3 Companies Estimated To Be Priced Below Their True Value In January 2026

As the U.S. stock market kicks off 2026 with major indexes reaching new heights, buoyed by significant geopolitical events and a surge in oil stocks, investors are keenly observing opportunities that may be priced below their intrinsic value. In this environment of heightened activity and record-setting performances, identifying undervalued stocks becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Workiva (WK) | $84.11 | $166.77 | 49.6% |

| WidePoint (WYY) | $5.50 | $10.71 | 48.6% |

| Valley National Bancorp (VLY) | $11.90 | $23.09 | 48.5% |

| Sportradar Group (SRAD) | $23.05 | $45.66 | 49.5% |

| Sea (SE) | $139.78 | $276.12 | 49.4% |

| Investar Holding (ISTR) | $26.79 | $52.57 | 49% |

| Fifth Third Bancorp (FITB) | $48.62 | $94.59 | 48.6% |

| Dingdong (Cayman) (DDL) | $2.87 | $5.67 | 49.4% |

| CNB Financial (CCNE) | $26.14 | $50.77 | 48.5% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $20.37 | $39.94 | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

Roku (ROKU)

Overview: Roku, Inc., along with its subsidiaries, operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $16.94 billion.

Operations: Roku generates revenue through two main segments: Devices, which contributed $587.13 million, and Platform, which accounted for $3.96 billion.

Estimated Discount To Fair Value: 35.9%

Roku is trading at a significant discount to its estimated fair value, with a price of US$114.68 against an estimated fair value of US$178.86. Recent strategic partnerships, such as the expansion with Nielsen and FreeWheel, enhance its advertising capabilities and data integration, potentially boosting future cash flows. Despite challenges like low forecasted return on equity, Roku's revenue growth is expected to outpace the broader market, supporting its potential as an undervalued stock based on cash flows.

- In light of our recent growth report, it seems possible that Roku's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Roku's balance sheet health report.

Jacobs Solutions (J)

Overview: Jacobs Solutions Inc. operates in infrastructure, advanced facilities, and consulting across various regions including the United States, Europe, and Asia with a market cap of approximately $16.40 billion.

Operations: The company's revenue segments include $1.27 billion from PA Consulting and $10.76 billion from Infrastructure & Advanced Facilities.

