Has AGNC Investment (AGNC) Run Too Far After Recent Share Price Strength?

- Are you wondering whether AGNC Investment is offering good value at today’s price, or if the recent run has moved it too far, too fast for new money to feel comfortable?

- The stock last closed at US$11.06, with returns of 3.2% over 7 days, 5.4% over 30 days, 1.2% year to date, 38.0% over 1 year and 55.1% over 3 years, plus 38.3% over 5 years. This raises a fair question about what is currently priced in.

- Recent attention on AGNC Investment has largely centered on its positioning in the mortgage REIT space and how its portfolio responds to changes in interest rates and funding conditions. Market commentary has also focused on how its dividend profile and book value trends influence sentiment on the stock.

- On our checklist of six valuation tests, AGNC Investment scores 4 out of 6, as shown in this valuation score. Next, we compare different valuation approaches and then finish with a perspective that can help you put all those numbers into a clearer story.

Approach 1: AGNC Investment Excess Returns Analysis

The Excess Returns model looks at how efficiently AGNC Investment uses shareholders’ equity and whether returns on that equity are higher than the cost of funding it. In simple terms, it asks how much value the company may create beyond the minimum return investors require.

For AGNC Investment, book value is estimated at $8.83 per share, rising to a stable book value of $9.31 per share, based on forecasts from 4 analysts. Stable EPS is put at $1.66 per share, while the cost of equity is estimated at $0.85 per share. That leaves an excess return of $0.81 per share, with an average forecast return on equity of 17.86%.

By compounding those excess returns on the forecast equity base, the model arrives at an intrinsic value of about $23.00 per share. When compared with the recent share price of $11.06, the Excess Returns approach implies AGNC Investment is 51.9% undervalued based on these assumptions.

Result: UNDERVALUED

Our Excess Returns analysis suggests AGNC Investment is undervalued by 51.9%. Track this in your watchlist or portfolio, or discover 885 more undervalued stocks based on cash flows.

Approach 2: AGNC Investment Price vs Earnings

For profitable companies, the P/E ratio is a useful shorthand because it tells you how much you are paying for each dollar of earnings. What counts as a reasonable P/E depends on how quickly earnings are expected to grow and how risky those earnings are, with higher growth or lower perceived risk often supporting a higher multiple.

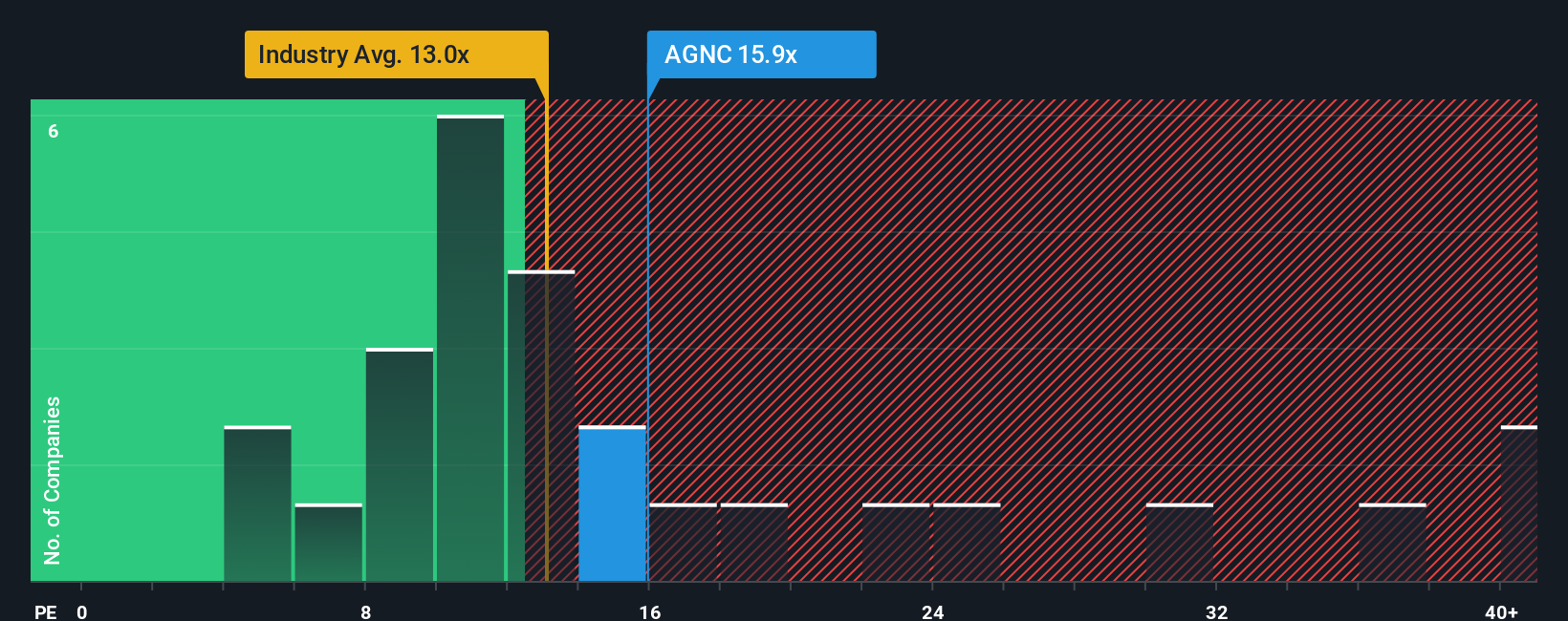

AGNC Investment currently trades on a P/E of 17.27x. That sits above the Mortgage REITs industry average of 12.28x, but slightly below the peer average of 17.89x. On its own, that mix of signals can be hard to interpret.

