Assessing WaFd (WAFD) Valuation After Recent Share Price Momentum

Why WaFd is on investors’ radar

WaFd (WAFD) has drawn attention after recent share price moves, with the stock closing at $32.47. That invites a closer look at how its returns and fundamentals line up today.

See our latest analysis for WaFd.

WaFd’s recent 1 day share price return of 1.06% comes after a steadier patch, with a 90 day share price return of 11.35% and a 5 year total shareholder return of 33.43%. This points to momentum building over a longer stretch rather than just a short term bounce.

If you are comparing WaFd with other financial names, it can help to widen the lens and see how it stacks up against solid balance sheet and fundamentals stocks screener (None results).

With WaFd trading at $32.47, a value score of 4, an estimated 9.00% intrinsic discount and a small 2.02% gap to the average analyst target, investors might ask whether there is still a buying opportunity or whether the market is already pricing in future growth.

Price-to-Earnings of 11.7x: Is it justified?

On an 11.7x P/E, WaFd appears to offer relatively good value compared with both its own fair value indicators and its recent share price of $32.47.

The P/E ratio links the current share price to the earnings per share. This is a common yardstick for banks where earnings power is a key focus. For WaFd, several checks point to value, including trading at 9% below an estimated fair value of $35.68 and at a discount to peer averages.

WaFd’s 11.7x P/E is below the peer average of 13.9x and slightly below the US Banks industry average of 11.8x. It is also close to an estimated fair P/E of 12x. Taken together, these figures indicate that the current pricing reflects a modest discount relative to these comparison points.

Explore the SWS fair ratio for WaFd

Result: Price-to-Earnings of 11.7x (UNDERVALUED)

However, these valuation signals can still be challenged if WaFd’s earnings power weakens or if its loan portfolio and credit quality come under pressure.

Find out about the key risks to this WaFd narrative.

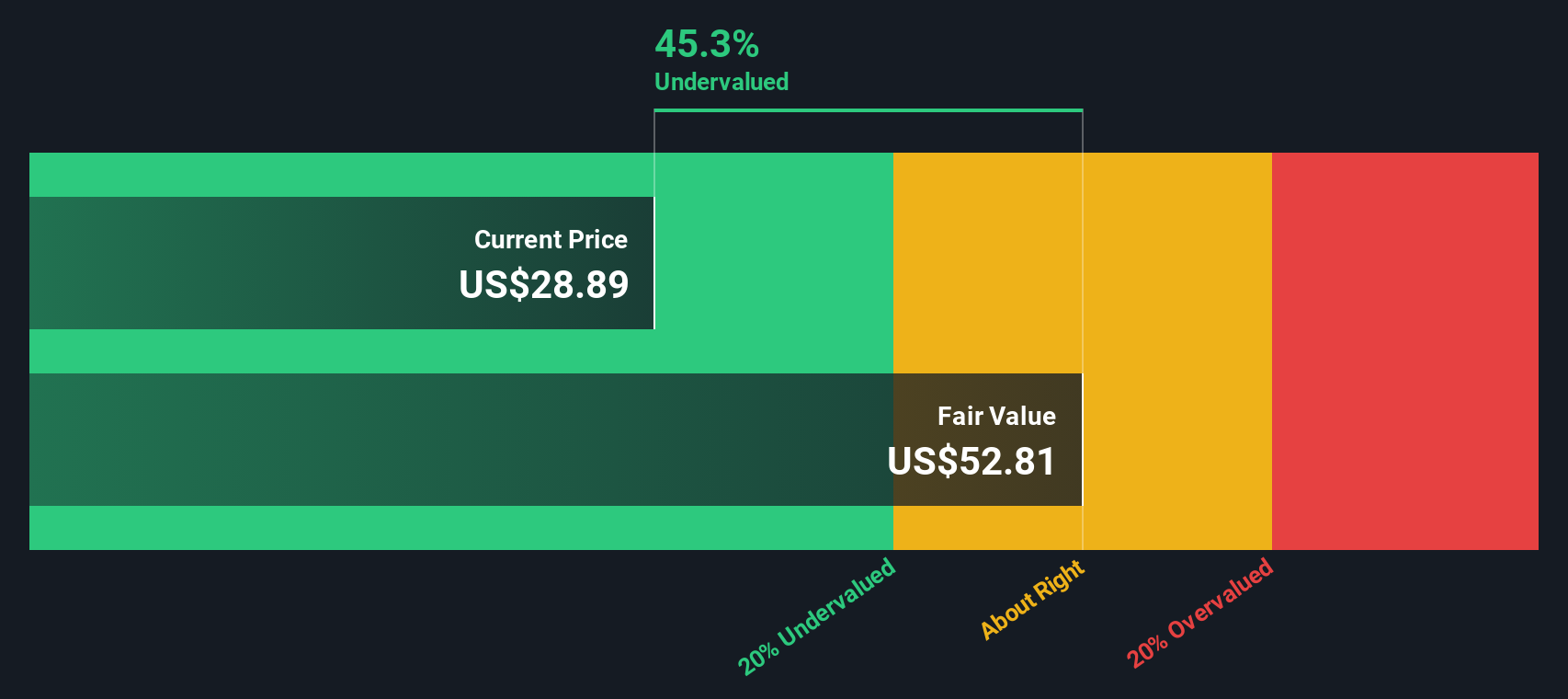

Another view using our DCF model

While the 11.7x P/E points to a modest discount, our DCF model also identifies WaFd as undervalued, with the US$32.47 share price sitting around 9% below an estimated fair value of US$35.68. If both methods lean the same way, it raises the question of how much potential mispricing might remain.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out WaFd for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own WaFd Narrative

If you see the numbers differently or prefer to rely on your own work, you can review the data yourself and build a personal thesis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding WaFd.

Ready for more investment ideas?

If WaFd has sparked your interest, do not stop here. The next step is lining up a few more quality ideas so you can compare opportunities with confidence.

- Target potential value opportunities by scanning these 880 undervalued stocks based on cash flows that may be trading below what their cash flows imply.

- Spot income ideas quickly by filtering for these 14 dividend stocks with yields > 3% that fit your yield goals.

- Tap into fast moving themes by reviewing these 79 cryptocurrency and blockchain stocks that are tied to digital assets and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com