Is Apple (AAPL) Pricing Look Stretched After Tariff Headlines And Recent Share Pullback

- Wondering if Apple at US$262.36 is priced for perfection or still offers value? This article will walk you through what the current share price might be implying.

- Over the last week the stock has recorded a 3.9% decline, adding to a 5.9% pullback over 30 days. It still shows an 8.8% return over 1 year and very large total returns across 3 and 5 years.

- Recent headlines have continued to focus on Apple’s role as a major technology bellwether, with attention on product ecosystem strength and its position within global indices that many portfolios track. This context helps frame why a 3.2% year to date decline can attract interest from both long term holders and newer investors who are assessing whether sentiment is shifting.

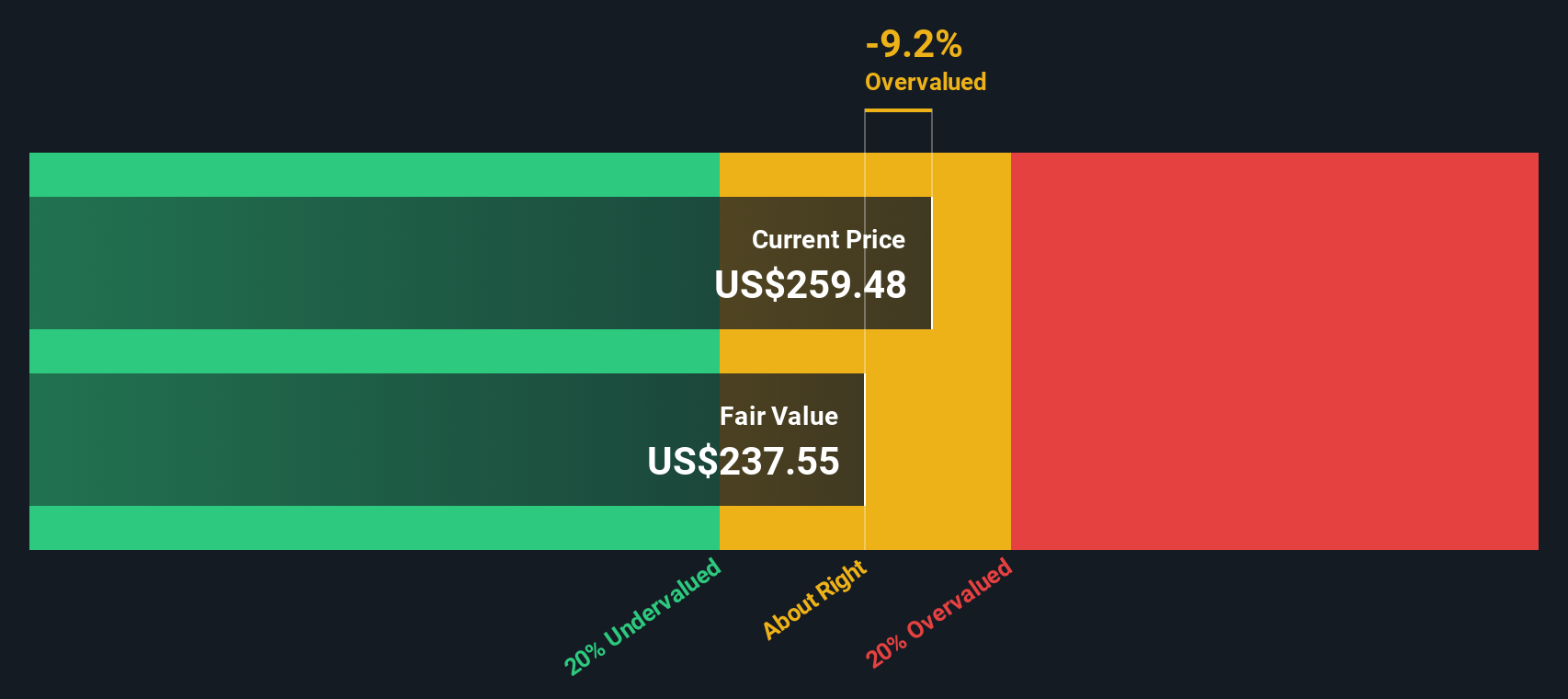

- Right now Apple earns a valuation score of 1 out of 6. This means it screens as undervalued on only one of six checks. We will look at what different valuation methods say about that before finishing with a framework that may help you think about value in an even clearer way.

