A Look At Shake Shack (SHAK) Valuation After Recent Share Price Recovery And Growth Expectations

Why Shake Shack Stock Is On Investors’ Radar

Shake Shack (SHAK) is drawing attention as investors weigh its recent share performance against the company’s current fundamentals, including annual revenue of US$1.37b and net income of US$42.6m.

See our latest analysis for Shake Shack.

Shake Shack’s share price has climbed over the past month, with a 30 day share price return of 7.02%, but that sits against a 1 year total shareholder return of a 36.75% decline and a 3 year total shareholder return of 63.46%, suggesting earlier momentum has tempered recently.

If Shake Shack’s moves have you rethinking your watchlist, it could be a good moment to widen the lens and check out fast growing stocks with high insider ownership.

With Shake Shack trading at US$83.51 against an average analyst price target of US$112.87, the key question is whether the current valuation reflects an undervalued growth story or whether the market has already priced in future gains.

Most Popular Narrative Narrative: 27% Undervalued

With Shake Shack’s fair value estimate of about US$114.36 sitting above the last close of US$83.51, the most followed narrative leans toward a valuation gap that hinges on how its growth, margins, and store rollout play out over time.

The company's strategic focus on urban expansion and accelerated domestic and international store openings, especially in untapped markets and through new formats such as drive-thru and licensed partnerships (e.g., casinos, Panama), directly taps into growing urbanization and demand for experiential fast-casual dining, supporting long-term, system-wide revenue growth.

Curious what justifies that higher fair value tag? The narrative leans on brisk revenue expansion, rising profit margins and a future earnings multiple that assumes investors stay willing to pay up. Want to see exactly how those moving parts combine into that US$114.36 figure and the required return of roughly 8.9%? The full narrative lays out every step in plain numbers.

Result: Fair Value of $114.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story could be challenged if beef and other input costs stay elevated, or if heavier marketing and expansion spending fail to translate into steadier traffic.

Find out about the key risks to this Shake Shack narrative.

Another Angle On Valuation

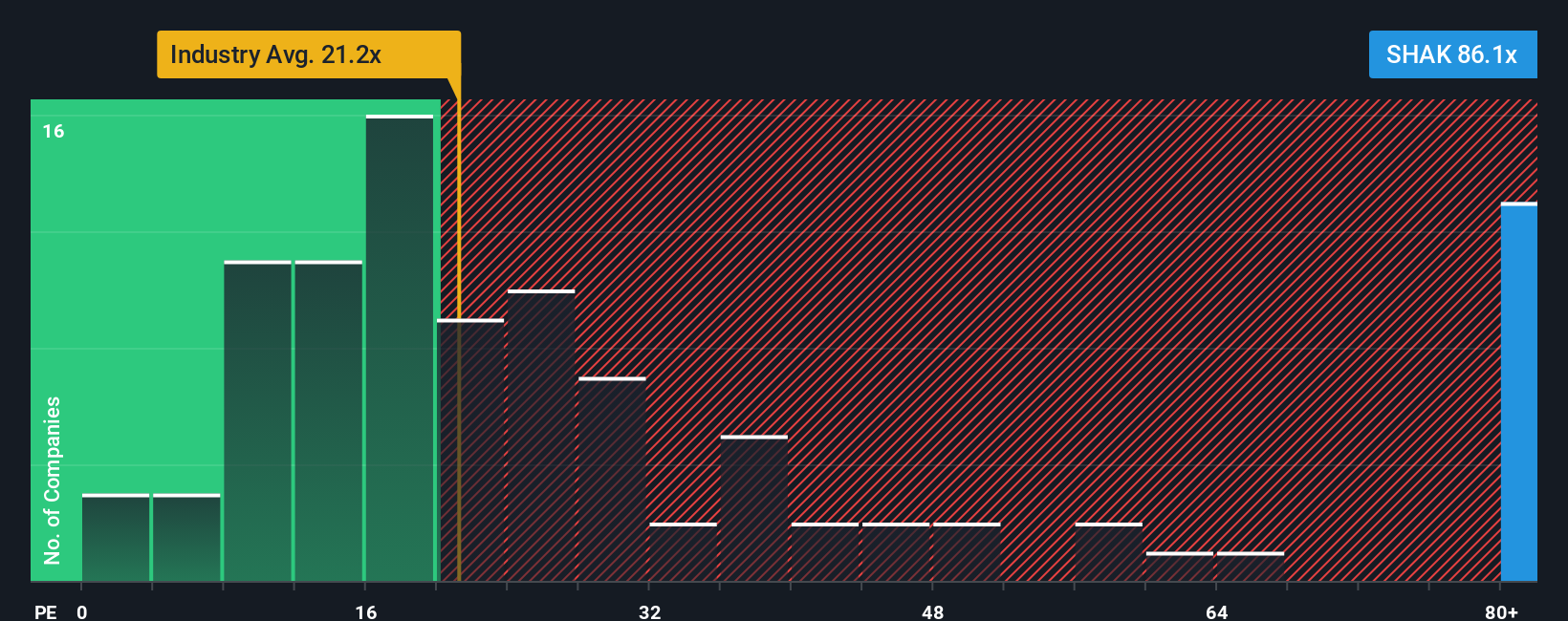

There is a twist when you look at Shake Shack through its P/E. The shares trade at 78.9x earnings, compared with 21.7x for the US Hospitality industry and 31.6x for peers, while our fair ratio sits at 25.4x. That gap points to meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shake Shack Narrative

If you see the numbers differently or prefer to test your own assumptions, it is quick and easy to build your version of the story: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Shake Shack.

Looking for more investment ideas?

Do not stop your research with one stock. You will get a broader view by scanning other opportunities that might suit your goals and risk comfort.

- Spot potential value candidates early by checking out these 882 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Position yourself in the AI theme by reviewing these 25 AI penny stocks shaping trends in automation, data, and machine learning.

- Strengthen your income focus by screening these 14 dividend stocks with yields > 3% that could help support a more regular cash return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com