Core & Main (CNM) Valuation Check As Analyst Earnings Upgrades Shape Expectations

Core & Main (CNM) is back on investor radar after analysts broadly raised their earnings estimates, a shift that often signals changing expectations for how a company’s near term financial results could look.

See our latest analysis for Core & Main.

At a share price of $53.25, Core & Main has had a mixed year, with recent 30 day and 90 day share price returns of 5.40% and 4.39%, alongside a modest 1 year total shareholder return of 4.04% and a very large 3 year total shareholder return that points to momentum cooling after a strong earlier run, even as the market reacts to earnings upgrades and its agreement to acquire Pioneer Supply in Texas and Oklahoma.

If this kind of earnings driven story interests you, it could be a good moment to widen your watchlist and check out fast growing stocks with high insider ownership.

With the shares around $53.25, a value score of 1 and about a 13% gap to the current analyst price target, the key question is whether Core & Main is still underappreciated or if the market is already pricing in future growth.

Most Popular Narrative: 10.7% Undervalued

With Core & Main last closing at $53.25 versus a narrative fair value of about $59.63, the current setup hinges on how future earnings and margins play out under a relatively moderate discount rate of 8.49%.

Core & Main anticipates generating strong operating cash flows, enabling further investment in organic growth and M&A, in addition to returning capital to shareholders through share repurchases, positively impacting earnings per share.

Want to see what is behind that confidence in cash generation and buybacks? Revenue assumptions, margin shifts and a future earnings multiple all have to line up. The full narrative spells out how those moving parts support a higher fair value than today’s share price.

Result: Fair Value of $59.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on execution. Leadership changes or weaker construction activity could quickly challenge the earnings, margin, and buyback assumptions behind that fair value.

Find out about the key risks to this Core & Main narrative.

Another Way Of Looking At The Price

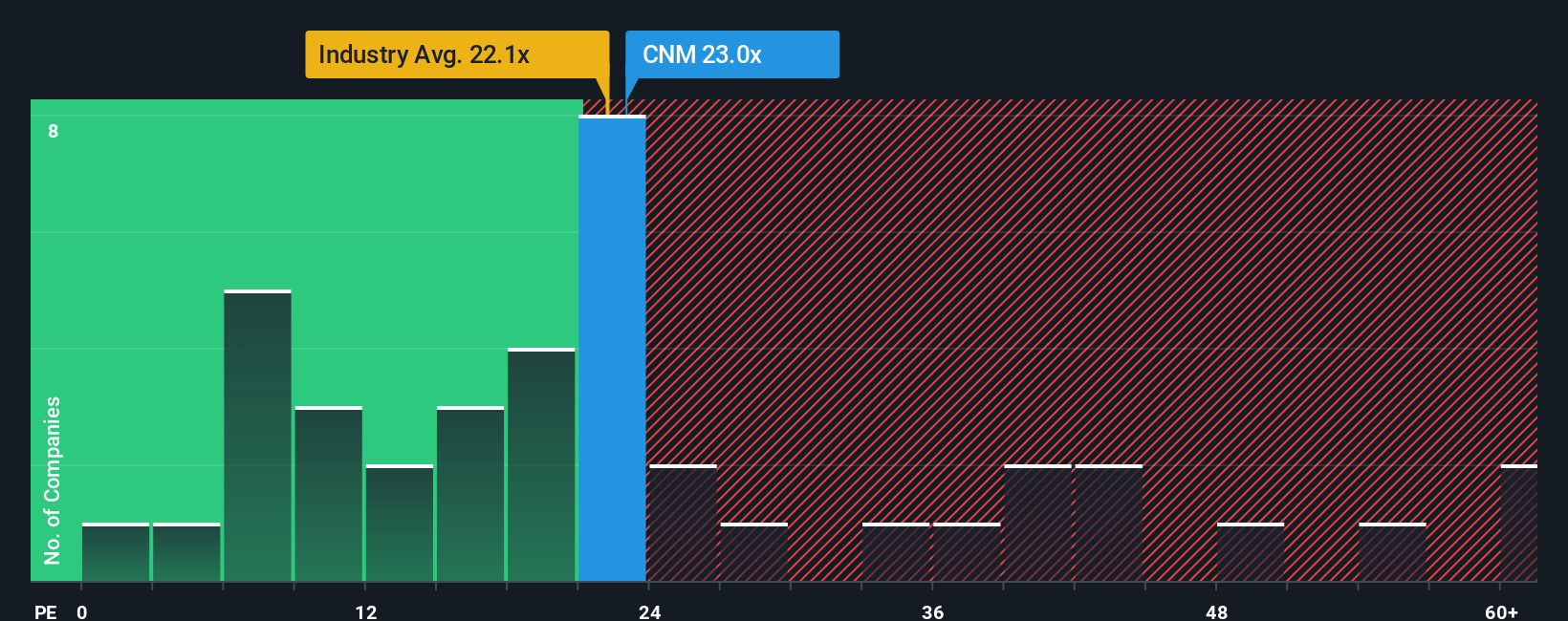

The narrative model paints Core & Main as about 10.7% undervalued, yet the current P/E of 23.1x tells a different story. It sits above both peers at 19.8x and the industry at 21.7x, while our fair ratio sits even higher at 27x. Is this a cushion or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core & Main Narrative

If you see the numbers differently, or simply want to test your own assumptions against the data, you can build a complete narrative in minutes, starting with Do it your way.

A great starting point for your Core & Main research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Core & Main is on your radar, do not stop there. Broaden your opportunity set with focused stock ideas built from real data and clear filters.

- Target potential value plays by scanning these 885 undervalued stocks based on cash flows that line up with your own view of quality and price.

- Ride long term shifts in technology by checking out these 26 AI penny stocks that are tied to real business models, not just hype.

- Boost your income focus by reviewing these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com