Assessing First Advantage (FA) Valuation After Institutional Buying And Earnings Turnaround

Institutional buying and earnings turnaround put First Advantage in focus

Onex Canada Asset Management recently raised its position in First Advantage (FA), adding 240,978 shares in the third quarter of 2025, alongside earnings that showed revenue growth and a turnaround in net income.

See our latest analysis for First Advantage.

First Advantage's recent news arrives alongside a 9.33% 1 month share price return and a 6.11% year to date share price return at a current share price of $15.12, while the 1 year total shareholder return of 15.58% decline contrasts with a 24.27% total shareholder return over three years, suggesting near term momentum is improving after a weaker year for holders.

If you are looking beyond First Advantage, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With the shares trading at $15.12, an estimated 16% below the average analyst price target and flagged with an intrinsic discount of about 46%, you have to ask: is this genuine value, or is the market already pricing in future growth?

Most Popular Narrative: 14% Undervalued

At a last close of US$15.12 against a narrative fair value of about US$17.57, the widely followed view frames First Advantage as modestly undervalued and firmly tied to its earnings and cash flow potential over the next few years.

Ongoing investments in proprietary AI-enabled technology, automation, and integrated platforms (particularly following the Sterling acquisition) are unlocking operational efficiencies and enabling more high-margin value-added services, creating potential for margin expansion and higher net earnings.

Want to understand why earnings are at the center of this valuation call? Revenue expectations, margin rebuild, and a higher future P/E all sit at the core. Curious which assumptions really carry the weight in that US$17.57 fair value estimate? The full narrative explains how those moving parts fit together.

Result: Fair Value of $17.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh risks such as softer hiring volumes and intense competition, which could pressure pricing, margins, and the earnings story behind that US$17.57 fair value.

Find out about the key risks to this First Advantage narrative.

Another View: Multiples Point To A Richer Price

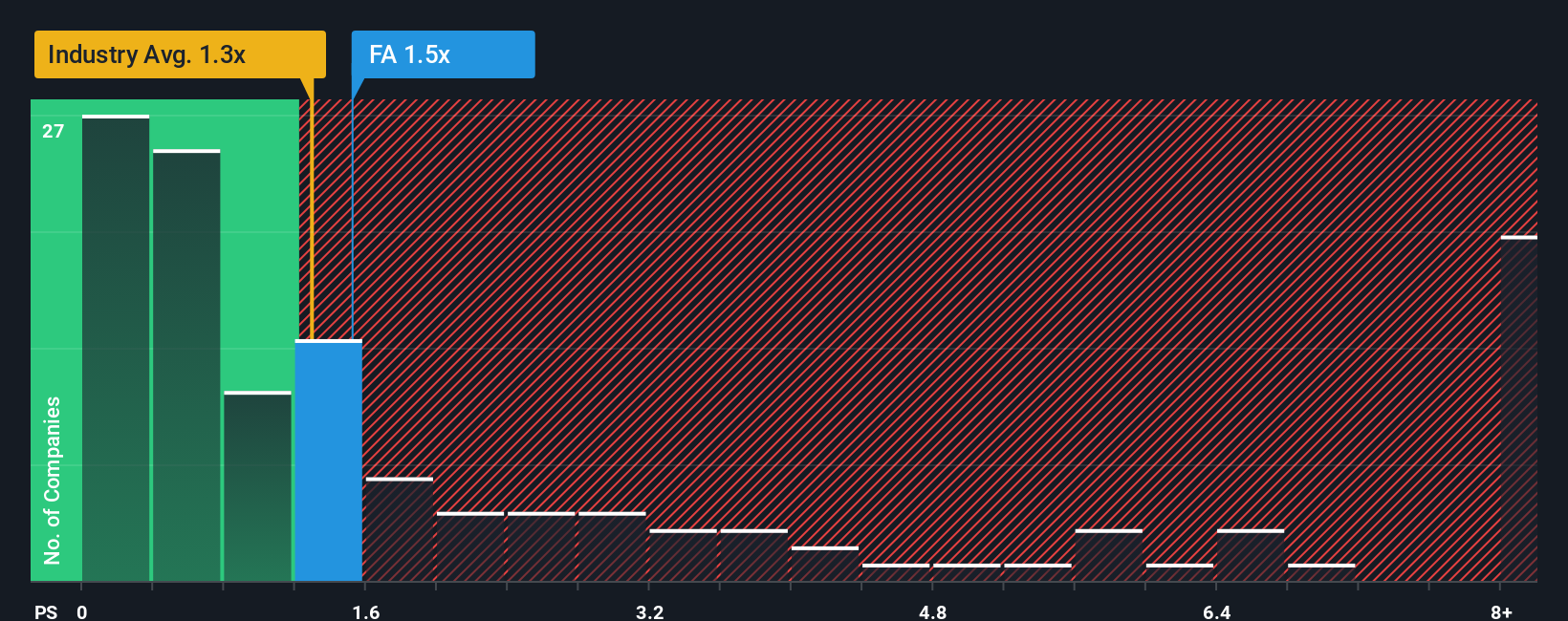

While the narrative and DCF-style work frame First Advantage as undervalued, the P/S ratio of 1.8x paints a tighter picture. It sits above the US Professional Services average of 1.3x and a fair ratio of 1.6x, which suggests less margin for error if the growth story slips. Where do you place more weight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Advantage Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own view using the same data, you can build a tailored thesis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding First Advantage.

Looking for more investment ideas?

If you stop with just one stock, you risk missing other opportunities that might fit your style even better, so consider putting a few smart options on your radar.

- Target income potential with these 11 dividend stocks with yields > 3% that could help you build a steadier cash flow profile from your equity holdings.

- Explore major technology shifts by scanning these 25 AI penny stocks that sit at the intersection of data, automation, and digital infrastructure.

- Look for possible mispriced opportunities using these 877 undervalued stocks based on cash flows that may trade at a discount to their underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com