Unveiling Undiscovered Gems in Asia This January 2026

As we step into January 2026, the Asian markets are capturing attention with mixed signals from key economic indicators and stock performances. While China's manufacturing sector shows signs of recovery, Japan's market dynamics are influenced by monetary policy shifts and currency fluctuations. In such an environment, identifying promising stocks involves looking for companies that demonstrate resilience and adaptability to changing economic conditions, making them potential undiscovered gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 0.97% | 1.03% | ★★★★★★ |

| YagiLtd | 27.83% | -6.06% | 32.03% | ★★★★★★ |

| Cresco | 4.98% | 9.33% | 11.61% | ★★★★★★ |

| Lumax International | NA | 5.90% | 5.96% | ★★★★★★ |

| AlpenLtd | 8.29% | 4.16% | -11.59% | ★★★★★★ |

| Kappa Create | 69.45% | 2.55% | 42.17% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 16.06% | 0.19% | -13.07% | ★★★★★☆ |

| Torigoe | 8.08% | 4.54% | 8.78% | ★★★★★☆ |

| E J Holdings | 20.38% | 4.50% | 2.36% | ★★★★★☆ |

| KG Chemical | 54.46% | 19.05% | 14.60% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shareate Tools (SHSE:688257)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shareate Tools Ltd. manufactures and sells cemented carbide products and drilling tools both in China and internationally, with a market cap of CN¥9.78 billion.

Operations: Shareate Tools Ltd.'s revenue is primarily derived from the sale of cemented carbide products and drilling tools. The company focuses on cost management to enhance profitability, with a notable emphasis on optimizing its production expenses. Its net profit margin has shown variability, reflecting fluctuations in operational efficiency and market conditions.

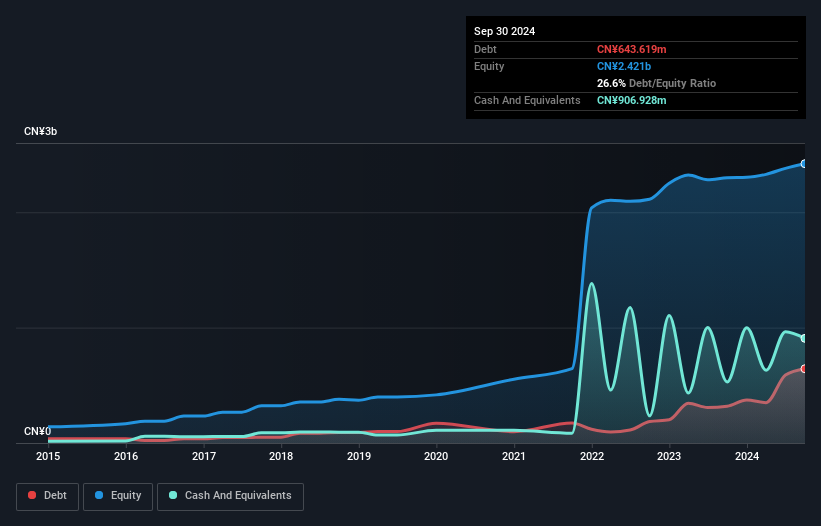

Shareate Tools, a notable player in the machinery sector, shows promise with its price-to-earnings ratio of 46.3x, undercutting the industry average of 51x. Over the past year, earnings surged by 23.9%, outpacing the industry's 6.1% growth rate. The debt to equity ratio rose from 22.6% to 38.2% over five years but remains manageable with a satisfactory net debt to equity of 4.9%. Recent financials reveal sales climbing to CNY1.79 billion and net income reaching CNY165 million for nine months ending September 2025, reflecting strong operational performance and potential for continued growth in this niche market segment.

- Navigate through the intricacies of Shareate Tools with our comprehensive health report here.

Understand Shareate Tools' track record by examining our Past report.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company focused on the design, development, and production of mask products in China with a market cap of CN¥10.47 billion.

Operations: Newway generates its revenue primarily from the electronic components and parts segment, totaling CN¥1.10 billion. The company's financial performance is influenced by its ability to manage costs associated with this core segment.

