Reddit (RDDT) Valuation Check After Recent Share Price Momentum And Conflicting Fair Value Estimates

Reddit (RDDT) has attracted fresh attention after recent price moves, with the stock showing a one-month return of 4.2% and a three-month return of 20.6%. This performance has prompted closer scrutiny from investors.

See our latest analysis for Reddit.

At a share price of $244.05, Reddit’s recent 7 day share price return of 4.58% and 90 day share price return of 20.64% point to building momentum, while the 1 year total shareholder return of 41.63% places the latest moves in a stronger, longer term context.

If Reddit’s recent run has your attention, it could be a good moment to see what else is moving and compare it with high growth tech and AI stocks.

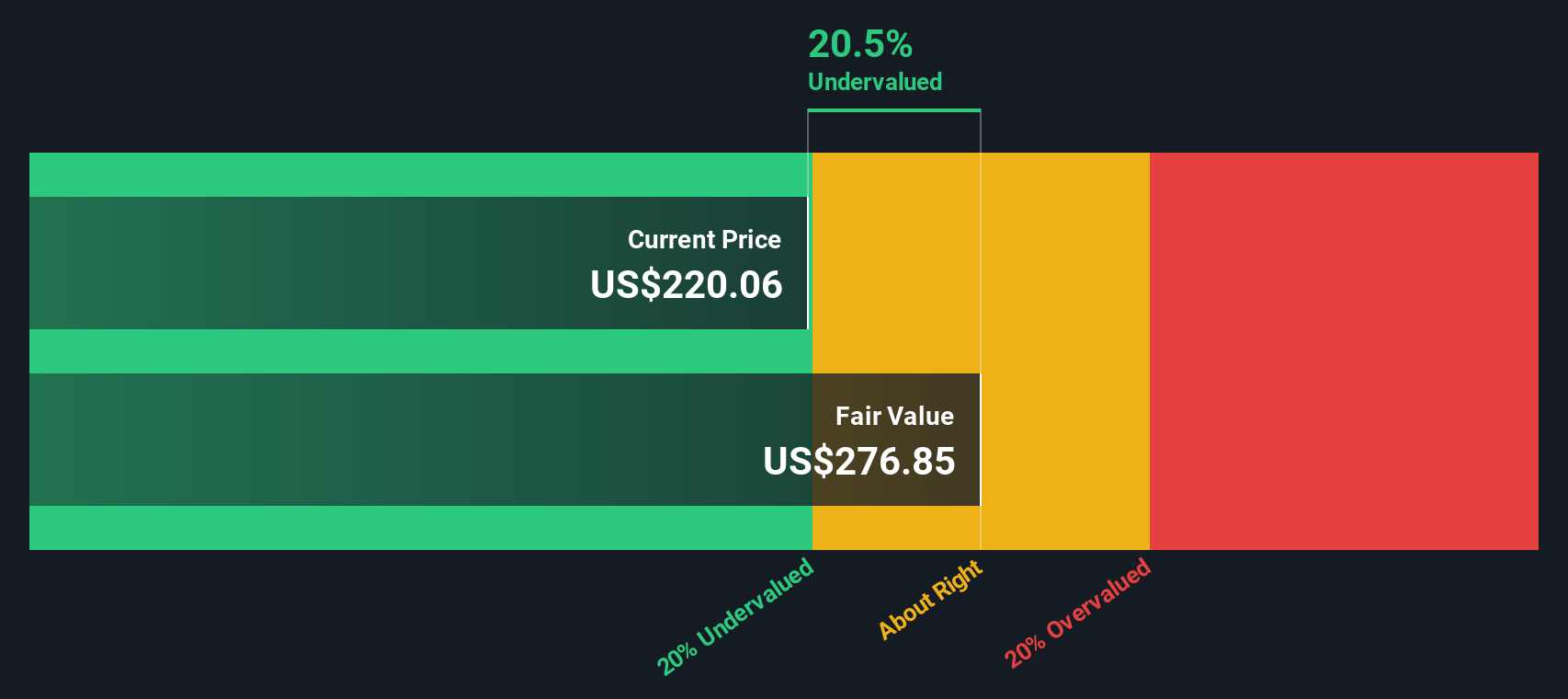

With Reddit trading at $244.05, close to a US$246.32 analyst target but with an estimated 34.09% intrinsic discount, you have to ask: is there still real upside here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 1.8% Overvalued

At Reddit’s last close of $244.05, the most widely followed narrative points to a fair value of about $239.76, putting the stock a touch above that mark while leaning heavily on growth and margin assumptions.

The analysts have a consensus price target of $195.962 for Reddit based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $235.0, and the most bearish reporting a price target of just $75.0.

Want to see what kind of revenue curve and margin profile could justify a richer multiple than the broader industry? The earnings ramp and assumed profitability shift are doing the heavy lifting here. Curious how those moving parts stack up against a higher discount rate and rising share count assumptions?

Result: Fair Value of $239.76 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Reddit keeping user engagement healthy and turning data licensing into a durable revenue stream; both of these could disappoint if trends weaken.

Find out about the key risks to this Reddit narrative.

Another View: DCF Points To A Very Different Story

While the popular narrative suggests Reddit is about 1.8% overvalued versus a fair value of $239.76, the SWS DCF model presents a different perspective. It puts fair value closer to $370.30, so the current $244.05 price sits roughly 34.1% below that mark. Which version of “fair” do you think is closer to how the market will ultimately view Reddit?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Reddit for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Reddit Narrative

If you are not fully on board with these views or you simply prefer to test the numbers yourself, you can build a custom Reddit thesis in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Reddit.

Looking for more investment ideas?

If Reddit is already on your radar, do not stop there. The real advantage comes from widening your watchlist and lining up your next potential moves.

- Spot early-stage potential by scanning these 3557 penny stocks with strong financials that pair smaller market caps with stronger balance sheets and more robust financial profiles than many peers.

- Zero in on future-facing themes with these 25 AI penny stocks that sit at the intersection of artificial intelligence trends and higher growth expectations.

- Hunt for mispriced opportunities using these 880 undervalued stocks based on cash flows that screen for companies trading below estimated cash flow based value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com