Should Carnival’s Record 2025 Results and Fleet Upgrades Require Action From Carnival Corporation (CCL) Investors?

- Carnival Corporation’s Holland America Line recently announced a collaboration with heritage brand Pendleton Woolen Mills to create a limited-edition, Alaska-themed throw blanket, which will be sold on board its Alaska sailings in 2026 as part of broader America’s 250th celebrations and special cruises.

- Alongside these brand partnerships, Carnival has reported record fiscal 2025 financial results and outlined plans to expand its fleet and upgrade guest amenities, underscoring how tailored experiences and stronger operations are becoming central to its cruise offering.

- Next, we’ll examine how Carnival’s record fiscal 2025 results and planned fleet upgrades feed into the company’s existing investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Carnival Corporation & Investment Narrative Recap

Carnival’s investment case rests on a large, global cruise platform using higher quality experiences and disciplined capacity growth to support earnings and cash flow, while steadily reducing its heavy debt load. The Holland America and Pendleton tie-up is directionally helpful for brand strength, but it does not materially change the key near term catalyst of improving profitability or the biggest current risk, which remains Carnival’s sizeable leverage and ongoing capital needs.

Among recent announcements, the record fiscal 2025 results, including US$26,622 million in revenue and US$2,760 million in net income, are most relevant here, because they show how stronger operations can support both guest experience investments and balance sheet repair. These results, together with plans to expand and upgrade the fleet, frame how smaller experiential initiatives like the Alaska themed Pendleton collaboration sit within a broader push to improve margins and support future cash generation.

Yet while the story looks stronger today, investors should still be aware of the implications of Carnival’s high debt load and refinancing obligations...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation &'s narrative projects $29.0 billion revenue and $3.7 billion earnings by 2028. This requires 3.8% yearly revenue growth and a roughly $1.2 billion earnings increase from $2.5 billion today.

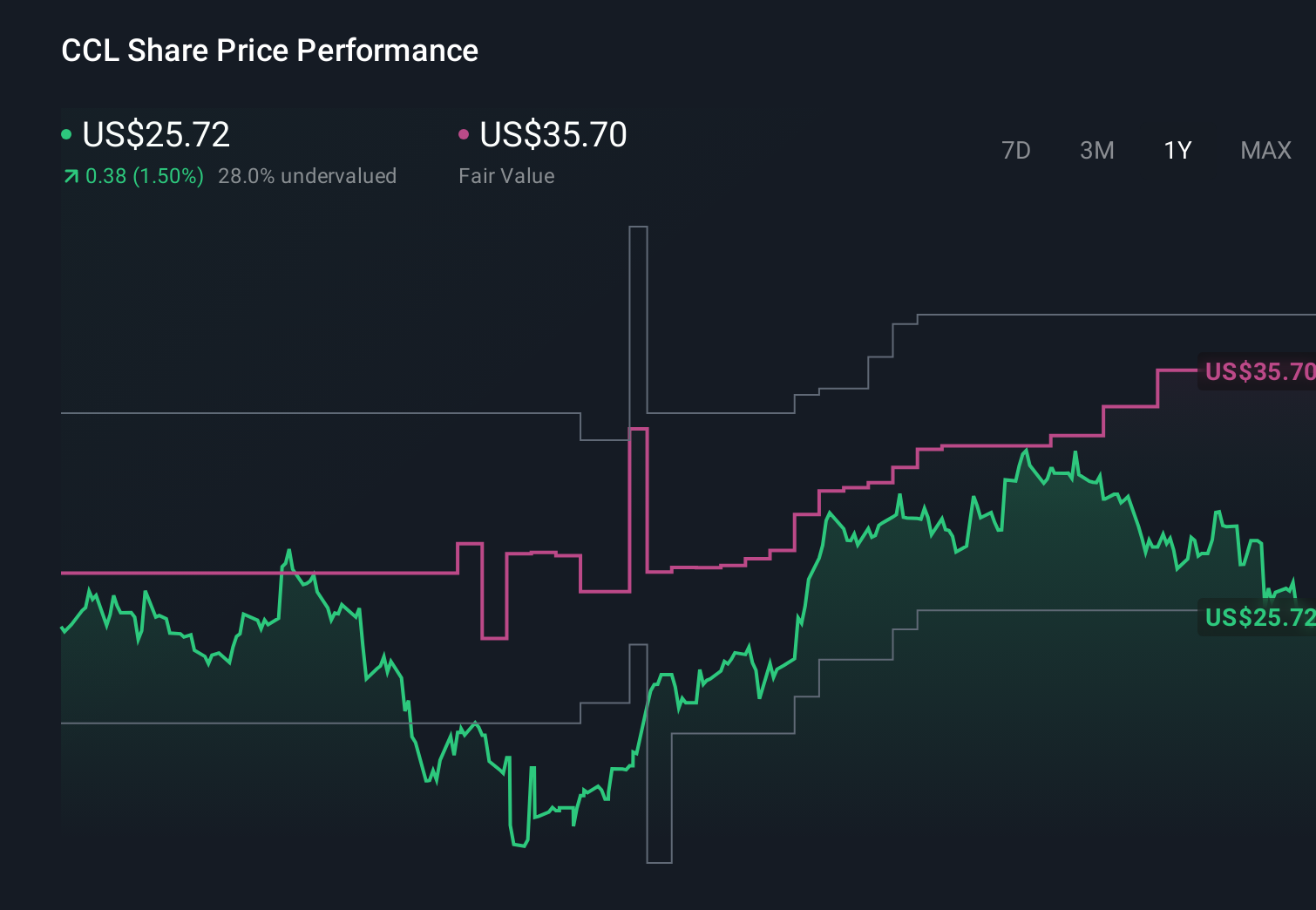

Uncover how Carnival Corporation &'s forecasts yield a $35.76 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently place Carnival’s fair value between US$28.61 and US$53.33, across 11 different views. Set against that spread, Carnival’s high debt and continuing refinancing needs may influence how you weigh its recent record earnings and planned fleet upgrades for future performance, so it is worth comparing several perspectives before deciding how the stock fits your portfolio.

Explore 11 other fair value estimates on Carnival Corporation & - why the stock might be worth as much as 69% more than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com