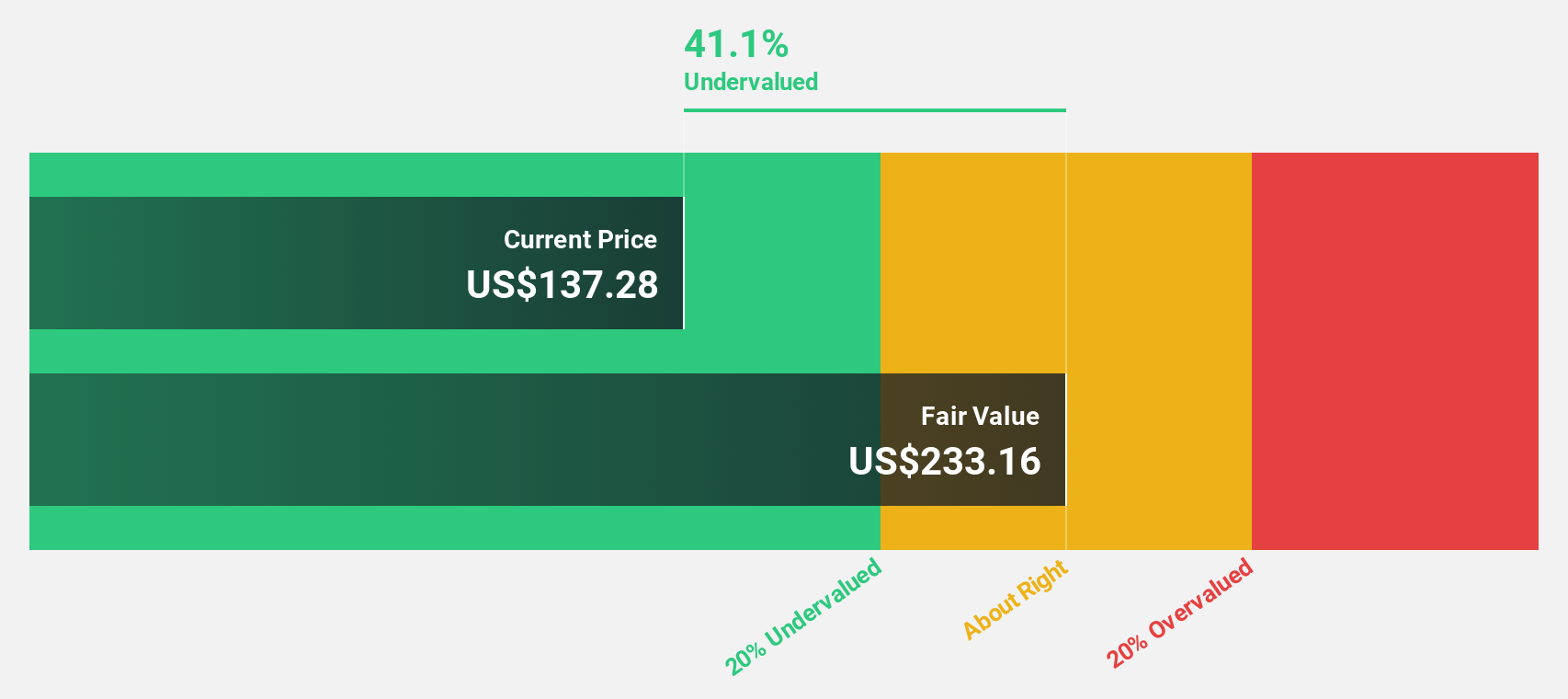

Estimated Discount To Fair Value: 40.6%

Jacobs Solutions is trading significantly below its estimated fair value, with a current price of US$138.86 compared to an estimated fair value of US$233.62. Despite recent earnings challenges, including decreased net income and profit margins, Jacobs' strategic client partnerships in sectors like AI infrastructure and quantum computing could enhance future cash flows. Earnings are forecasted to grow substantially faster than the broader market, reinforcing its position as potentially undervalued based on cash flows.

- The analysis detailed in our Jacobs Solutions growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Jacobs Solutions.

Sea (SE)

Overview: Sea Limited operates as a consumer internet company through its subsidiaries in Southeast Asia, Latin America, the rest of Asia, and internationally with a market cap of $82.75 billion.

Operations: Sea Limited generates revenue through its digital entertainment segment with $3.92 billion, e-commerce with $7.67 billion, and digital financial services amounting to $1.21 billion.

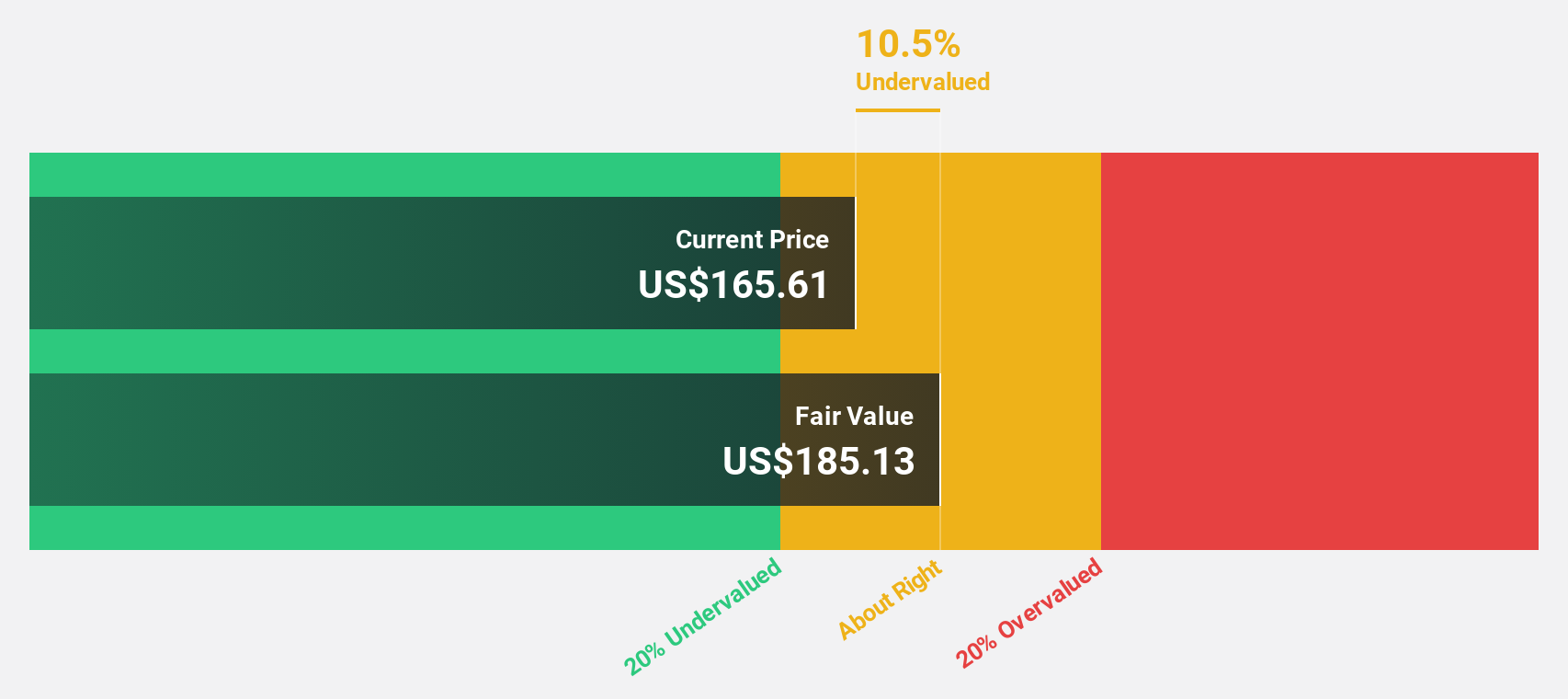

Estimated Discount To Fair Value: 49.4%

Sea Limited is trading well below its estimated fair value of US$276.12, with a current price of US$139.78, highlighting potential undervaluation based on cash flows. The company's recent earnings report showed substantial growth, with net income rising to US$1.18 billion from US$207 million the previous year. Analysts project Sea's earnings to grow significantly at 26.8% annually over the next three years, outpacing the broader market's expected growth rate.

- According our earnings growth report, there's an indication that Sea might be ready to expand.

- Get an in-depth perspective on Sea's balance sheet by reading our health report here.

Where To Now?

- Access the full spectrum of 185 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com