A Look At Life Time Group Holdings (LTH) Valuation After South Lamar Club Opening In Austin

Why the South Lamar opening matters for Life Time Group Holdings

Life Time Group Holdings (LTH) has opened its new Life Time South Lamar club in Austin, adding a 57,000-square-foot, two floor location focused on social connection, wellness, and community driven lifestyle experiences.

This expansion into a high growth, culturally influential neighborhood gives investors another concrete example of how the company is building out its urban club network. The South Lamar club is designed around recovery spaces, group training, and family friendly services.

See our latest analysis for Life Time Group Holdings.

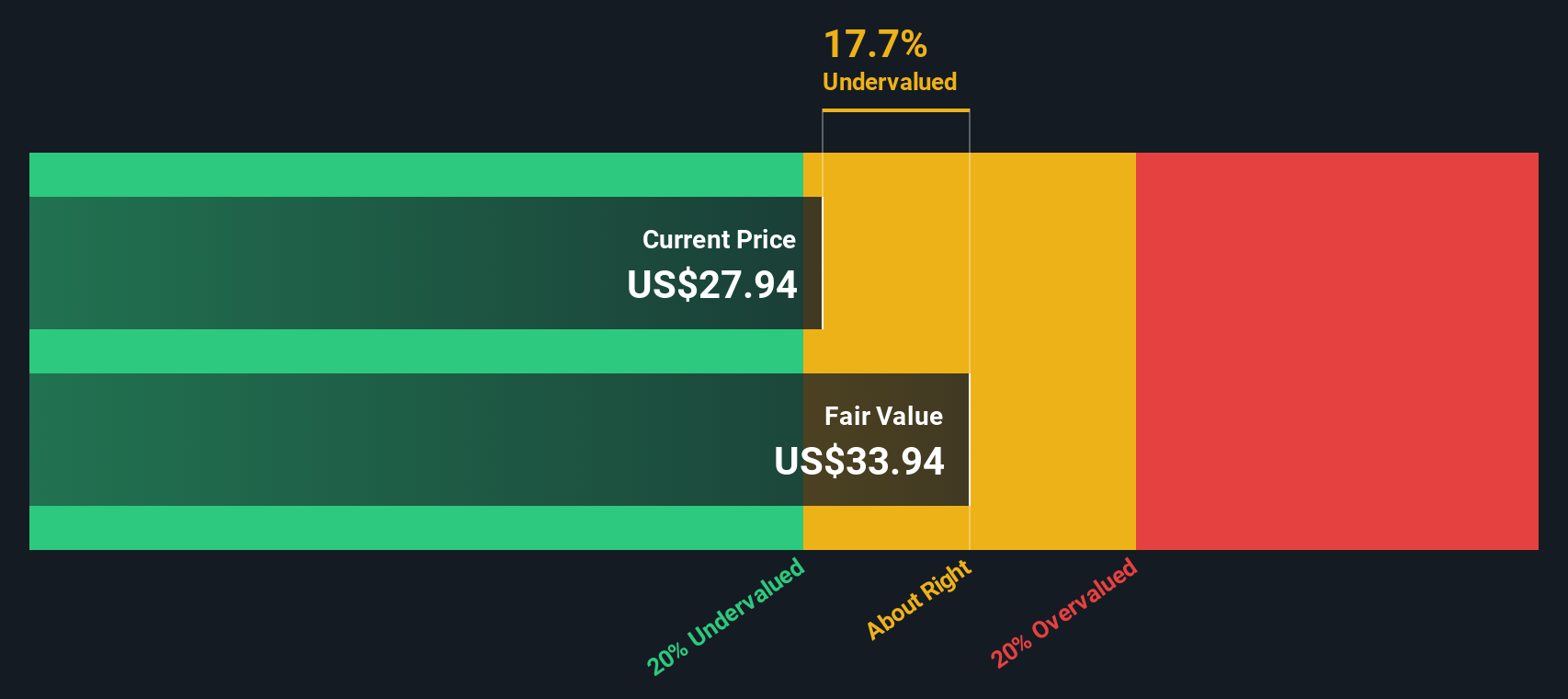

At a share price of US$27.44, Life Time Group Holdings has seen a 7.27% 30 day share price return and a 16.37% 1 year total shareholder return, suggesting momentum building around expansion efforts like South Lamar and shifting views on the company’s risk and growth profile.

If club openings like South Lamar have you thinking about where growth and ownership conviction might meet, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With Life Time trading at US$27.44, sitting on a 16.37% 1 year total return and a value score of 4, plus a sizeable gap to analyst targets, you have to ask: is there still upside here or is future growth already in the price?

Most Popular Narrative: 31.2% Undervalued

With a fair value estimate of US$39.91 against the last close at US$27.44, the most followed narrative frames Life Time as materially mispriced, hinging on multi year membership, margin, and earnings assumptions.

The expanding pipeline of new and larger club openings in affluent and high-density markets positions Life Time for sustained membership and top-line revenue growth, benefiting from the growing consumer demand for premium health, wellness, and lifestyle experiences. Accelerating growth in ancillary, higher-margin services, including personal training, Life Time Digital offerings, nutritional supplements, and health/wellness programs, supports increased average revenue per member and improved net margins as consumer expectations shift toward holistic wellness.

Curious what earnings path and profit profile have to line up for that price gap to close? The narrative leans on steady double digit growth, richer margins, and a future earnings multiple usually reserved for faster growing names. If you want to see exactly how those moving pieces stack together, the full narrative lays out the numbers behind that US$39.91 fair value line by line.

Result: Fair Value of US$39.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh the heavy capital needs for new clubs and residential projects, as well as the risk that at-home fitness and digital offerings could limit in-club revenue growth.

Find out about the key risks to this Life Time Group Holdings narrative.

Another View on Life Time's Valuation

Analysts looking at Life Time through a different lens reach a less optimistic conclusion. Our DCF model suggests fair value around US$24.85 per share, compared with the current US$27.44 price and the US$39.91 narrative estimate. This flags the risk that long range growth and margin assumptions may be doing a lot of heavy lifting.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Life Time Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Life Time Group Holdings Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom view of Life Time in just a few minutes by starting with Do it your way.

A great starting point for your Life Time Group Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Life Time has you thinking bigger about your portfolio, do not stop here. The screener can surface other angles that might fit your goals just as well.

- Spot early stage opportunities with real financial substance by scanning these 3553 penny stocks with strong financials that already show stronger balance sheets and earnings quality than many expect at this size.

- Ride the wave of automation and data driven business models by focusing on these 26 AI penny stocks positioned at the intersection of software, infrastructure, and real world use cases.

- Target potential mispricings by filtering for these 885 undervalued stocks based on cash flows where cash flow based metrics may point to a gap between current prices and business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com