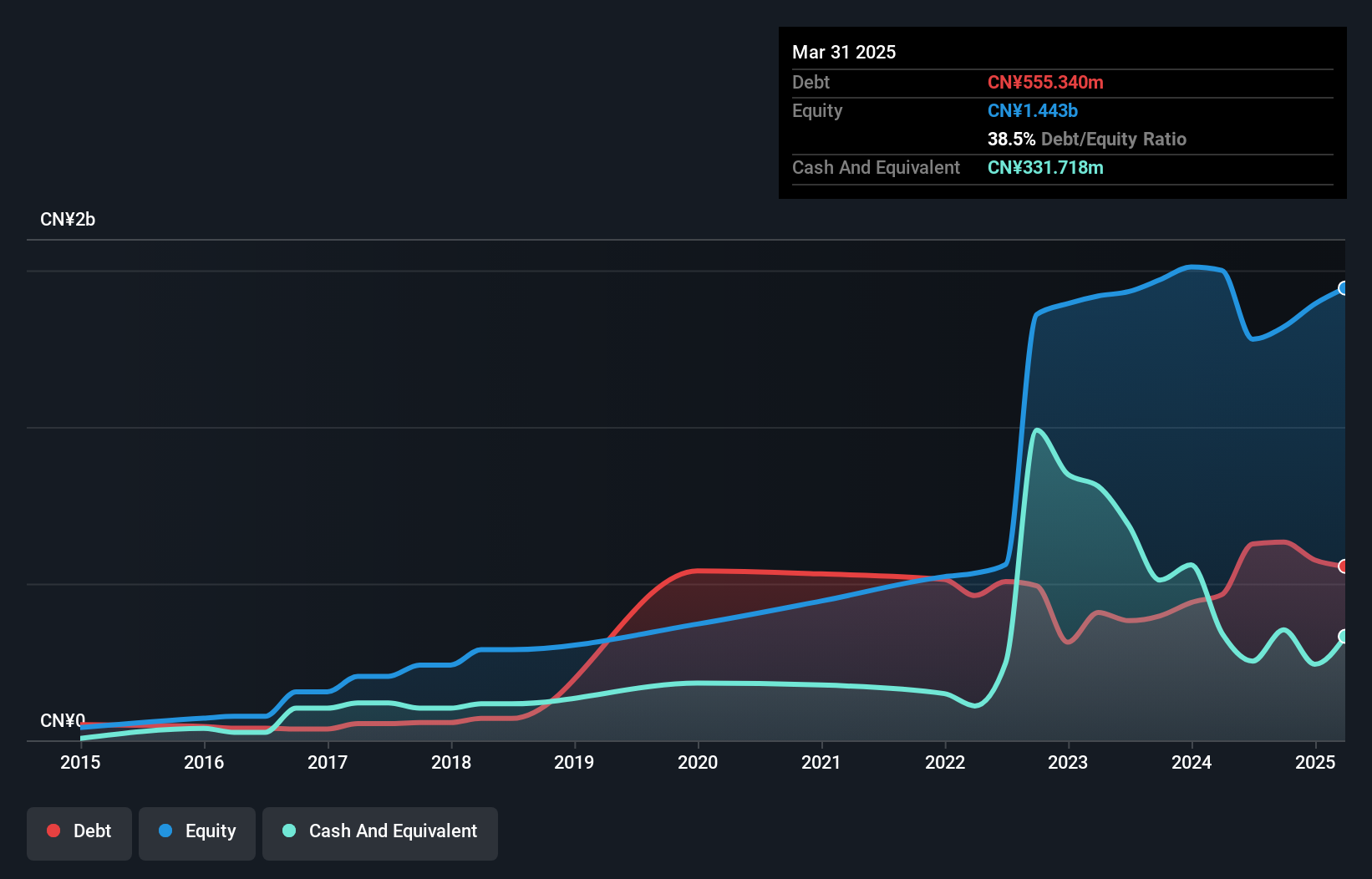

Shenzhen Newway Photomask Making, a nimble player in the electronics sector, has shown robust earnings growth of 49.6% over the past year, outpacing the industry average of 9%. The company trades at a good value, currently 31.5% below its estimated fair value. Debt management appears prudent with a reduction in debt to equity from 125.3% to 61.6% over five years and satisfactory net debt to equity at 17.4%. Recent financials highlight sales of CNY827 million for nine months ending September 2025, up from CNY602 million last year, with net income rising to CNY171 million from CNY121 million previously.

Shen Zhen Australis Electronic TechnologyLtd (SZSE:300940)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shen Zhen Australis Electronic Technology Co., Ltd. is a company engaged in the electronics sector, with a market capitalization of CN¥7.46 billion.

Operations: Shen Zhen Australis Electronic Technology Co., Ltd. generates revenue through its various electronics-related segments. The company's financial performance is characterized by its market capitalization of CN¥7.46 billion, reflecting its position in the industry.