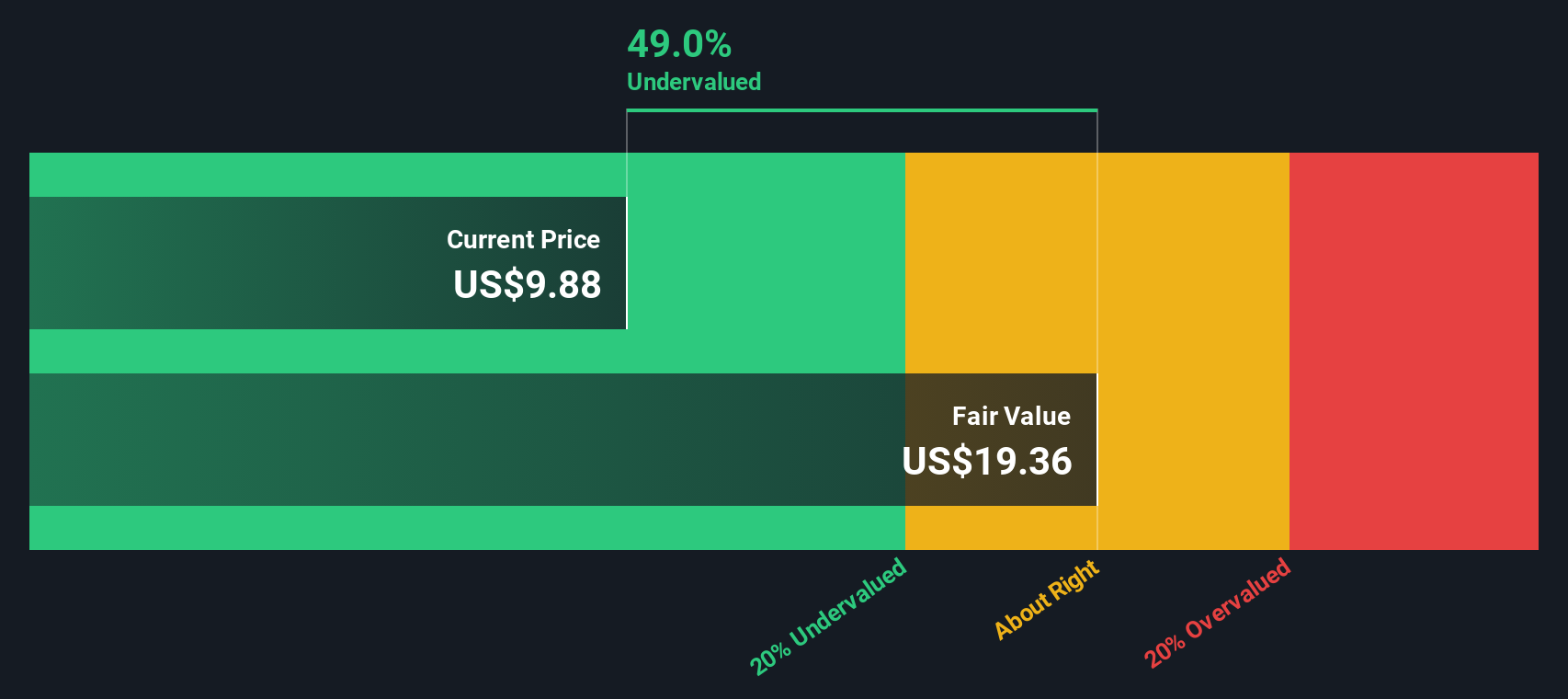

Simply Wall St’s Fair Ratio aims to address this by estimating what P/E you might expect for AGNC Investment after considering factors such as its earnings growth profile, profit margins, risk characteristics, industry and market cap. For AGNC Investment, the Fair Ratio is 19.36x, which is higher than the current 17.27x. Within this framework, the stock screens as undervalued relative to the earnings multiple that might be implied by those fundamentals.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1449 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AGNC Investment Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are simply your story for a company, where you spell out what you think happens to its revenue, earnings and margins, link that to a forecast and a fair value, then compare that to the current price to decide if AGNC Investment looks attractive or not. On Simply Wall St, millions of investors share these Narratives on the Community page, and they update automatically when new information such as news or earnings arrives. For example, if one investor thinks AGNC Investment is worth the more bullish US$11.00 based on stronger revenue growth and stable margins, while another leans toward the more cautious US$8.25 because they focus on interest rate volatility and policy risks, you can see both fair values side by side and decide which story makes more sense to you.

Do you think there's more to the story for AGNC Investment? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com