Assessing Globant (NYSE:GLOB) Valuation As Returns On Capital Weaken While Investment Rises

Recent commentary on Globant (NYSE:GLOB) has focused on a decline in its return on capital employed over the past five years, even as the company has put more capital to work.

See our latest analysis for Globant.

Globant's recent 7.63% 7 day share price return and 18.29% 90 day share price return to US$70.36 contrast with a 67.03% 1 year total shareholder return decline. This suggests near term momentum, while longer term returns remain under pressure.

If Globant's mixed track record has you thinking about diversification, this could be a good moment to look at high growth tech and AI stocks that are catching attention right now.

Against that backdrop, Globant trades at US$70.36 with some models suggesting a sizeable intrinsic discount and a gap to analyst targets. Is the market overlooking value here, or has it already priced in all the growth ahead?

Most Popular Narrative: 16.6% Undervalued

Globant's fair value in the most followed narrative sits above the recent US$70.36 close, framing the stock as undervalued based on projected cash generation.

The analysts have a consensus price target of $106.2 for Globant based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $240.0, and the most bearish reporting a price target of just $74.0.

Curious what kind of revenue trajectory, margin lift and future earnings multiple are baked into that fair value tag? The core assumptions might surprise you.

The most popular narrative uses an 8.90% discount rate and ties fair value to a path of rising earnings, expanding profitability and a lower forward P/E than some peers today. It also hinges on the idea that subscription style AI projects and outcome based contracts could gradually reshape Globant's earnings mix toward higher recurring cash flows.

Result: Fair Value of $84.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is a real chance that slower revenue growth and tougher competition, especially in key regions, could continue to pressure margins and delay that upside.

Find out about the key risks to this Globant narrative.

Another Way To Look At The Valuation

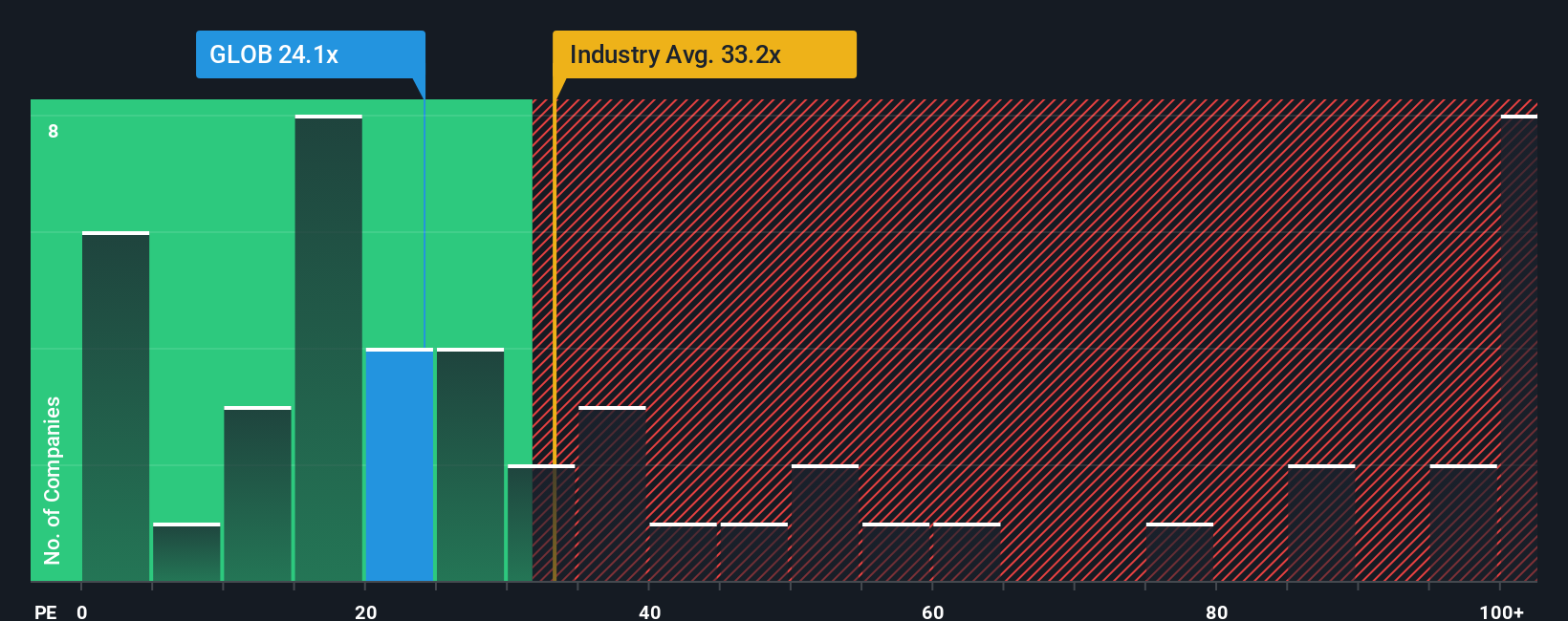

While the SWS DCF model points to Globant trading below fair value, the current P/E of 31.1x tells a different story versus peers at 13.4x and an estimated fair ratio of 36x. That gap hints at both valuation risk and potential upside if sentiment shifts. Which side do you lean toward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Globant Narrative

If the story here does not quite match your view, or you would rather rely on your own work, you can shape a fresh Globant thesis in just a few minutes with Do it your way.

A great starting point for your Globant research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research with one company. Use the Simply Wall St Screener to hunt for fresh ideas that fit the kind of portfolio you actually want.

- Target income potential with these 12 dividend stocks with yields > 3% that could help anchor your portfolio with regular cash returns.

- Hunt for growth stories among these 26 AI penny stocks positioned around artificial intelligence themes that many investors are watching closely.

- Seek value-minded opportunities through these 886 undervalued stocks based on cash flows that might trade at lower prices than their cash flow profiles suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com