Apple scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Apple Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash Apple could generate in the future and discounts those cash flows back to what they might be worth in today’s dollars.

Apple’s latest twelve month Free Cash Flow is about $99.9b. Using a 2 Stage Free Cash Flow to Equity model, analysts and extrapolated estimates project Free Cash Flow reaching $184.1b by 2030, with intermediate years such as 2026 to 2030 ranging from about $128.7b to $194.1b in projected annual cash flows, all measured in dollars and then discounted back to today.

When all those discounted cash flows are added up, the model suggests an intrinsic value of about $225.50 per share. Compared with the current share price of $262.36, this implies the stock is around 16.3% overvalued according to this specific DCF setup.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Apple may be overvalued by 16.3%. Discover 877 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Apple Price vs Earnings

For a mature, profitable company, the P/E ratio is a useful way to think about what you are paying for each dollar of current earnings. It gives a quick sense of how the market is weighing Apple’s earnings power today relative to other options.

What counts as a “normal” or “fair” P/E depends on what investors expect for future growth and how much risk they see in those earnings. Higher expected growth or lower perceived risk can support a higher P/E, while slower growth or greater uncertainty tends to support a lower one.

Apple currently trades at about 34.61x earnings. That is above the Tech industry average of roughly 22.95x and also slightly above the peer average of 33.14x. Simply Wall St’s Fair Ratio for Apple is 37.63x, which is its proprietary estimate of what a justified P/E could be after accounting for factors like earnings growth, profit margins, industry, market cap and company specific risks. This Fair Ratio can be more tailored than a simple peer or industry comparison because it folds those company characteristics into a single number. With a Fair Ratio of 37.63x versus the current 34.61x, Apple screens as slightly undervalued on this metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Apple Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are the stories you and other investors build around a company that tie together your view of its future revenue, earnings and margins with a specific fair value. Narratives sit inside an easy to use tool on Simply Wall St's Community page that compares that fair value to the current price, updates automatically when new news or earnings arrive, and can look very different from one investor to another. For example, one Apple Narrative recently set fair value around US$286.58 while another put it closer to US$177.34. This gives you a clear view of how different perspectives translate into numbers you can actually act on.

For Apple however we will make it really easy for you with previews of two leading Apple Narratives:

First, here is how a bullish investor currently frames the stock, and then how a bearish investor sees the same facts but comes to a very different conclusion.

Fair value: US$275.00 per share

Implied pricing: around 4.6% below this narrative fair value at the last close of US$262.36

Revenue growth assumption: 12.78%

- Tariffs on Chinese imports of up to 145% are a key pressure point, given that a large share of iPhones are assembled in China, so Apple is working on exemptions and shifting more production to India and Vietnam.

- Q1 2025 profit of US$36.33b, or US$2.40 per share, and record services revenue of US$26.3b support the view that the business model is holding up despite cost and supply chain pressures.

- The narrative leans on Apple’s investments in artificial intelligence, strong brand loyalty, and analyst pricing targets such as US$251.72 and US$275 as reasons to see room for recovery over time, even with ongoing geopolitical risks.

Fair value: US$177.34 per share

Implied pricing: around 48.0% above this narrative fair value at the last close of US$262.36

Revenue growth assumption: 14.68%

- This view highlights a P/E ratio above 28x, described as high relative to a broad market average of around 20x, for a company that the author sees as past its fastest growth phase.

- It points to slower growth in core hardware like the iPhone, pressure on margins from rising costs and lower priced products, and questions how much services can offset that.

- Heavy exposure to China, rising competition from local brands, and what the author sees as cautious use of Apple’s large cash balance are all used to argue that the current share price builds in very optimistic expectations.

Taken together, these Narratives show you how two informed investors can look at the same Apple share price of US$262.36, plug in different fair values of US$275.00 and US$177.34, and come away with very different conclusions about whether the stock is priced high or low.

If you find that helpful, it can be useful to ask which assumptions feel closer to your view on tariffs, growth in services, the role of artificial intelligence and Apple’s long term position in smartphones and beyond, then decide where you sit between these two anchors.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for Apple? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com