A Look At Zillow Group (ZG) Valuation As Shares Move Without A Clear News Catalyst

Zillow Group stock triggered overview

Zillow Group (ZG) shares have moved without a clear single news catalyst, which puts the focus on recent performance and fundamentals as investors reassess the real estate platform’s role in their portfolios.

See our latest analysis for Zillow Group.

At a share price of US$65.88, Zillow Group’s recent trading has been choppy, with a 30 day share price return of an 8.36% decline and a 1 year total shareholder return of a 5.44% loss. The 3 year total shareholder return of 65.82% contrasts with a 5 year total shareholder return of a 56.72% decline, suggesting momentum has cooled compared to earlier years.

If you are comparing Zillow’s setup with other real estate and housing exposed names, it could be a useful time to scan auto manufacturers as another way to think about consumer and housing related demand trends.

With Zillow Group trading at US$65.88, modestly up against its own recent swings and sitting at a reported 42% discount to one intrinsic estimate, you have to ask: is this a genuine mispricing, or is the market already baking in future growth?

Most Popular Narrative: 25.5% Undervalued

With Zillow Group last closing at US$65.88 against a narrative fair value of US$88.46, the current gap centers squarely on expectations for future growth and profitability.

The analysts have a consensus price target of $86.957 for Zillow Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $66.0.

Curious what kind of revenue trajectory, margin lift, and future earnings multiple are being penciled in to support that gap? The underlying narrative focuses on compounding profitability, a richer mix of higher monetization products, and a premium valuation usually associated with faster growing platforms. The full breakdown shows how these elements are combined into that fair value story.

Result: Fair Value of $88.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if real estate transaction volumes stay weak or if commission and regulatory pressures reduce spending on Premier Agent and advertising.

Find out about the key risks to this Zillow Group narrative.

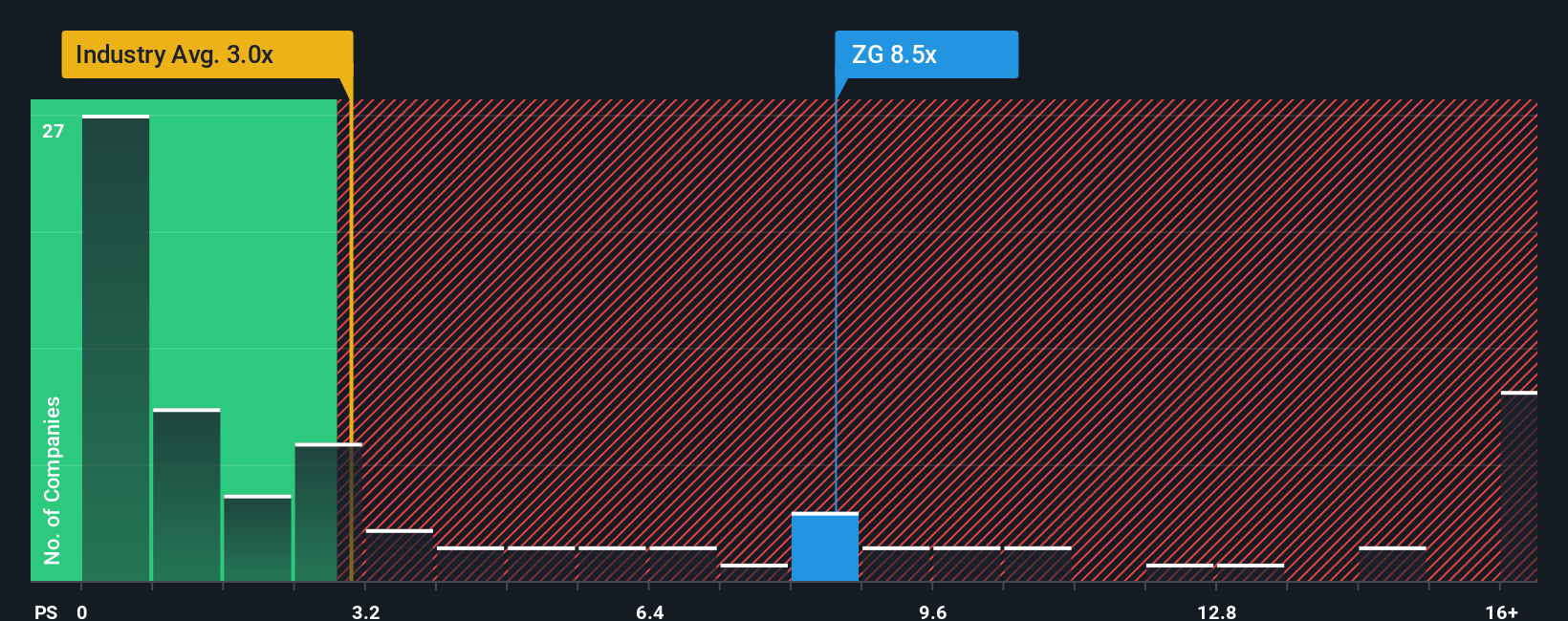

Another View: Valuation Through Sales Multiples

The narrative and DCF style fair values suggest Zillow Group could be undervalued, but its current pricing on sales tells a different story. At a P/S ratio of 6.4x versus a fair ratio estimate of 4.4x, the stock trades well above where the market could move toward. It also sits far above the US Real Estate industry average of 2.0x and a peer average of 3.1x, which points to meaningful valuation risk if sentiment or growth expectations cool. Which story do you think holds up better under your own assumptions?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zillow Group Narrative

If you see the data differently or prefer to test your own assumptions, you can build a complete Zillow Group narrative yourself in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zillow Group.

Looking for more investment ideas?

If Zillow Group has you thinking differently about your portfolio, do not stop here. Broaden your watchlist now so you are not late to the next opportunity.

- Spot potential value plays early by scanning these 877 undervalued stocks based on cash flows that currently screen as priced below their estimated cash flow potential.

- Explore technology-related themes by checking out these 25 AI penny stocks that are connected to artificial intelligence and market growth stories.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% that may help support more consistent cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com