A Look At EnerSys (ENS) Valuation As AI And Electrification Demand Draw Fresh Attention

Recent commentary around EnerSys (ENS) has focused on rising demand for energy storage and data center power tied to electrification and AI, which is putting fresh attention on how the stock’s current consolidation might appeal to patient investors.

See our latest analysis for EnerSys.

The recent interest in EnerSys around energy storage and AI linked data center demand has coincided with strong share price momentum, with a 90 day share price return of 35.21% feeding into a 1 year total shareholder return of 66.82%.

If the AI and electrification angle has caught your eye, it may be worth widening the lens to see how other high growth tech and AI stocks are shaping up as potential ideas.

With EnerSys posting a 66.82% 1-year total shareholder return, trading at US$154.92 and sitting only around 3% below an average analyst price target of US$159, is there still a buying opportunity here, or is the market already pricing in future growth?

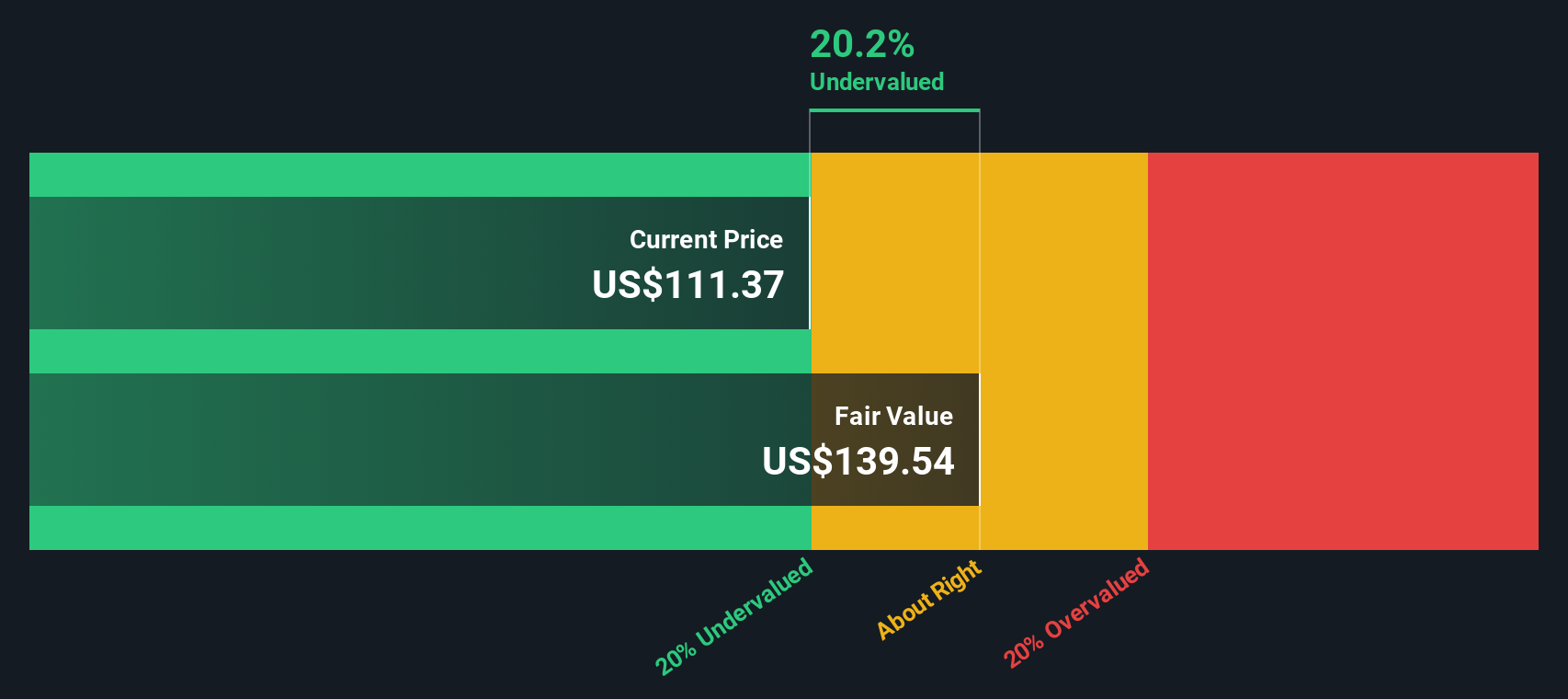

Most Popular Narrative Narrative: 2.6% Undervalued

The most followed narrative places EnerSys fair value at US$159 per share, which is slightly above the last close of US$154.92 and frames the stock as modestly mispriced.

Major cost-reduction initiatives, including a strategic realignment and transition to Centers of Excellence (CoEs), are expected to generate $80 million in annualized savings starting in fiscal 2026, structurally expanding net and operating margins. Recent and ongoing acquisitions in the defense and specialty lithium-ion segments (such as Rebel Systems and Bren-Tronics) are broadening EnerSys' presence in high-growth, premium product markets, which is expected to increase both revenue and gross margins.

Curious how modest revenue assumptions, higher profit margins, and a richer future earnings multiple all connect to that US$159 figure? The full narrative walks through each step of that valuation bridge, including how cash flows are discounted and why the projected earnings profile could justify a higher P/E than today.

Result: Fair Value of $159 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value story still leans on assumptions that could be challenged if trade policy pressures persist or if acquired growth fails to translate into stronger margins.

Find out about the key risks to this EnerSys narrative.

Another View: SWS DCF Flags a Very Different Story

While the consensus narrative frames EnerSys as modestly undervalued around US$159 per share, our DCF model paints a sharper contrast, with a fair value estimate of US$58.04. From that perspective, the current US$154.92 price appears materially overvalued. Which narrative do you think fits the risk you are willing to take?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EnerSys for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EnerSys Narrative

If the valuation gap or assumptions here do not sit right with you, you can always test the numbers yourself and shape a custom EnerSys view in just a few minutes, Do it your way.

A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If EnerSys has sharpened your thinking, do not stop here. Broaden your watchlist with focused stock ideas that match how you like to invest.

- Spot early-stage opportunities by scanning these 3557 penny stocks with strong financials that already show signs of financial strength rather than just hype.

- Tap into AI-driven growth stories through these 25 AI penny stocks that link real business models to artificial intelligence, not just buzzwords.

- Zero in on price-conscious ideas by filtering for these 880 undervalued stocks based on cash flows and compare their cash flow profiles with what you are seeing in EnerSys.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com