3 Middle Eastern Dividend Stocks To Consider With Up To 6.5% Yield

As the Middle East market experiences a notable upswing, led by Saudi Arabia's decision to open its capital market to all foreign investors, regional indices have seen significant gains with sectors like finance and consumer staples driving growth. In this dynamic environment, dividend stocks stand out as attractive options for investors seeking steady income streams, particularly in light of recent regulatory changes that aim to broaden participation and improve liquidity.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.15% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.33% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.56% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.73% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.76% | ★★★★★☆ |

| Dubai Insurance Company (P.S.C.) (DFM:DIN) | 5.93% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.35% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 6.52% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.25% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.74% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training in the United Arab Emirates, with a market cap of AED3.42 billion.

Operations: Emirates Driving Company P.J.S.C. generates revenue primarily through its Car and Other Related Services segment, amounting to AED738.10 million.

Dividend Yield: 5.4%

Emirates Driving Company P.J.S.C. offers a dividend yield of 5.36%, which is lower than the top quartile in the AE market. Despite this, its dividends are well-covered by earnings and cash flows with payout ratios of 54.5% and 62.7%, respectively, suggesting sustainability. However, the dividend track record has been volatile over the past decade despite recent growth in payments and profits, with earnings increasing by 20.5% last year to AED 263.15 million for nine months ending September 2025.

- Take a closer look at Emirates Driving Company P.J.S.C's potential here in our dividend report.

- The valuation report we've compiled suggests that Emirates Driving Company P.J.S.C's current price could be quite moderate.

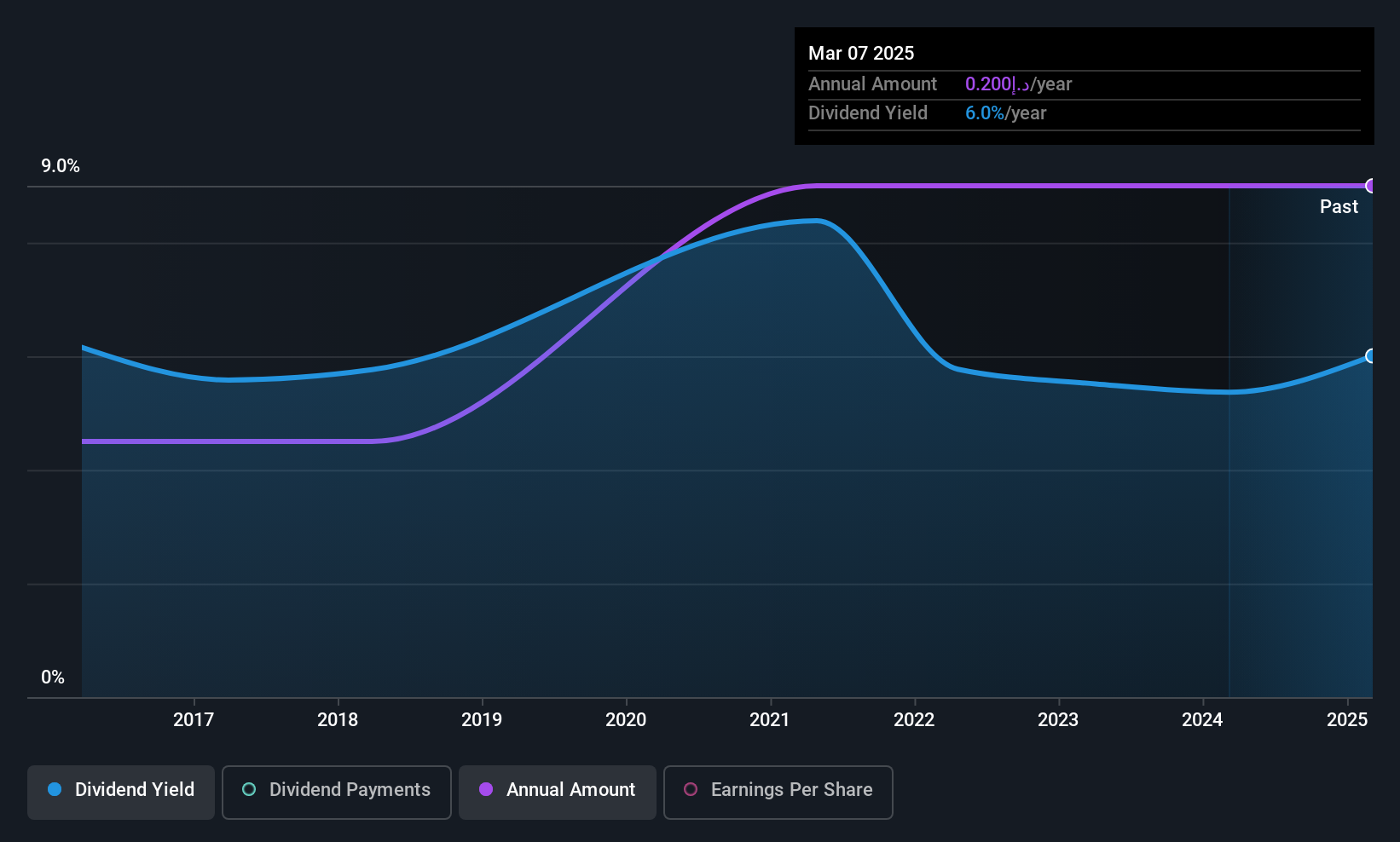

Sukoon Insurance PJSC (DFM:SUKOON)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sukoon Insurance PJSC offers insurance solutions to individuals and businesses in the United Arab Emirates, with a market cap of AED1.89 billion.

Operations: Sukoon Insurance PJSC generates revenue primarily through its Life Insurance segment, which accounts for AED212.20 million, and its Non-Life Insurance segment, contributing AED5.04 billion.

