A Look At Philip Morris International’s Valuation As Zyn And Iqos Iluma Gain Attention

How Philip Morris International’s ESOP filing fits into the wider equity story

Philip Morris International (NYSE:PM) recently filed an $80.525 million shelf registration for 500,000 shares of common stock tied to an employee stock ownership plan. This is a relatively routine move that still raises useful questions for investors.

See our latest analysis for Philip Morris International.

The shelf registration sits against a mixed share price backdrop, with a recent 4.63% 1 month share price return but a slight year to date share price decline. At the same time, the 1 year total shareholder return of 31.82% and 5 year total shareholder return of 143.34% point to stronger longer term momentum supported by interest in Zyn and expectations around the planned Iqos Iluma rollout.

If this ESOP filing has you thinking beyond Philip Morris International, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With the shares sitting below some analyst targets and an estimated intrinsic value, yet already reflecting enthusiasm around Zyn and the planned Iqos Iluma rollout, is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 15.2% Undervalued

With Philip Morris International last closing at US$155.15 versus a narrative fair value of US$182.94, the current setup centers on what is baked into future earnings and margins.

The accelerating global adoption of smoke-free alternatives, driven by increasing health awareness and regulatory moves away from combustibles, is associated with strong double-digit volume and margin growth in PMI's IQOS, ZYN, and VEEV platforms. This secular shift enables the company to reach new consumer segments, expand its addressable market, and potentially increase net revenues and operating margins over time.

Curious how an earnings bridge, a richer profit margin profile, and a lower future P/E are all working together in this valuation story? The full narrative sets out the revenue path, the margin step up, and the profit multiple that supports a higher fair value than today’s price, and it ties all three into one earnings target that everything else hangs off.

Result: Fair Value of $182.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on smoke free products growing quickly enough to offset cigarette declines and on regulation not tightening further around nicotine and tax.

Find out about the key risks to this Philip Morris International narrative.

Another View: What P/E Says About Philip Morris International

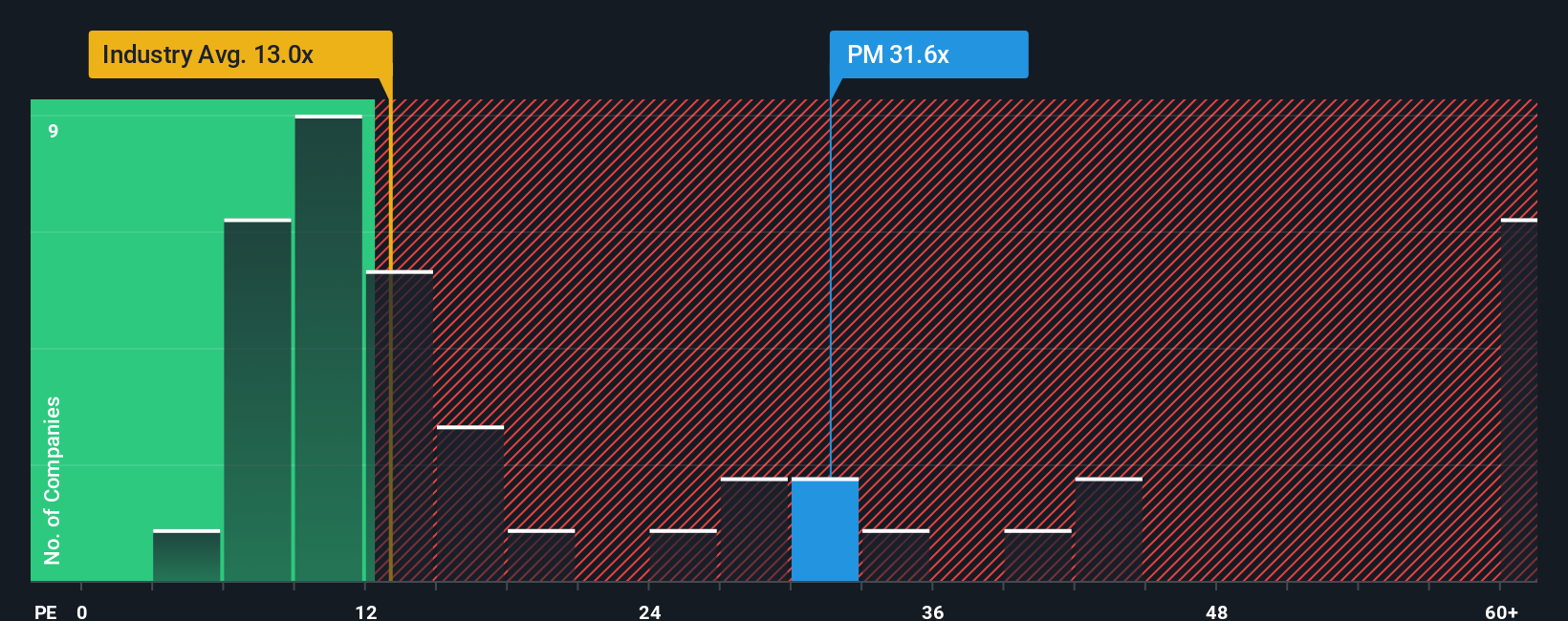

If you step away from the narrative fair value and just look at the current P/E of 28.1x, Philip Morris International screens as expensive versus the global tobacco industry at 13.3x, peers at 23x, and a fair ratio of 26x, which leaves less room if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Philip Morris International Narrative

If you look at the numbers and come to a different view, or just prefer to crunch the data yourself, you can build a custom Philip Morris International story in a few minutes with Do it your way.

A great starting point for your Philip Morris International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you risk missing other opportunities that might fit your style better, so take a few minutes to scan fresh ideas today.

- Spot potential value by checking out these 885 undervalued stocks based on cash flows that screen for prices that differ from cash flow based assessments.

- Capture growth themes by scanning these 26 AI penny stocks that are tied to artificial intelligence developments.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com