A Look At TAG Immobilien (XTRA:TEG) Valuation As Higher Interest Rates Pressure Debt Costs And Property Values

TAG Immobilien (XTRA:TEG) is under increased investor scrutiny as higher European interest rates push up financing costs and weigh on property valuations, a key issue for its affordable residential focus in Germany.

See our latest analysis for TAG Immobilien.

At a share price of €13.37, TAG Immobilien has seen mixed momentum, with a 1 year total shareholder return of 1.03% contrasting with a strong 3 year total shareholder return of 89.27% and a weaker 5 year total shareholder return of 35.54%.

If TAG’s interest rate sensitivities have you reassessing risk, it could be a good moment to broaden your watchlist and look at fast growing stocks with high insider ownership.

With TAG Immobilien trading at €13.37 and reporting €943.258m of revenue and €391.828m of net income, investors are asking a key question: is this pricing too low or already reflecting any future growth?

Most Popular Narrative Narrative: 26.3% Undervalued

Against TAG Immobilien’s last close of €13.37, the most followed narrative points to a fair value of €18.15. This raises clear questions about what assumptions sit underneath that gap.

Prudent capital management, marked by a reduced LTV (now at 45.3%), strong cash and liquidity positions, and stable refinancing costs, is mitigating interest expense risk and providing ample capacity for future development and growth, thus supporting long-term earnings stability.

Want to see what is driving that higher fair value? The core of this narrative rests on falling top line, rising profit margins and a richer future earnings multiple. Curious how those pieces fit together over the next few years? The full narrative breaks down the revenue reset, margin shift and valuation math that link today’s price to that €18.15 figure.

Result: Fair Value of €18.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Poland continuing to absorb new units and on refinancing staying manageable, with construction delays or higher debt costs both capable of knocking that story off course.

Find out about the key risks to this TAG Immobilien narrative.

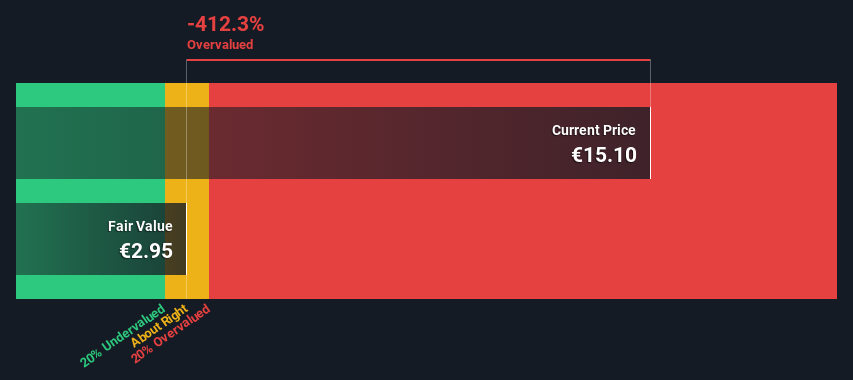

Another View: Our DCF Model Says Overvalued

While the consensus narrative points to a fair value of €18.15 and calls TAG Immobilien undervalued, our DCF model points in the opposite direction. On that approach, a fair value of €10.19 suggests the current €13.37 price sits above what those cash flow assumptions support.

This gap cuts both ways. If you think cash flows will be stronger or less volatile than our inputs, the DCF may look too cautious. If you worry about falling revenue, high leverage and one off gains, the DCF warning may feel more realistic. Which story are you more inclined to test against your own numbers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TAG Immobilien for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TAG Immobilien Narrative

If the stories here do not quite match your own view, you can test the same data yourself and build a fresh TAG narrative in minutes: Do it your way.

A great starting point for your TAG Immobilien research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If TAG Immobilien has sharpened your thinking, do not stop here. Use the screener to spot other opportunities that could fit your plan.

- Target dependable income by reviewing these 11 dividend stocks with yields > 3% that might suit an investor focused on regular cash returns.

- Hunt for potential mispricing with these 877 undervalued stocks based on cash flows, built to surface companies where cash flow expectations and prices look out of sync.

- Get ahead of structural change by checking out these 79 cryptocurrency and blockchain stocks that sit at the intersection of markets and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com