Aon (AON) Valuation Check As Shares Flatten And Fair Value Signals Possible Upside

What Aon’s Recent Share Performance Signals for Investors

Aon (NYSE:AON) has drawn fresh attention after a mixed run in its share performance, with a small gain over the past month and a modest decline across the past 3 months that is testing investor conviction.

At a recent close of US$349.92, the stock sits close to flat over the past year. Over the same period, the company reports annual revenue of US$17.0b and net income of US$2.7b, figures that help frame how the current valuation is being assessed.

See our latest analysis for Aon.

Against that backdrop, Aon’s recent 30 day share price return of 1.90% sits alongside a 1 year total shareholder return of 0.10%, while the 5 year total shareholder return of 75.94% reflects a much stronger long term picture, suggesting momentum has softened recently as investors reassess growth prospects and risk.

If this kind of steady, service based business interests you, it can be useful to also scan other areas of the market using tools like Simply Wall St’s screener for fast growing stocks with high insider ownership.

With Aon trading close to flat over the past year and sitting below the average analyst price target, the key question is whether the current valuation leaves upside on the table or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 12.4% Undervalued

Against Aon’s last close of US$349.92, the most followed narrative points to a higher fair value, built on specific growth and margin assumptions.

Investment in priority hires and expanding Aon Business Services (ABS) capabilities are creating capacity to fund growth initiatives and drive operational efficiencies, benefiting net margins and earnings.

Want to see what is behind that optimism on margins and earnings power? The narrative focuses on steadier revenue growth and a richer profit profile, with these projections discounted at a specific rate to reach its fair value line.

Result: Fair Value of $399.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside story could be challenged if softer commercial risk pricing persists or if higher debt costs after the NFP acquisition squeeze margins more than expected.

Find out about the key risks to this Aon narrative.

Another View: Multiples Paint a Very Different Picture

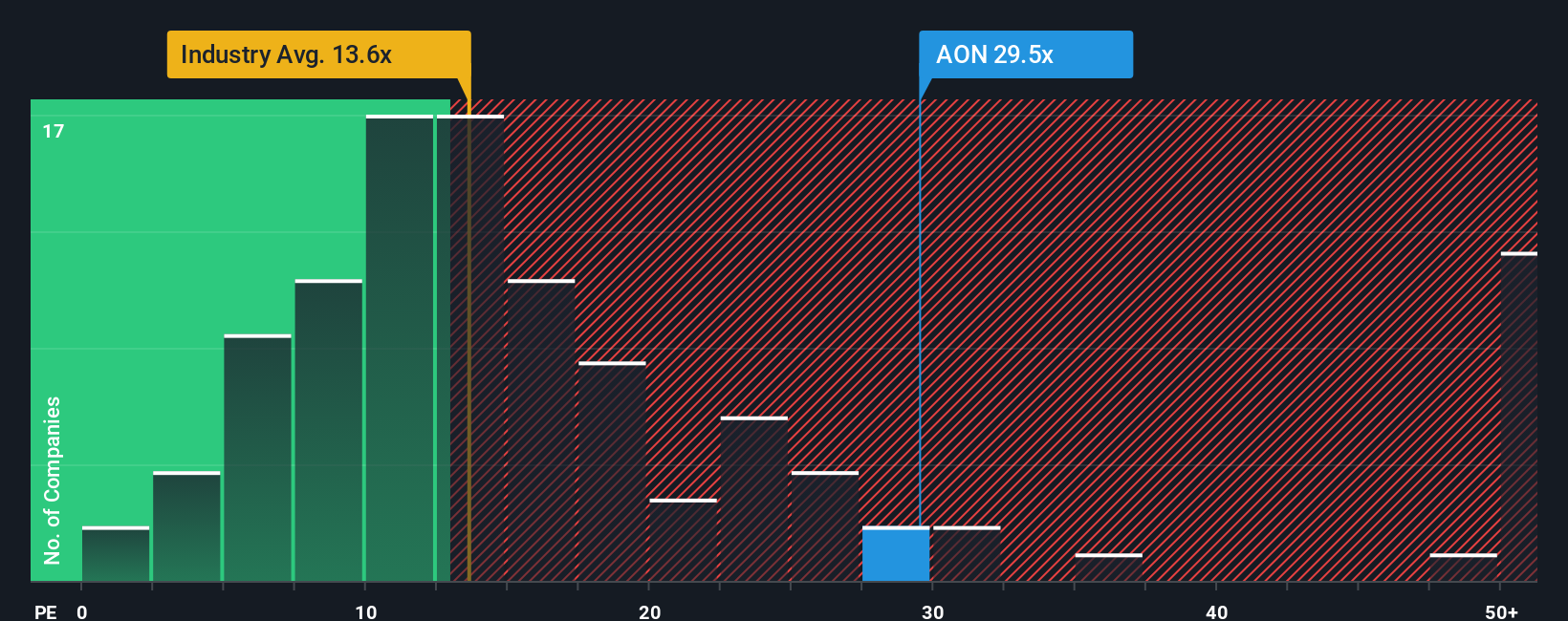

While the narrative and fair value estimate of US$399.37 suggest upside, the current P/E of 27.7x tells a tougher story. It is higher than the estimated fair ratio of 16x, above the US Insurance industry at 12.9x, and above peers at 26.4x. This points to meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aon Narrative

If you interpret the numbers differently or want to test your own assumptions, you can build a personalised Aon thesis in just a few minutes by starting with Do it your way.

A great starting point for your Aon research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready To Find Your Next Investment Idea?

If Aon is already on your radar, do not stop there. Use the same data driven tools to spot other opportunities before they get crowded.

- Target dependable income by scanning these 12 dividend stocks with yields > 3% that focus on consistent payouts and yields above 3%.

- Hunt for potential mispricing with these 885 undervalued stocks based on cash flows that highlight companies priced below their estimated cash flow value.

- Get ahead of emerging tech themes through these 26 AI penny stocks that group smaller AI names into one focused starting list.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com