UniFirst (UNF) Margin Stability At 6.1% Tests Bulls Earnings Acceleration Narrative

Q1 2026 earnings snapshot

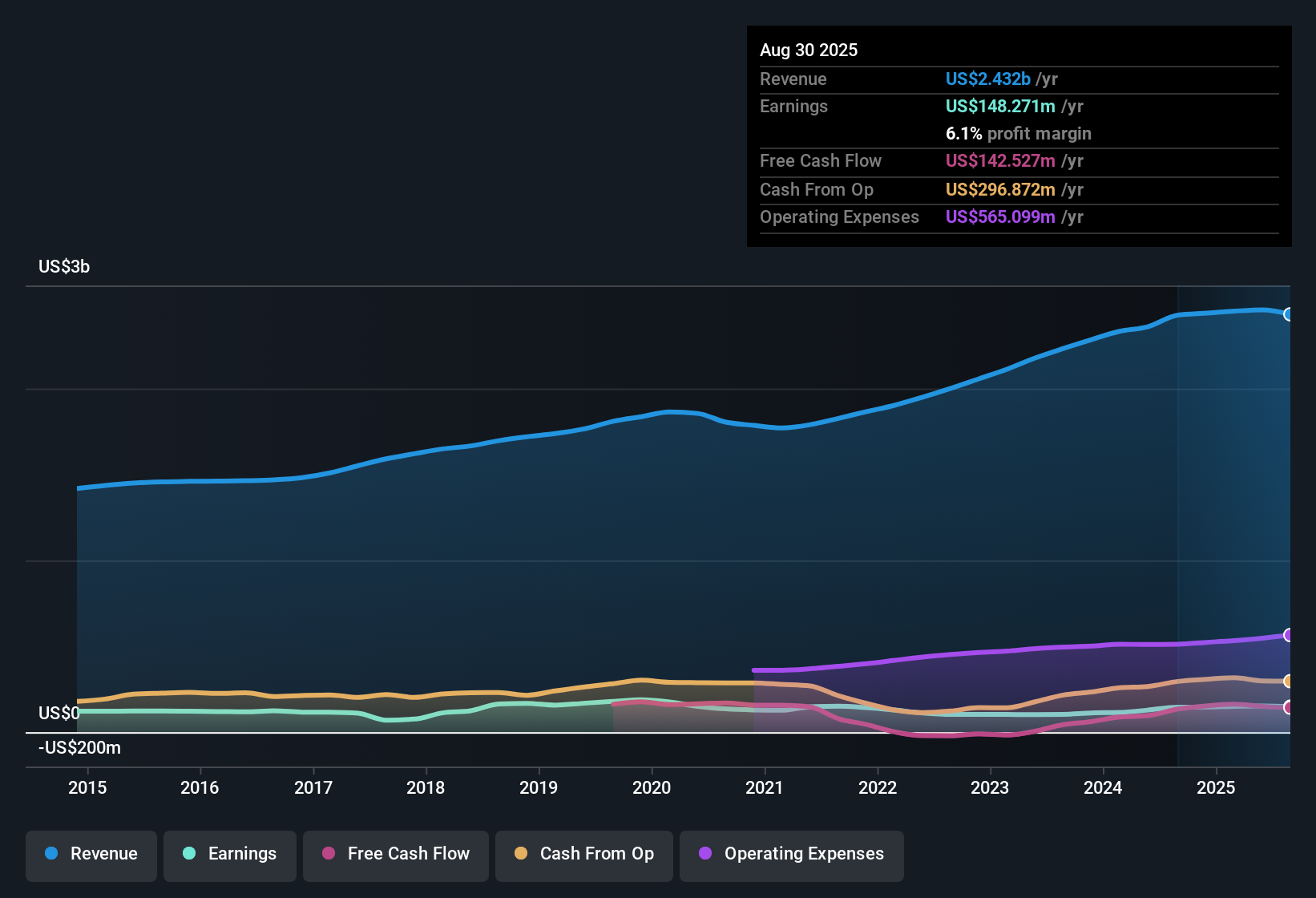

UniFirst (UNF) opened its new fiscal year with Q1 2026 results anchored by prior quarter revenue of US$614.4 million and basic EPS of US$2.23, with trailing twelve month EPS at US$8.01 on US$2.4 billion of revenue and net income of US$148.3 million. Over recent quarters the company has seen revenue move from US$603.3 million in Q3 2024 to US$604.9 million in Q1 2025 and then to US$610.8 million and US$614.4 million in Q3 and Q4 2025, while quarterly EPS has tracked between US$1.32 and US$2.40 over the same period, outlining a picture of steady top line and consistent profitability. With a 6.1% net margin over the last 12 months and earnings that have grown about 2% per year over five years, investors may interpret this print in the context of margin durability and evaluate what that implies for UniFirst’s longer-term prospects.

See our full analysis for UniFirst.With the headline numbers on the table, the next step is to see how this earnings run rate lines up with the prevailing stories about UniFirst, and where the data backs or challenges those narratives.

See what the community is saying about UniFirst

Margins steady around 6.1%

- Over the last 12 months UniFirst generated US$2.4b of revenue and US$148.3 million of net income, which works out to a 6.1% net margin, slightly above the prior 6.0% figure cited.

- Analysts' consensus view highlights margin improvements in Core Laundry Operations and future ERP benefits, yet current margins at 6.1% and a five year earnings growth rate of about 2% mean investors are still weighing:

- Operational projects such as ERP and distribution center expansion that are expected to support margins over time against present headwinds such as higher health care costs.

- Forecast profit margin expansion from 6.2% to 6.7% over three years alongside recent modest earnings growth of 2% per year and 2% growth over the last year.

Modest long term EPS growth

- Trailing twelve month basic EPS sits at US$8.01 compared with US$7.79 and US$6.87 in the prior two trailing windows, while five year earnings growth has been about 2% per year.

- Bulls focus on forecasts calling for earnings to reach US$179.2 million, or US$9.71 per share, by around 2028, and this optimistic angle is being weighed against the actual history:

- Forecast annual earnings growth of 13.6% contrasts with the much slower 2% per year pace over the past five years.

- Expected margin uplift from 6.2% to 6.7% and small share count reductions of about 0.15% per year need to be viewed in light of recent trailing net income of US$148.3 million.

P/E discount, DCF premium

- UniFirst trades on a trailing P/E of 24x, below the US Commercial Services industry average of 25.6x and well below the peer average of 38.2x, while the current share price of US$197 sits above a DCF fair value of about US$151.95.

- Bears point out that revenue is forecast to grow 3.7% per year and earnings 13.6% per year, both below the 10.5% and 16% broader US market forecasts, and they also flag valuation tension:

- The stock price of US$197 is higher than both the cited DCF fair value of US$151.95 and the allowed analyst price target reference of US$175.00.

- Forecasts relying on a future P/E of 21.9x compare with today’s 24x multiple and an industry average of 25.6x, giving bears concrete numbers to question how much upside is already reflected.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for UniFirst on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to test your own view against the data and shape a clear thesis that fits your approach: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding UniFirst.

See What Else Is Out There

UniFirst pairs modest 2% yearly earnings growth with a P/E of 24x and a share price above a DCF fair value of about US$151.95.

If you want ideas where the price tag looks more compelling, check out CTA_SCREENER_UNDERVALUED to quickly focus on companies our models flag as better value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com