Is AI-Focused Networking Momentum And CEO Stock Sales Altering The Investment Case For Arista Networks (ANET)?

- In recent months, Arista Networks has seen demand for its high-speed, AI-focused networking gear surge, while CEO Jayshree Ullal sold close to US$1.00 billion of stock through pre-arranged trading plans as her net worth exceeded US$6.00 billion.

- At the same time, Arista has strengthened its role as an AI and cloud networking backbone provider, securing new hyperscale design wins and drawing broadly positive analyst views supported by solid revenue growth, strong margins, and substantial cash generation.

- We’ll now examine how Arista’s growing AI-driven networking revenue and hyperscale design wins shape and potentially reinforce its existing investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Arista Networks Investment Narrative Recap

To own Arista, you need to believe high-speed Ethernet will remain central to AI and cloud data centers, and that Arista can keep winning hyperscale and enterprise refresh cycles without losing pricing power. The recent AI-fueled rally and CEO Jayshree Ullal’s roughly US$1.0 billion in pre-arranged stock sales do not appear to alter the core near term catalyst, which remains AI data center buildouts, or the biggest current risk around customer concentration and competitive pressure.

The most relevant recent development is Arista’s reported design wins for 400G and 800G switches with hyperscale cloud customers focused on AI workloads. These wins sit at the heart of the AI and cloud buildout thesis, directly tied to the company’s growing AI networking revenue and its role in next generation data center architectures that many analysts currently view as Arista’s primary engine for future value creation.

Yet, while the AI buildout story is compelling, investors should also be aware of how concentrated Arista’s revenue is among a few hyperscale and AI customers and how that could...

Read the full narrative on Arista Networks (it's free!)

Arista Networks’ narrative projects $13.6 billion revenue and $5.4 billion earnings by 2028. This requires 19.5% yearly revenue growth and about a $2.1 billion earnings increase from $3.3 billion today.

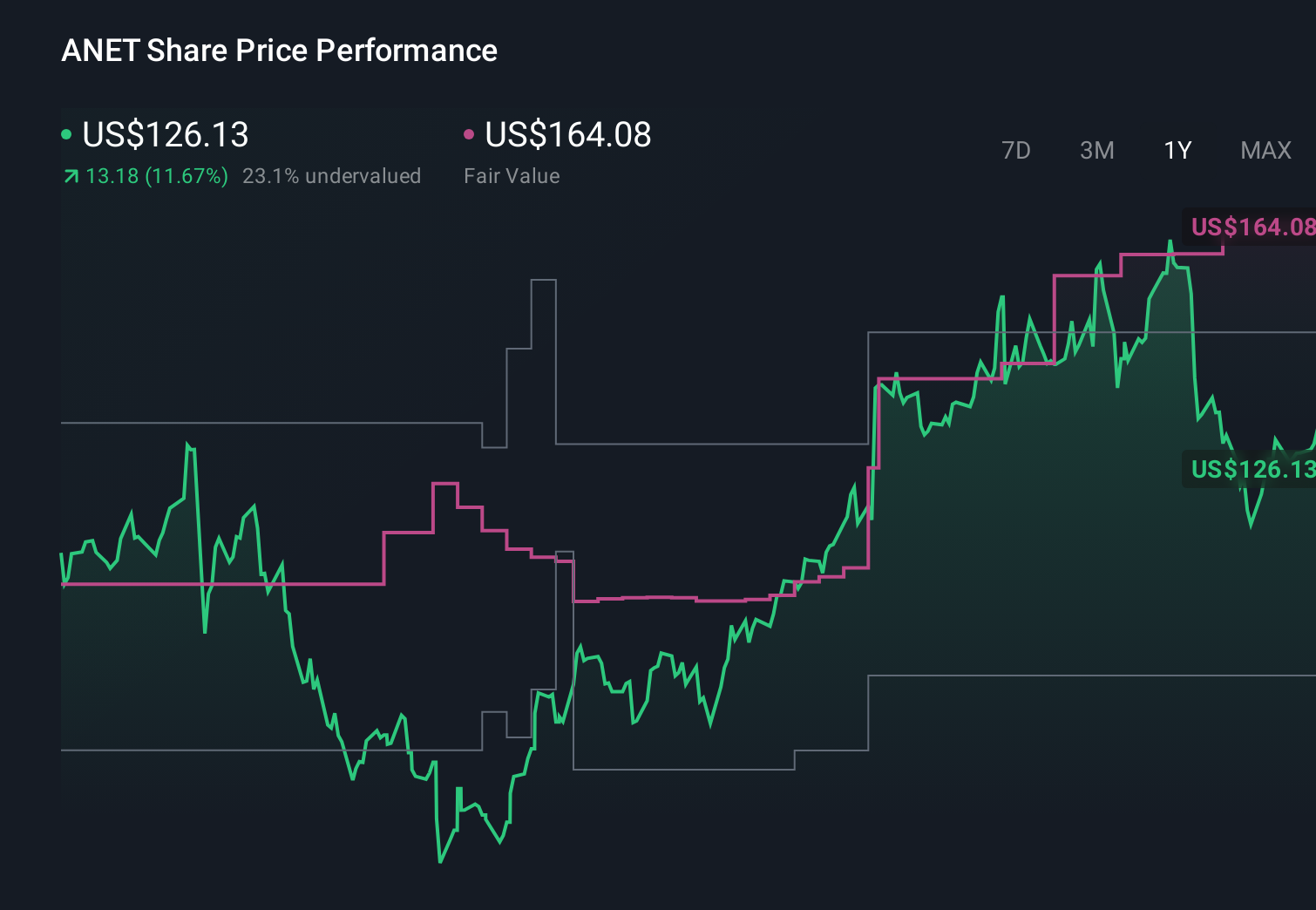

Uncover how Arista Networks' forecasts yield a $163.37 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were already assuming Arista could lift revenue to about US$15.4 billion and earnings to roughly US$5.9 billion, yet this upbeat view also flags concentrated hyperscale spending as a key vulnerability, so the latest AI driven momentum and insider selling may ultimately shift how confident you feel in that upper end scenario.

Explore 19 other fair value estimates on Arista Networks - why the stock might be worth as much as 19% more than the current price!

Build Your Own Arista Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arista Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Arista Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arista Networks' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com