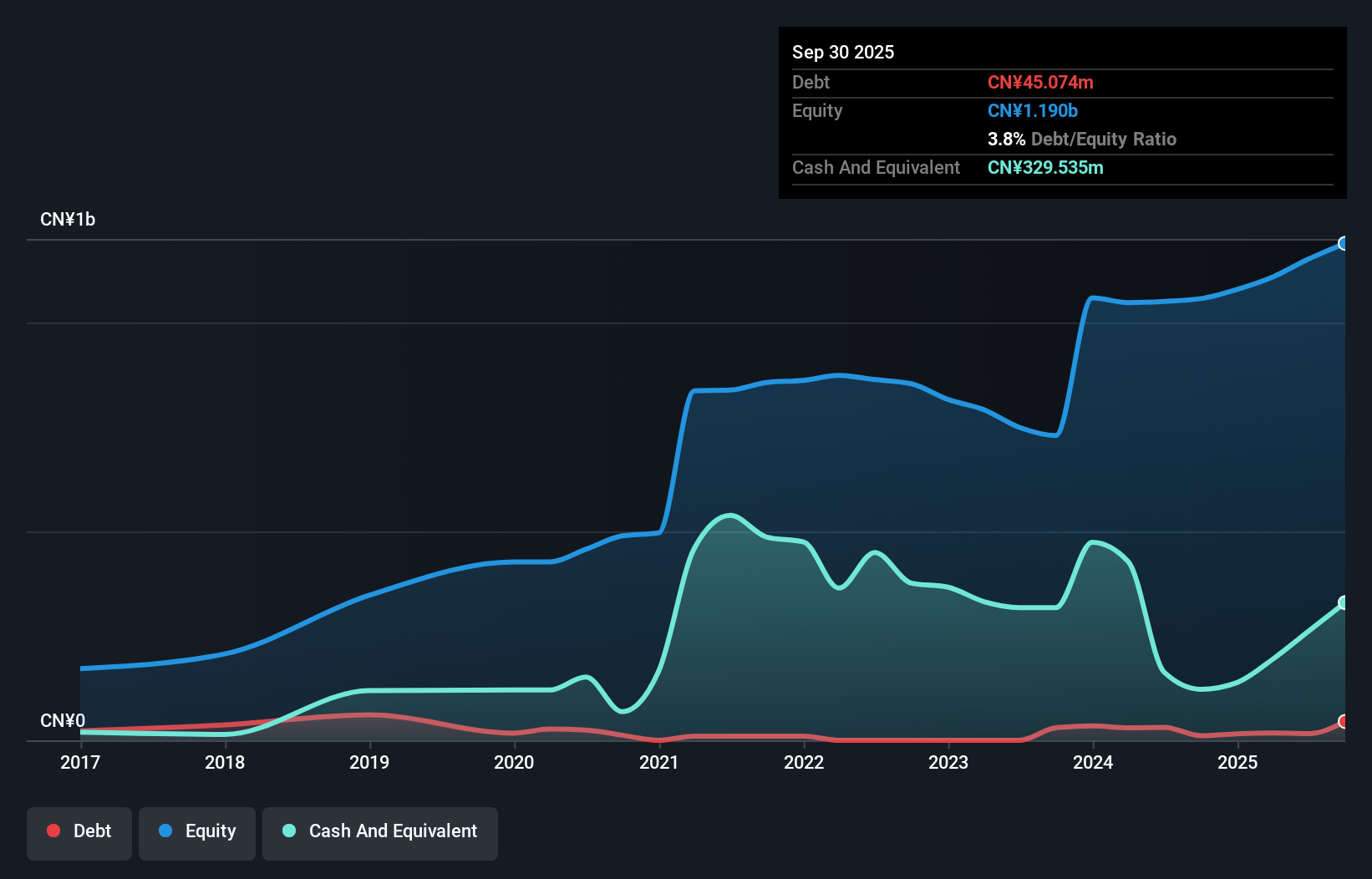

Shen Zhen Australis Electronic Technology has demonstrated impressive growth, with sales hitting CNY 615.33 million for the first nine months of 2025, a significant rise from CNY 238.34 million the previous year. The company turned profitable this year, reporting a net income of CNY 110.14 million compared to last year's loss of CNY 1.55 million, showcasing its potential in the semiconductor industry where it now outpaces average growth rates. Despite recent volatility in its share price over three months, its debt-to-equity ratio increased from 2.5 to 3.8 over five years, indicating some financial restructuring efforts are ongoing.

Where To Now?

- Access the full spectrum of 2494 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com