European Growth Stocks With Strong Insider Ownership

As the pan-European STOXX Europe 600 Index reaches new highs, buoyed by an improving economic backdrop and a strong annual performance, investors are increasingly turning their attention to growth companies with robust fundamentals. In this context, stocks with high insider ownership can be particularly appealing as they often indicate management's confidence in the company's future prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 35% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

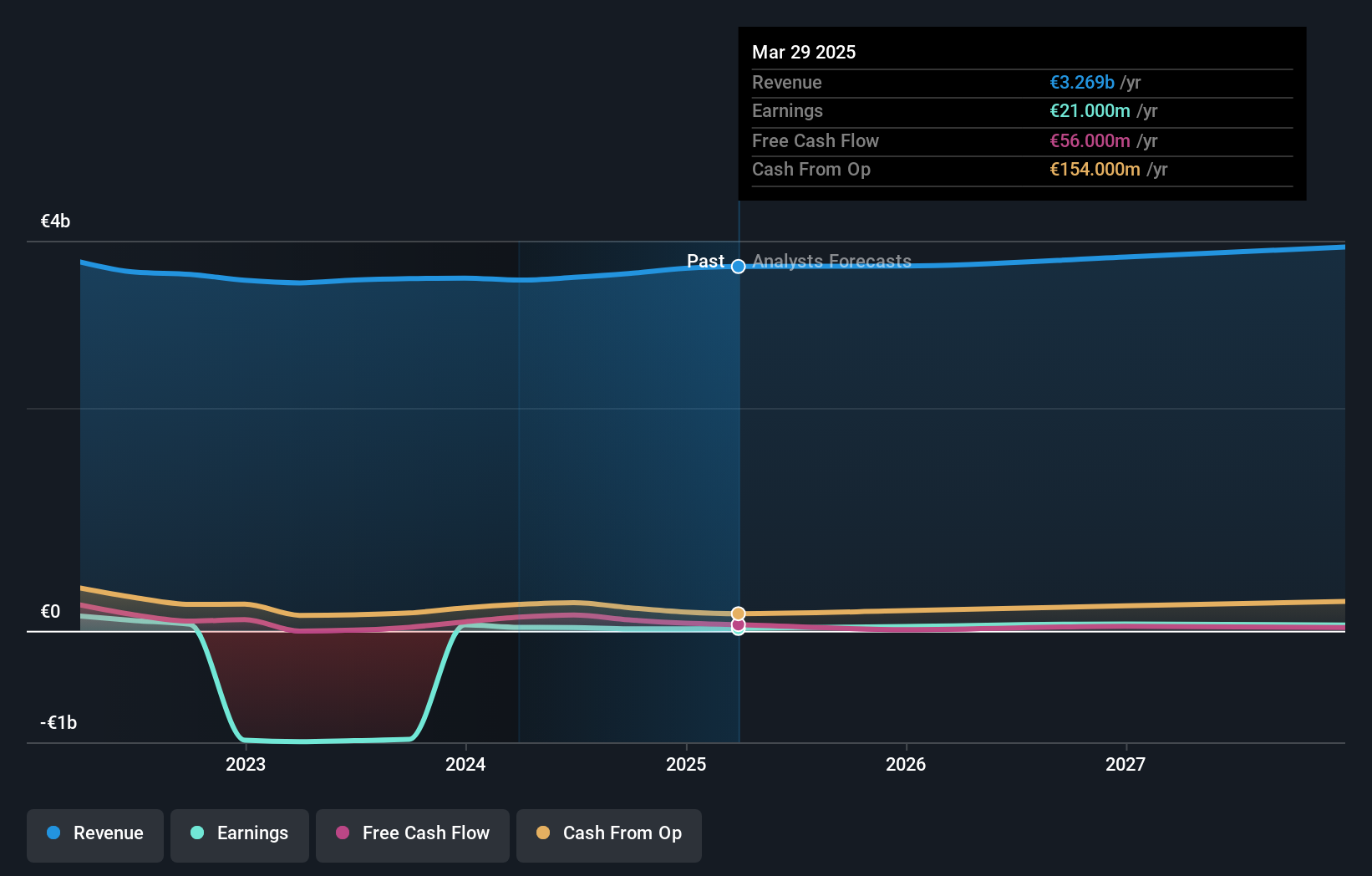

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally, with a market cap of €567.69 million.

Operations: The company's revenue segments consist of Parcels (€2.41 billion) and Mail in the Netherlands (€1.32 billion).

Insider Ownership: 35.1%

PostNL demonstrates a mixed growth outlook with insider ownership potentially aligning management interests with shareholders. Despite trading at 29.7% below estimated fair value and being forecasted to achieve profitability within three years, the company faces challenges such as a net loss of EUR 63 million for the nine months ending September 2025 and slow revenue growth projections of 2.7% annually, which lags behind the Dutch market's average growth rate.

- Dive into the specifics of PostNL here with our thorough growth forecast report.

- Our valuation report here indicates PostNL may be undervalued.

