Apogee Enterprises (APOG) Margin Compression To 3.2% Challenges Bullish Earnings Narratives

Apogee Enterprises Q3 2026 Earnings Snapshot

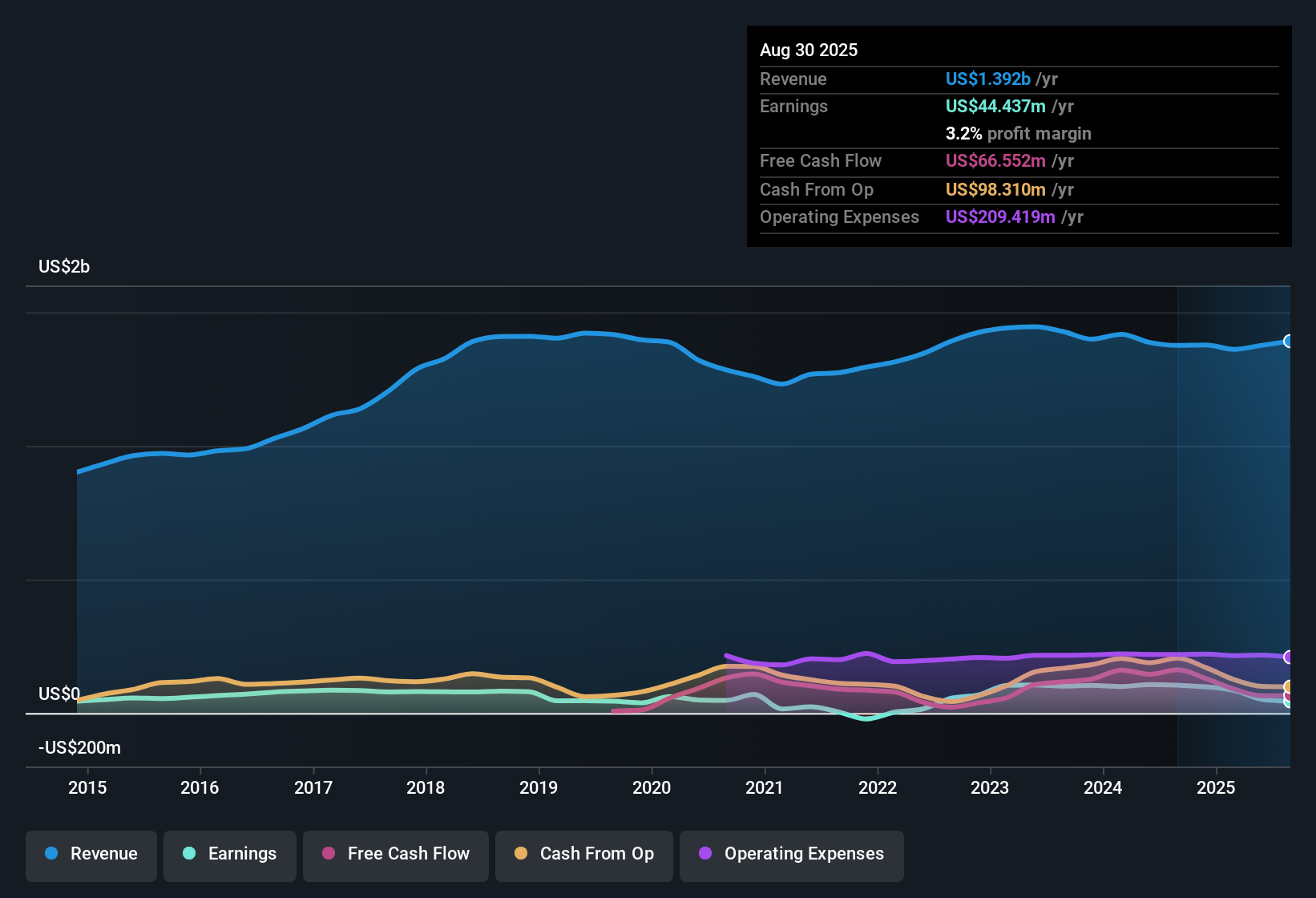

Apogee Enterprises (APOG) has just turned in another data point in a volatile stretch, with recent quarterly revenue sitting at about US$358.2 million and basic EPS of roughly US$1.10, against a trailing twelve month picture that shows total revenue of about US$1.39 billion and EPS of roughly US$2.07. Over the last few reported quarters, the company has seen revenue move from about US$331.5 million and EPS of roughly US$1.42 in early 2025 to the latest US$358.2 million and US$1.10 respectively, with periods of both profit and loss along the way. With trailing net profit margin at 3.2% versus 7.6% a year earlier and a large one off US$47.6 million loss weighing on the headline figures, investors are likely to focus on how durable the margin profile really is from here.

See our full analysis for Apogee Enterprises.With the latest numbers on the table, the next step is to see how they line up against the widely followed narratives around Apogee’s growth potential, risks, and long term profitability story.

See what the community is saying about Apogee Enterprises

Margins Pinched By 3.2% Net Profit Level

- Over the last 12 months, Apogee earned net income of US$44.4 million on about US$1.39b of revenue, which works out to a 3.2% net profit margin compared with 7.6% a year earlier.

- Consensus narrative talks about long term margin gains from things like green building demand and efficiency projects such as Project Fortify Phase 2. However, the current 3.2% margin creates a gap between that story and reality, especially given:

- The recent trailing twelve month EPS of US$2.07 is well below the earlier trailing figures above US$4, which sits awkwardly beside expectations for higher future profitability.

- The forecast that earnings could grow around 24% per year sits against a recent period where net income over the last year was US$44.4 million, much lower than the US$100 million plus level seen in the prior year set of trailing data.

Q2 EPS Swing Around A US$47.6 Million One Off

- Quarterly EPS has been choppy, from US$1.42 and US$1.40 in early and mid 2025 to a small profit of US$0.12 in late 2025, a loss of US$0.13 in early 2026, then back to US$1.10 in the latest Q2 2026, with a one off loss of US$47.6 million pulling down the trailing results.

