A Look At Boston Beer Company (SAM) Valuation As Noncompete Lawsuit Raises New Questions

Legal dispute over noncompete policy and why it matters for Boston Beer Company stock

Boston Beer Company (SAM) is now at the center of a lawsuit challenging its noncompete policy under Massachusetts law, raising questions around how any outcome could influence its employment practices and investor sentiment.

See our latest analysis for Boston Beer Company.

At a share price of $197.87, Boston Beer has seen a 1-day share price return decline of about 1% and a 90-day share price return decline of about 10%, while its 1-year total shareholder return is down about 30%. This suggests momentum has been fading even before this legal dispute sharpened the focus on operational risk.

If this legal challenge has you thinking about how different business models handle risk and growth, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With the share price around $197.87, an indicated intrinsic discount of about 38% and a discount to the average analyst target of about 22%, you have to ask: is this a mispriced beer maker, or is the market already accounting for future growth?

Most Popular Narrative Narrative: 17.3% Undervalued

With Boston Beer shares at $197.87 and the most followed narrative pointing to fair value around $239.36, the gap raises clear questions about the earnings path implied.

Ongoing productivity initiatives (brewery efficiency, procurement and waste reduction) are structurally raising gross margins, which should continue to benefit earnings as volume normalizes and new, margin-accretive products (e.g., Sun Cruiser) scale.

Curious what kind of margin lift and earnings profile need to line up for that valuation? The full narrative spells out the revenue, margin and P/E assumptions behind it.

Result: Fair Value of $239.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can change quickly if category trends worsen, or if crowded Beyond Beer shelves force heavier spending that eats into those projected margin gains.

Find out about the key risks to this Boston Beer Company narrative.

Another View: What P/E Says About The Story

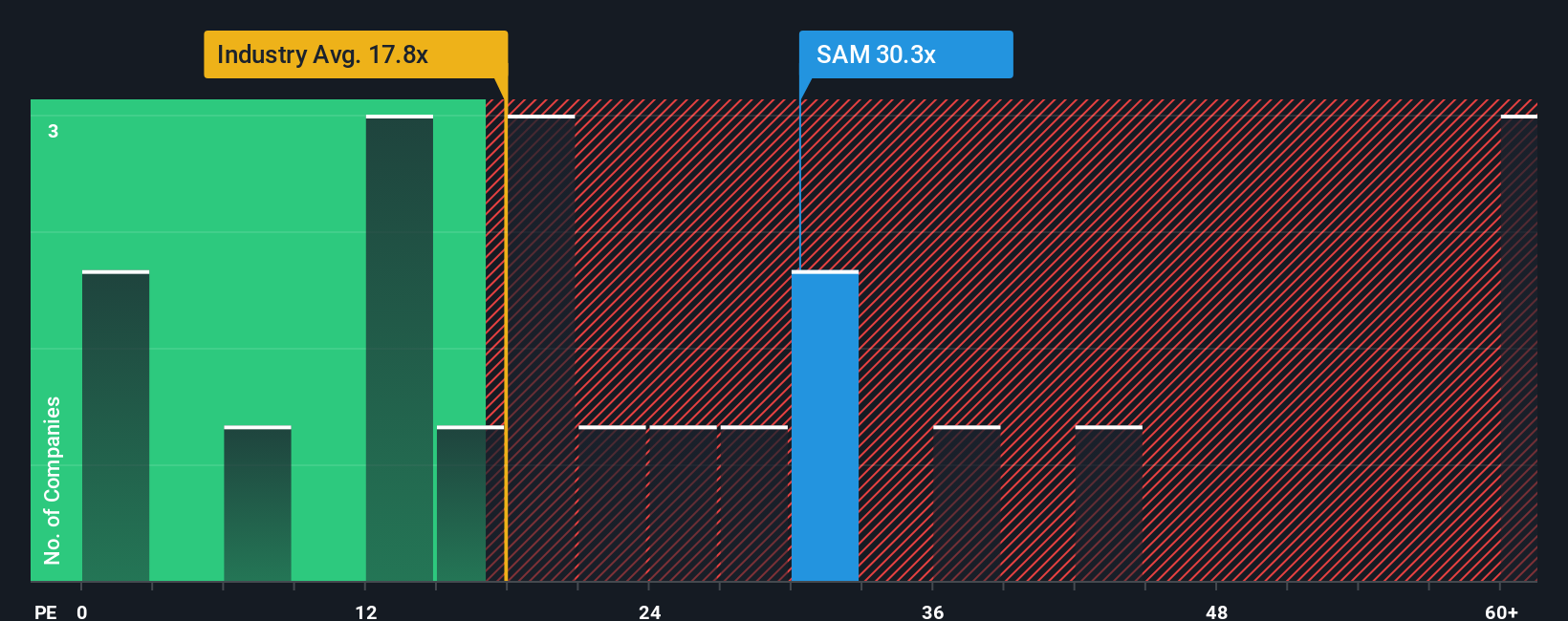

So far, the community and analyst narrative leans on earnings potential and implied upside. Yet on a simple P/E check, Boston Beer trades at 22.4x, above its fair ratio of 15.7x and the global Beverage industry at 18x, while sitting below direct peers at 25.5x.

That mix of richer pricing than the broader industry but cheaper than closer peers suggests the market is still weighing which group it should really trade with and how much risk to price into those earnings. Is this a reasonable middle ground or a sign that expectations may still need to reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Boston Beer Company Narrative

If your view on Boston Beer differs from the crowd, or you simply prefer to test the assumptions yourself, you can build a fresh narrative in just a few minutes, starting with Do it your way.

A great starting point for your Boston Beer Company research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Boston Beer is on your radar, do not stop there. Broadening your watchlist with fresh ideas can help you spot opportunities you would otherwise miss.

- Scan for potential mispricing by checking out these 880 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Tap into growth themes by reviewing these 25 AI penny stocks that are tied to advances in artificial intelligence.

- Strengthen your income focus by searching for these 14 dividend stocks with yields > 3% that might complement a total return approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com