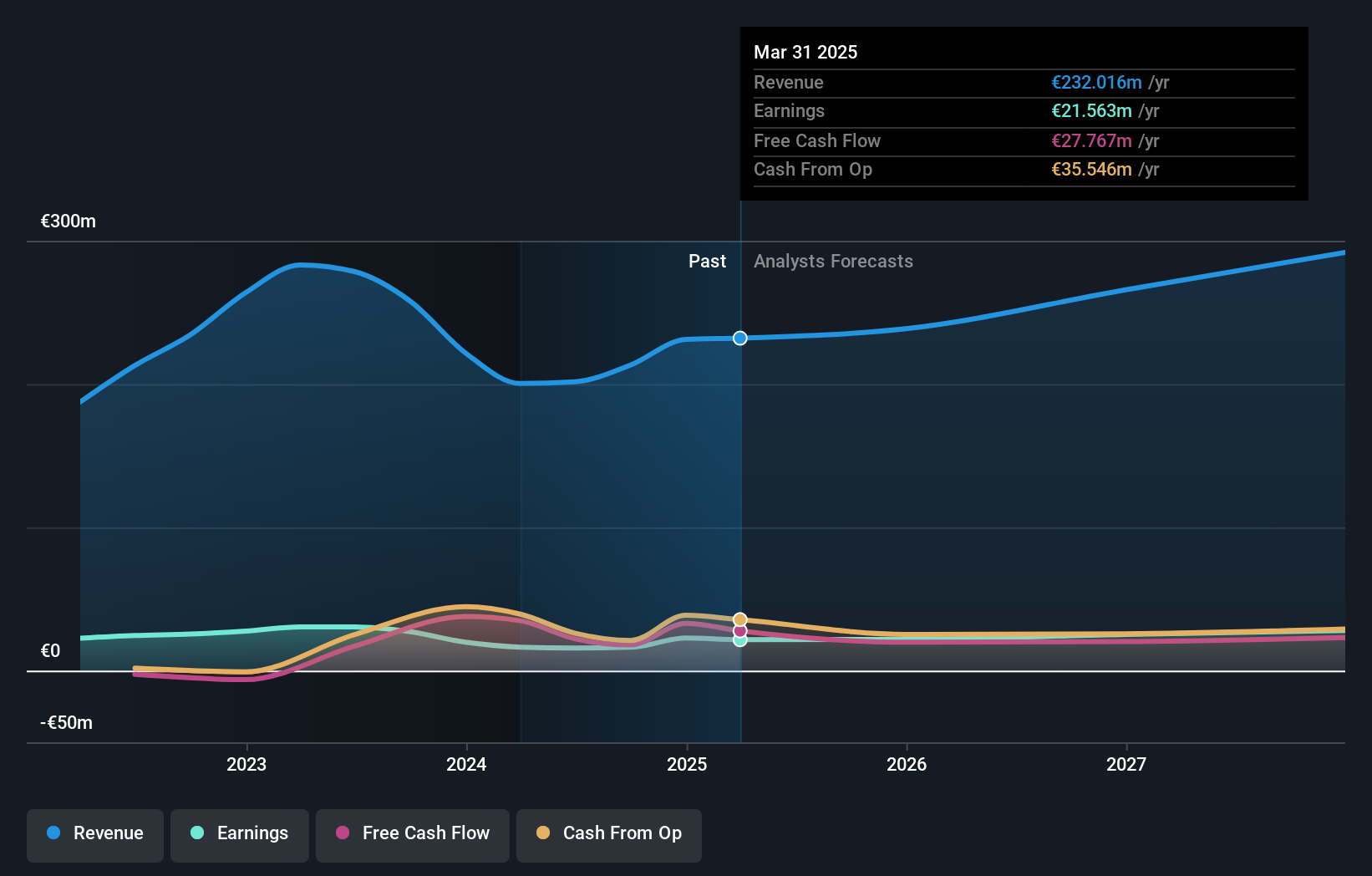

Incap Oyj (HLSE:ICP1V)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Incap Oyj, with a market cap of €303.90 million, offers electronics manufacturing services through its subsidiaries across Europe, North America, and Asia.

Operations: The company's revenue is derived entirely from its Electronics Manufacturing Services segment, amounting to €219.68 million.

Insider Ownership: 37.2%

Incap Oyj, with significant insider ownership, is positioned for growth despite recent earnings declines. Its innovative expansion in Estonia enhances production efficiency and flexibility. The company's revenue is forecasted to grow at 18.2% annually, outpacing the Finnish market's 4.1%. Trading at 38.5% below estimated fair value, Incap offers a compelling valuation relative to peers. However, its return on equity is expected to remain modest at 13.9%, highlighting potential profitability constraints amidst robust revenue growth expectations.

- Click here to discover the nuances of Incap Oyj with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential undervaluation of Incap Oyj shares in the market.

