Softer VLCC Spot Rates and Steady OPEC+ Output Could Be A Game Changer For Frontline (FRO)

- In recent days, Frontline plc has faced softer crude-tanker market conditions, as very large crude carrier spot freight benchmarks retreated from earlier elevated levels while OPEC+ decided in late 2025 to keep oil output policy unchanged through March 2026.

- These shifts in spot rates and export expectations are important because they directly influence Frontline’s near-term earnings power and the cash available for future dividends.

- We’ll now examine how weaker VLCC spot freight rates could alter Frontline’s previously outlined investment narrative and its underlying assumptions.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Frontline Investment Narrative Recap

To own Frontline, you need to be comfortable with a cyclical crude tanker business where spot-market exposure drives earnings and dividends. The recent pullback in VLCC spot rates and the OPEC+ decision mainly affect the key near term catalyst, which is Frontline’s upcoming February 27 earnings report, and they also highlight the biggest current risk: exposure to potentially weaker or more volatile spot freight income. At this stage, the impact appears meaningful for near term cash generation but not thesis breaking.

Against this backdrop, Frontline’s recent pattern of variable dividends, including the Q3 2025 cash dividend of US$0.19 per share after higher payouts earlier in 2025, looks directly linked to swings in earnings and spot-market strength. For me, that history makes the next quarterly update even more relevant, as it should give a clearer sense of how the current softer rate environment might flow through to distributable cash and how sensitive shareholder returns are to future rate changes.

Yet even with these tailwinds, investors should be aware that Frontline’s heavy reliance on the spot market could...

Read the full narrative on Frontline (it's free!)

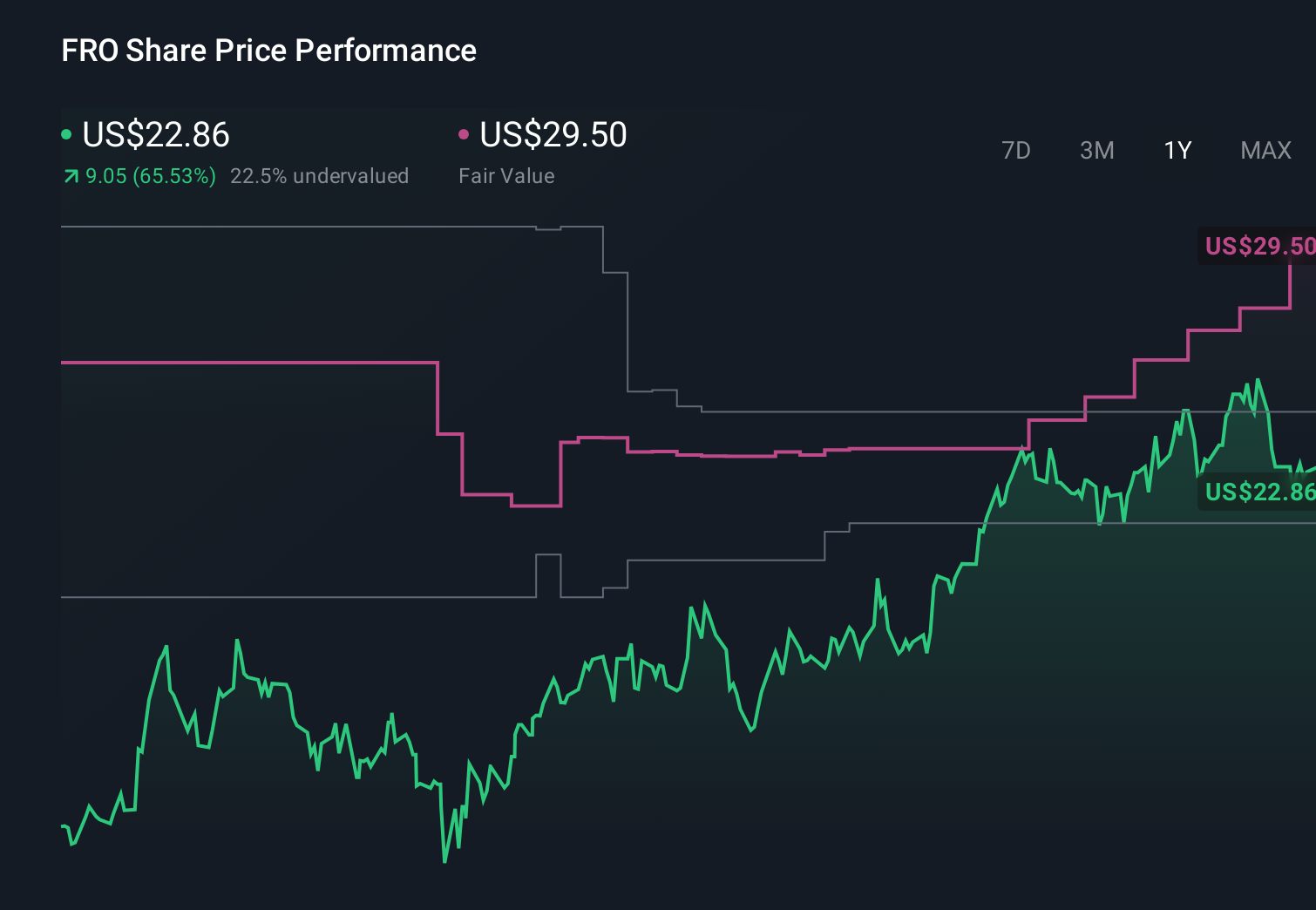

Frontline's narrative projects $1.3 billion revenue and $828.1 million earnings by 2028. This requires a 10.7% yearly revenue decline and an earnings increase of about $590 million from $238.0 million today.

Uncover how Frontline's forecasts yield a $29.50 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$9.65 to US$66.33 per share, underlining how far apart individual views can be. You are seeing that diversity play out right as softer VLCC spot rates and Frontline’s spot exposure add extra uncertainty to near term earnings power, so it is worth weighing several different scenarios for how the tanker cycle could affect results.

Explore 8 other fair value estimates on Frontline - why the stock might be worth over 3x more than the current price!

Build Your Own Frontline Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frontline research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Frontline research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frontline's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 11 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com