JHS Svendgaard Laboratories Limited's (NSE:JHS) Low P/S No Reason For Excitement

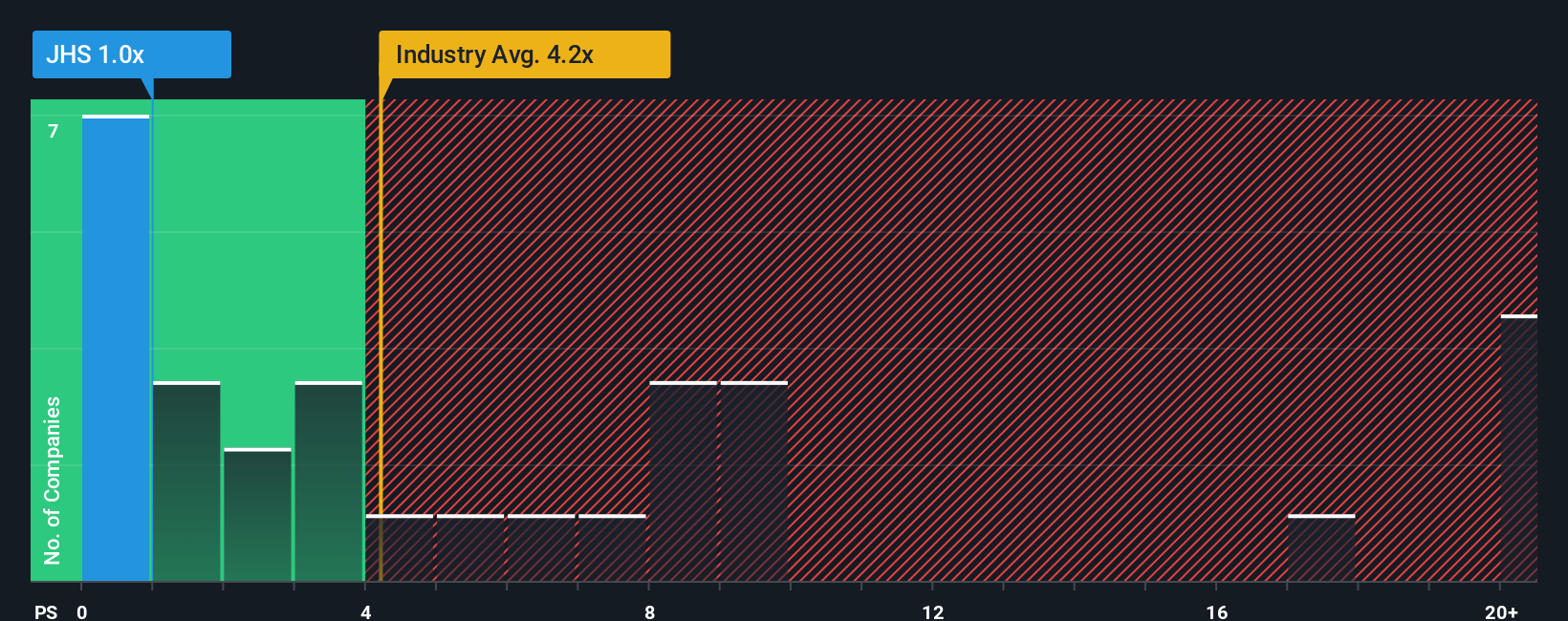

With a price-to-sales (or "P/S") ratio of 1x JHS Svendgaard Laboratories Limited (NSE:JHS) may be sending very bullish signals at the moment, given that almost half of all the Personal Products companies in India have P/S ratios greater than 4.2x and even P/S higher than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for JHS Svendgaard Laboratories

How Has JHS Svendgaard Laboratories Performed Recently?

The revenue growth achieved at JHS Svendgaard Laboratories over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on JHS Svendgaard Laboratories will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For JHS Svendgaard Laboratories?

JHS Svendgaard Laboratories' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 15%. The latest three year period has also seen a 11% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 7.3% shows it's noticeably less attractive.

In light of this, it's understandable that JHS Svendgaard Laboratories' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What We Can Learn From JHS Svendgaard Laboratories' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of JHS Svendgaard Laboratories confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you settle on your opinion, we've discovered 4 warning signs for JHS Svendgaard Laboratories (2 are concerning!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.