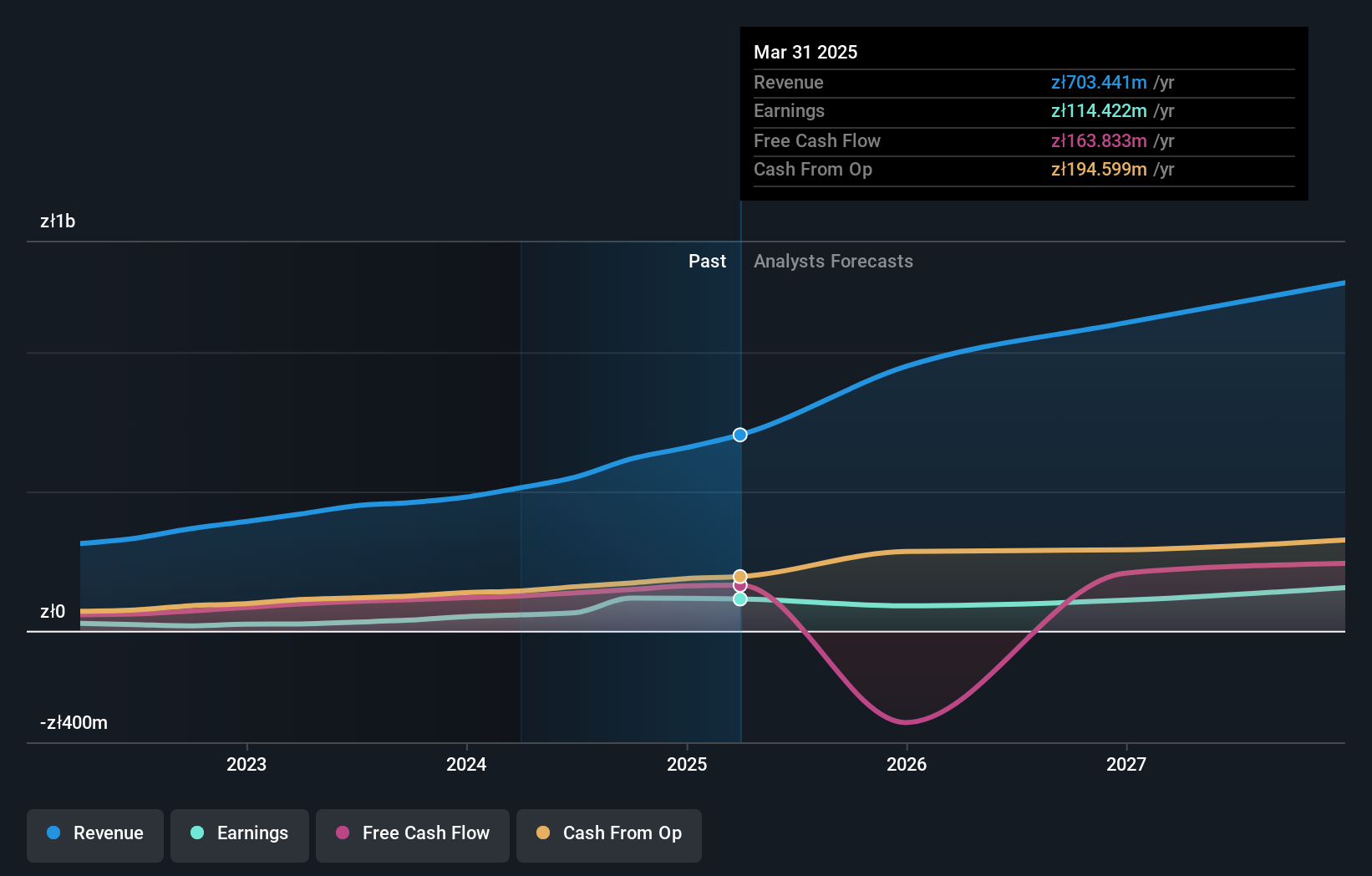

Cyber_Folks (WSE:CBF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cyber_Folks S.A. is a technology company with global operations and has a market capitalization of PLN3.26 billion.

Operations: The company's revenue segments include VERCOM at PLN472 million, Corporate at PLN1.83 million, E-Commerce at PLN144.09 million, and Cyber_Folks at PLN176.49 million.

Insider Ownership: 22.4%

Cyber_Folks has substantial insider ownership and is positioned for growth, with revenue expected to increase by 13.2% annually, surpassing the Polish market's growth rate of 4.3%. Despite a recent decline in profit margins from 19% to 7.6%, earnings are forecasted to grow significantly at 40.7% per year, well above the market average of 14.8%. Trading at a considerable discount of 45.4% below estimated fair value, the company faces challenges due to high debt levels and large one-off items impacting results.

- Click to explore a detailed breakdown of our findings in Cyber_Folks' earnings growth report.

- Our comprehensive valuation report raises the possibility that Cyber_Folks is priced higher than what may be justified by its financials.

Next Steps

- Dive into all 207 of the Fast Growing European Companies With High Insider Ownership we have identified here.

- Searching for a Fresh Perspective? Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com