Ulta Beauty (ULTA) Valuation Check As Rare Beauty Rollout And Philanthropy Ignite Investor Interest

Ulta Beauty (ULTA) is expanding its assortment by rolling out Selena Gomez’s Rare Beauty line across all 1,500+ stores and online starting February 1, paired with a limited-time donation program supporting youth mental health initiatives.

See our latest analysis for Ulta Beauty.

For context, Ulta Beauty’s share price has been firming, with a 90 day share price return of 11.55% and a 1 year total shareholder return of 47.37%. This suggests momentum has been building alongside initiatives like Rare Beauty’s rollout and new product partnerships.

If this kind of brand driven growth story interests you, it could be a good moment to widen your search with fast growing stocks with high insider ownership.

With Ulta Beauty now trading near an all time high and sitting slightly above the average analyst price target, the key question is whether Rare Beauty and other growth drivers still leave upside on the table or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 4.6% Overvalued

With Ulta Beauty closing at US$631.15 against a narrative fair value of about US$603, the story hinges on whether its expansion plans justify that gap.

The widening of Ulta's assortment, particularly through exclusive brand launches, key partnerships with in-demand emerging brands, and the rollout of a curated online marketplace, positions the company to attract Gen Z and Millennials, increase basket sizes, and capture higher-margin sales, benefiting both revenue and gross margins.

Curious how a steady top line, modest margin shifts, and a richer earnings multiple all come together to support that price tag? The narrative leans on disciplined growth assumptions, a premium future P/E and a long dated earnings path that might surprise you once you see the underlying math.

Result: Fair Value of $603.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are pressure points, such as higher store and wage costs and the potential loss of Target shop-in-shop revenue after 2026, that could challenge this story.

Find out about the key risks to this Ulta Beauty narrative.

Another Take: Valuation Gaps On The P/E Side

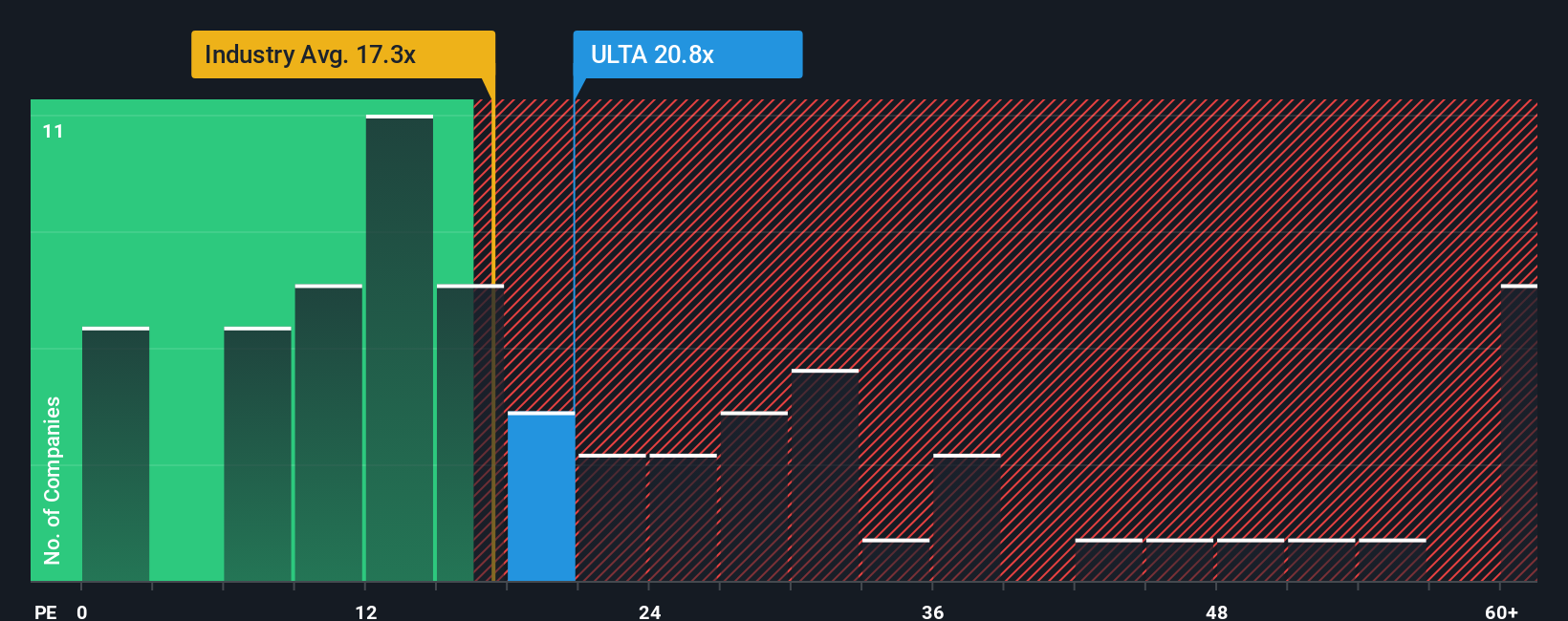

Ulta Beauty trades on a P/E of 23.5x, which is lower than its peer average of 35.5x, but higher than both the US Specialty Retail industry at 19.8x and its own fair ratio of 17.4x. That mix of discount and premium raises a simple question: where is the real valuation risk here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ulta Beauty Narrative

If you see the numbers differently or simply prefer to weigh the data yourself, you can build a personalised Ulta story in minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ulta Beauty.

Looking for more investment ideas?

If Ulta has caught your attention, do not stop here. Broaden your watchlist with a few focused stock ideas that speak directly to how you like to invest.

- Target high potential value by scanning these 882 undervalued stocks based on cash flows that align with your return expectations and risk comfort.

- Ride major tech shifts by checking out these 25 AI penny stocks that are shaping how data and automation show up in everyday products and services.

- Boost your income focus with these 14 dividend stocks with yields > 3% and see which companies are currently offering higher yields that might complement a growth heavy portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com