Assessing Singapore Technologies Engineering (SGX:S63) Valuation After Updated 2025 Profit Guidance

Updated profit guidance draws fresh attention

Singapore Technologies Engineering (SGX:S63) has issued updated earnings guidance, stating that it expects to report a positive net profit for the second half of 2025 after accounting for all one off effects. This development is drawing renewed interest from investors.

See our latest analysis for Singapore Technologies Engineering.

The updated profit guidance comes after a period where short term share price momentum has picked up, with a 1 month share price return of 8.67% and a year to date share price return of 5.83%. Over the past 5 years, total shareholder return sits at 178.95%, which may indicate ongoing interest from investors.

If this guidance has you rethinking the wider defence and engineering space, it could be a good moment to scan aerospace and defense stocks for other ideas on your watchlist.

With Singapore Technologies Engineering trading near its analyst price target yet screening on some models as around 15% below estimated intrinsic value, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 1% Overvalued

The widely followed narrative puts fair value for Singapore Technologies Engineering at about the same level as the current S$8.90 share price, framing only a small premium.

The analysts have a consensus price target of SGD8.704 for Singapore Technologies Engineering based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SGD10.5, and the most bearish reporting a price target of just SGD7.2.

Curious what justifies paying today’s price for tomorrow’s earnings power? Revenue growth assumptions, margin shifts and a future earnings multiple are doing most of the heavy lifting. Want to see exactly how those moving parts line up?

Result: Fair Value of $8.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this storyline can crack if defense demand cools faster than expected or if supply chain issues drag on the commercial aerospace business longer than analysts currently factor in.

Find out about the key risks to this Singapore Technologies Engineering narrative.

Another Take On Value

So far, the story has leaned on analyst targets and a narrative fair value of S$8.83 that paints Singapore Technologies Engineering as slightly overvalued at S$8.90. The P/E picture tells a different story, with more mixed signals for you to weigh.

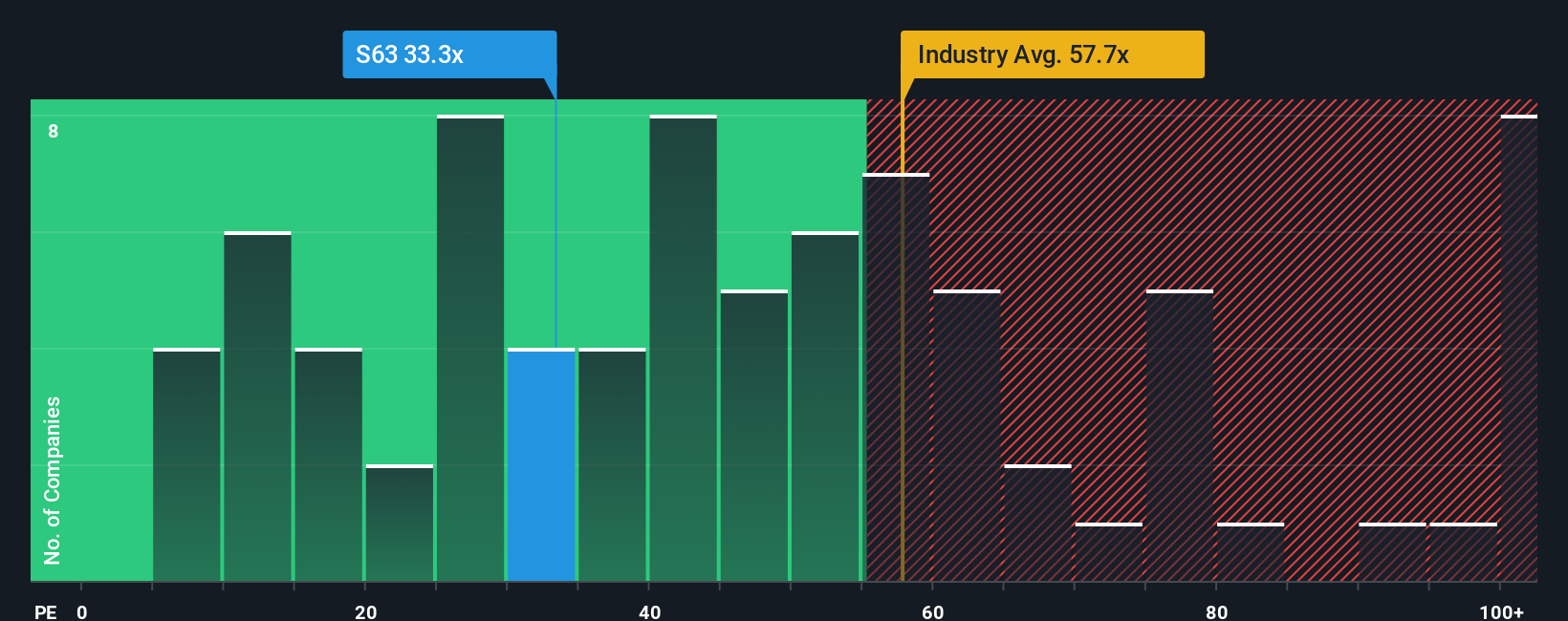

On one hand, the current P/E of 36.1x looks expensive against an estimated fair ratio of 25.6x, which points to valuation risk if the market eventually settles closer to that level. On the other, 36.1x is far lower than the 63.8x Asian Aerospace & Defense industry average and the 64x peer average, which suggests investors are not paying the same premium here as for many competitors.

This split view raises a practical question for you: is the fair ratio the anchor the share price could gravitate toward over time, or does the industry premium leave room for the current multiple to hold up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Singapore Technologies Engineering Narrative

If parts of this story do not quite fit with your own view, you can pull up the numbers yourself and shape a fresh view in minutes with Do it your way.

A great starting point for your Singapore Technologies Engineering research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Singapore Technologies Engineering is on your radar, do not stop there. Widen your search now so you are not late to the next opportunity.

- Spot potential bargains early by scanning these 886 undervalued stocks based on cash flows that currently trade below estimates based on their cash flow profiles.

- Tap into future tech themes with these 26 AI penny stocks that are building businesses around artificial intelligence applications.

- Target higher income potential by reviewing these 12 dividend stocks with yields > 3% that may support a more income focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com