- Bears often argue that heavy dependence on domestic commercial construction and tariff exposure can make earnings fragile, and this volatile EPS path adds some support to that concern, even as some factors cut the other way:

- Lower Glass segment demand and tariff effects are specifically called out in the cautious view, and the swing from a Q1 2026 loss of US$2.7 million to a Q2 2026 profit of US$23.6 million shows how sensitive results can be to segment health and cost pressures.

- At the same time, the one off US$47.6 million loss is a discrete event that partly explains why trailing EPS dropped from above US$4 to a little over US$2, which means not all of the weakness reflects ongoing operations.

Valuation Gap Versus 3.24% Dividend Yield

- With the share price at US$32.11, analysts’ consensus price target of US$52.00 and a DCF fair value of about US$66.74 both sit well above where the stock trades, while the trailing dividend yield stands at 3.24% and the P/E of 15.5x is below the wider US Building industry average of 20.4x but slightly above the peer average of 14.6x.

- The bullish view leans on that gap, arguing the stock could benefit as earnings grow and margins improve. However, the current numbers keep that argument honest:

- Analysts looking for earnings of US$118.9 million by around 2028 are starting from a trailing base of US$51.4 million, so the current margin profile and debt load need to be weighed against those expectations.

- Income focused investors may pay close attention to the 3.24% dividend yield alongside the idea that the company is trading roughly 51.9% below the DCF fair value of US$66.74, while also considering that net margin is currently at 3.2% rather than the higher levels used in past assumptions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Apogee Enterprises on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently and feel like the story points in another direction? Take a couple of minutes to shape it your way with Do it your way.

A great starting point for your Apogee Enterprises research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Apogee’s recent 3.2% net margin, choppy EPS path and reliance on a one off US$47.6 million loss highlight how uneven its earnings profile currently looks.

If you would prefer companies with steadier profit trends and fewer surprises, check out stable growth stocks screener (2145 results) to focus on businesses that have a track record of consistent revenue and earnings across different conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com