Is Mitsubishi Electric (TSE:6503) Quietly Reframing Its Energy Strategy With Hydrogen-Ready Turbines And Fusion?

- Mitsubishi Power and Mitsubishi Electric Corporation recently completed functional testing of their jointly developed next-generation gas turbine control system, designed to improve stable, efficient power output and support diversified fuels including natural gas and hydrogen in large-scale thermal power plants.

- In parallel, Mitsubishi Electric’s role in fabricating high-precision Fast Plasma Positioning Control Coils for the JT-60SA fusion project underlines its involvement at the frontier of advanced energy and plasma control technologies.

- Next, we’ll examine how progress in gas turbine controls supporting hydrogen-ready power plants could influence Mitsubishi Electric’s broader investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Mitsubishi Electric Investment Narrative Recap

To own Mitsubishi Electric, you need to believe it can keep converting its broad industrial and energy technology base into resilient earnings while managing pricing pressure and digital transition risk. The new gas turbine control system and fusion project coils showcase strong engineering depth, but the immediate impact on the main near term catalyst, upcoming quarterly results and guidance, looks limited rather than transformational.

The next generation gas turbine control system, scheduled for market introduction in fiscal 2026, ties most directly to the investment story by reinforcing Mitsubishi Electric’s role in higher value, data heavy industrial solutions. For investors watching whether the company can gradually shift mix toward more advanced, software rich offerings and support margins against lower cost competitors, this type of control technology platform is an important proof point, even if not yet a major financial contributor.

Yet against this progress, investors should be aware of rising competition from lower cost Asian manufacturers and what that could mean for...

Read the full narrative on Mitsubishi Electric (it's free!)

Mitsubishi Electric's narrative projects ¥6044.2 billion revenue and ¥423.4 billion earnings by 2028.

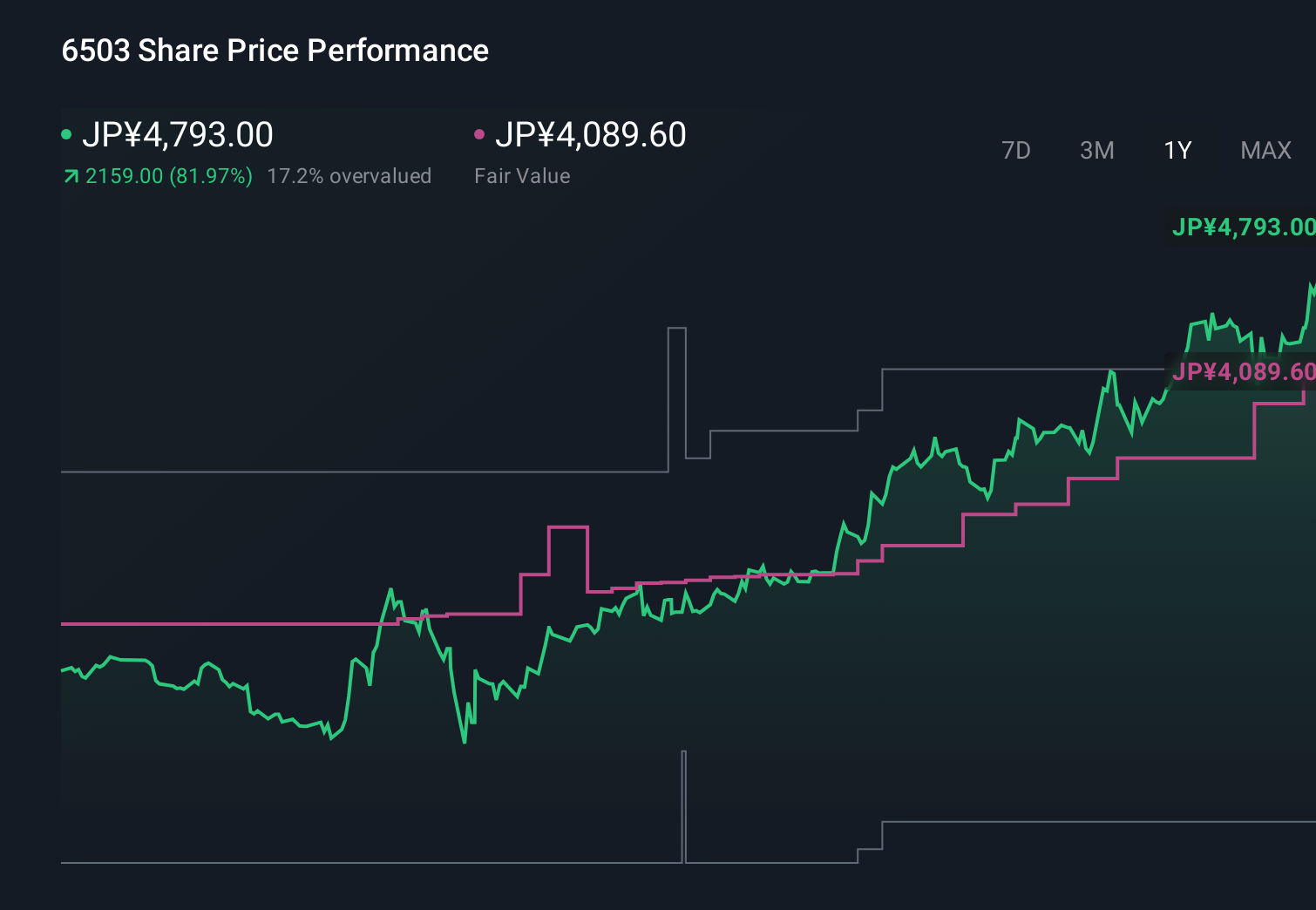

Uncover how Mitsubishi Electric's forecasts yield a ¥4210 fair value, a 14% downside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community currently see fair value for Mitsubishi Electric between ¥3,730 and ¥4,210 per share, underscoring how far opinions can diverge. You should weigh those views against the risk that Mitsubishi Electric’s slower pivot to advanced digital and AI based offerings could leave parts of the business exposed to margin pressure over time.

Explore 2 other fair value estimates on Mitsubishi Electric - why the stock might be worth 24% less than the current price!

Build Your Own Mitsubishi Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Electric research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mitsubishi Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Electric's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com