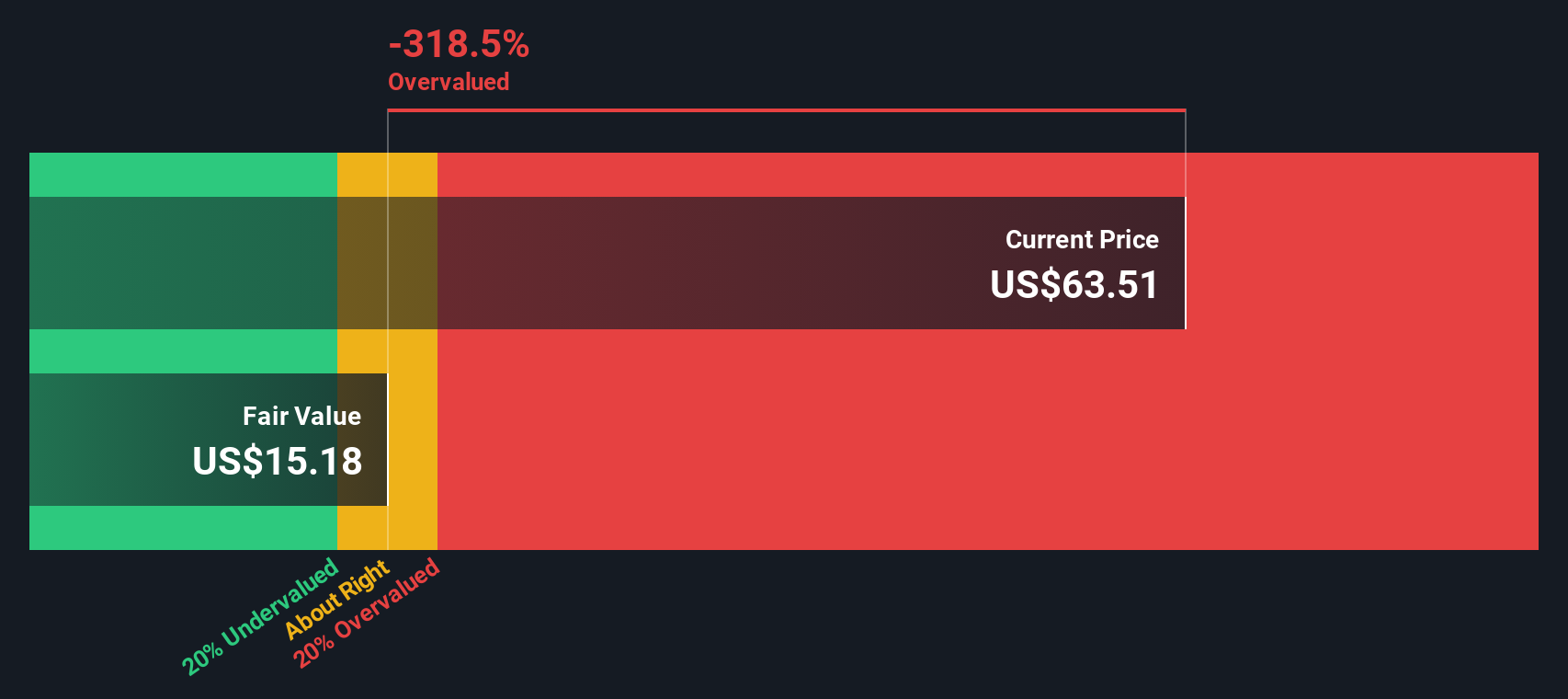

While the narrative fair value of about $66.67 suggests Air Lease is around 4% undervalued, our SWS DCF model points the other way. It shows a fair value estimate of $16.03, which would imply the current $64.17 price is far above that level.

The gap between these two approaches is wide. The key question is which set of assumptions you feel more comfortable leaning on when so much depends on future cash flows, discount rates and terminal value.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air Lease for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air Lease Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a complete Air Lease view in just a few minutes: Do it your way.

A great starting point for your Air Lease research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Air Lease has sharpened your thinking, do not stop here. Use the Simply Wall St screener to uncover other opportunities that match your style and priorities.

- Target potential mispricings by scanning these 878 undervalued stocks based on cash flows and spotting companies where current prices differ from underlying fundamentals.

- Ride powerful technology trends by checking out these 25 AI penny stocks that are tied to artificial intelligence themes shaping the future.

- Tap into income ideas by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% backed by listed businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com