Dividend Yield: 4.9%

Sukoon Insurance PJSC's dividends are well-supported by both earnings and cash flows, with low payout ratios of 26.5% and 11.6%, respectively, indicating sustainability despite a historically volatile dividend track record. The company reported significant earnings growth of 43% over the past year, with net income for nine months ending September 2025 at AED 255.9 million. However, its dividend yield of 4.88% is below the top quartile in the AE market, and shares remain highly illiquid.

- Navigate through the intricacies of Sukoon Insurance PJSC with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Sukoon Insurance PJSC is priced higher than what may be justified by its financials.

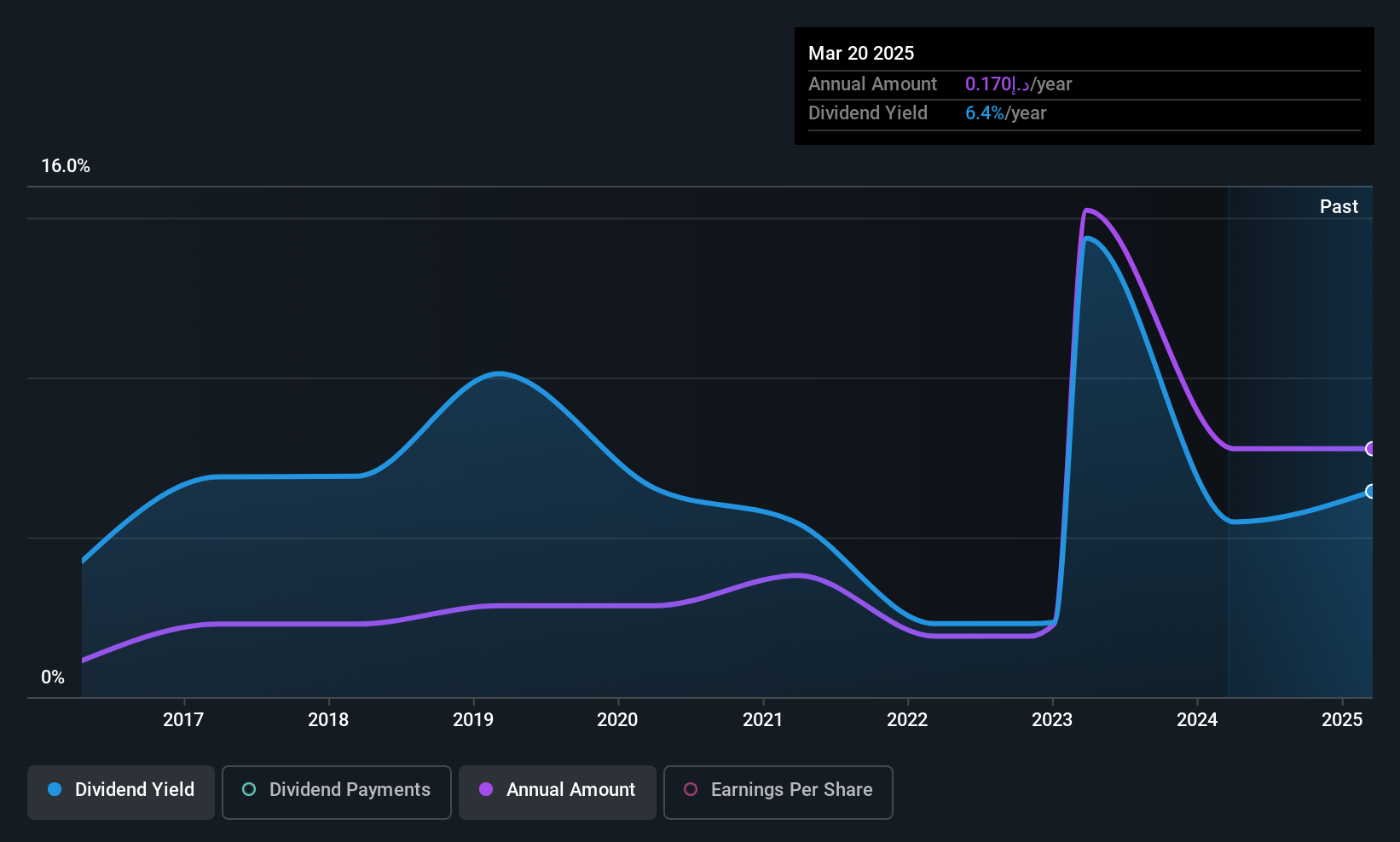

Banque Saudi Fransi (SASE:1050)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banque Saudi Fransi offers banking and financial services to individuals and businesses both in the Kingdom of Saudi Arabia and internationally, with a market cap of SAR41.80 billion.

Operations: Banque Saudi Fransi's revenue is primarily derived from its Corporate Banking segment at SAR6.75 billion, followed by Retail Banking at SAR6.22 billion, and Investment Banking & Brokerage at SAR639.10 million, while the Treasury segment reported a negative contribution of SAR4.23 billion.

Dividend Yield: 6.5%

Banque Saudi Fransi's dividends are supported by a payout ratio of 54%, indicating coverage by earnings. The dividend yield of 6.52% ranks in the top quartile within the Saudi market, although historical volatility suggests an unstable track record. Recent financials show improved earnings with net income rising to SAR 1.35 billion for Q3 2025, up from SAR 1.15 billion a year ago, alongside successful debt financing activities involving SAR 2.5 billion Sukuk issuance under its capital program.

- Dive into the specifics of Banque Saudi Fransi here with our thorough dividend report.

- Our expertly prepared valuation report Banque Saudi Fransi implies its share price may be lower than expected.

Turning Ideas Into Actions

- Reveal the 57 hidden gems among our Top Middle Eastern Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com