Assessing Helios Technologies (HLIO) Valuation After Recent Share Price Strength And Analyst Expectations

With no specific news catalyst on the tape, Helios Technologies (HLIO) is drawing attention for its recent share performance and financial profile, prompting investors to reassess how the stock fits into their portfolios today.

See our latest analysis for Helios Technologies.

At a share price of US$57.13, Helios has seen a 17.36% 90 day share price return. Its 1 year total shareholder return of 25.05% contrasts with flatter 3 and 5 year total shareholder returns, which may indicate that momentum has picked up more recently.

If Helios has caught your eye, it could be a moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

So with Helios trading at US$57.13, showing a 25.05% 1 year total return and some analysts seeing upside to their price targets, is the market leaving you a margin of safety here or already pricing in future growth?

Most Popular Narrative Narrative: 12.4% Undervalued

With Helios Technologies last closing at US$57.13 against a narrative fair value of about US$65.20, the current price sits below that framework and sets up a clear valuation gap for you to assess.

The analysts have a consensus price target of $60.6 for Helios Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $73.0, and the most bearish reporting a price target of just $55.0.

Curious what kind of earnings ramp, margin profile, and future P/E multiple are baked into that fair value? The core assumptions here are anything but plain. The narrative leans on faster profit growth than revenue, richer margins, and a compressed valuation multiple that still sits above the sector. Want to see exactly how those moving parts add up to the US$65.20 figure?

Result: Fair Value of $65.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still a few pressure points to keep in mind, including ongoing exposure to cyclical construction and agriculture demand, as well as the risk that electrification undercuts traditional hydraulics.

Find out about the key risks to this Helios Technologies narrative.

Another View: Rich Multiples Keep The Bar High

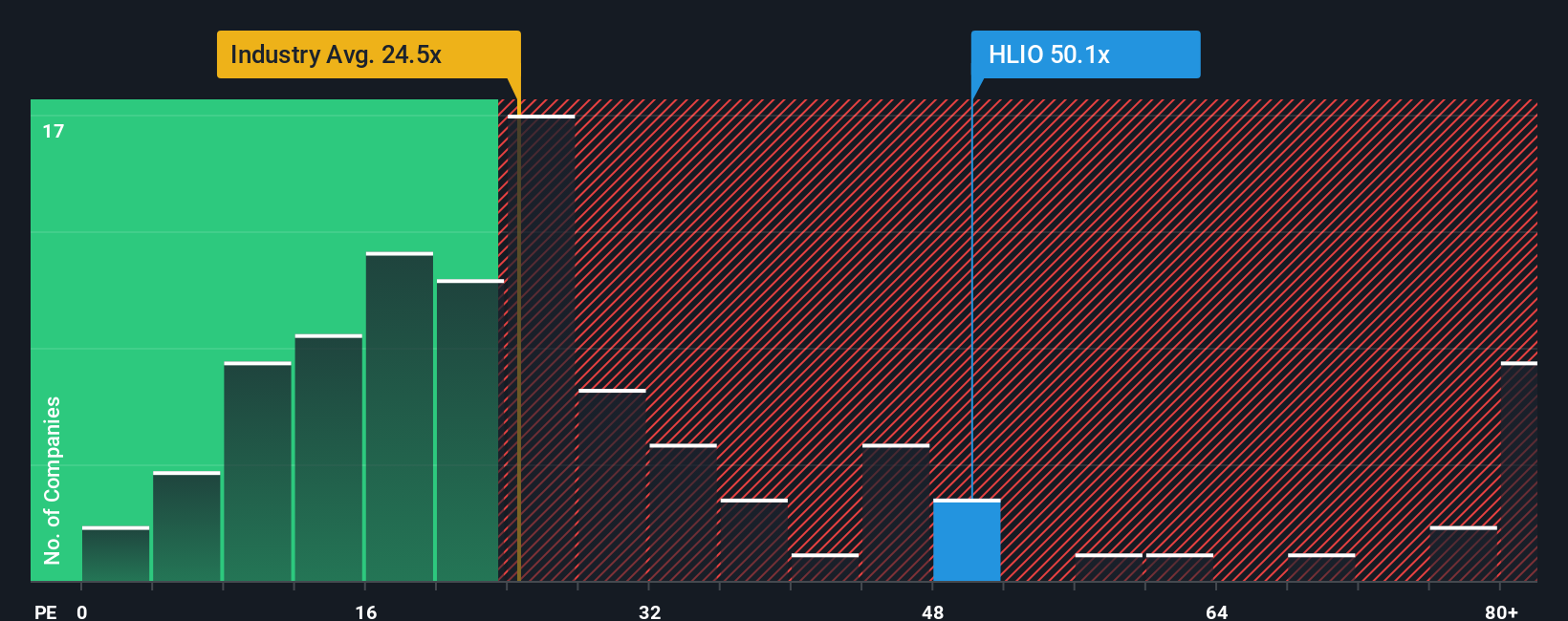

The narrative fair value suggests upside, but the current P/E of 56.2x is well above the estimated fair ratio of 44.5x, the US Machinery industry at 26x and peers at 37.2x. That premium can work for you if earnings deliver, but what happens if expectations cool?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helios Technologies Narrative

If you see the numbers differently or prefer to test the assumptions yourself, you can build a custom Helios view in minutes with Do it your way.

A great starting point for your Helios Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Helios does not fully fit what you want, do not stop here. Use focused stock lists to quickly surface other ideas that match your style.

- Target income potential by scanning these 12 dividend stocks with yields > 3% that might suit investors who prioritise regular cash returns from their holdings.

- Spot potential mispricings by reviewing these 885 undervalued stocks based on cash flows where current prices may sit below estimated cash flow based fair values.

- Get ahead of emerging themes by checking these 79 cryptocurrency and blockchain stocks that are tied to digital assets, blockchain infrastructure and related services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com