Assessing Perseus Mining’s Valuation After Expanding Its Loan Facility To Support West African Projects

Why Perseus Mining’s expanded loan facility matters now

Perseus Mining (ASX:PRU) has expanded its loan facility, giving the company more financial flexibility to support operational projects and gold production across its West African sites. This move directly affects how investors might view its balance sheet strength.

See our latest analysis for Perseus Mining.

Perseus Mining’s expanded loan facility comes at a time when momentum has been building, with a 30 day share price return of 8.49% and a 90 day share price return of 16.16%, alongside a very large 5 year total shareholder return of 417.95% that points to strong long term value creation.

If you are weighing Perseus against other opportunities in the resources space, it can help to see what else is delivering strong long term gains. Now could be a good time to broaden your search and check out fast growing stocks with high insider ownership.

With the share price close to analyst targets and a value score of 3, Perseus does not appear to be extremely cheap. The key question is whether current levels already reflect its growth plans or if the market is underestimating future progress.

Most Popular Narrative: 1% Overvalued

Against the last close of A$5.75, the most followed narrative points to a fair value of A$5.72, placing Perseus Mining very slightly above that mark while still assuming a supportive backdrop for its projects and margins.

Ongoing development of new projects (Nyanzaga in Tanzania and CMA Underground at Yaouré), as well as planned life extensions of existing mines, positions Perseus for growth in production capacity, which should accelerate topline revenue growth and enhance operating leverage over the medium to long term.

Curious what kind of revenue curve and profit margins sit behind that fair value line, and how a lower future P/E still supports the story? The most followed narrative walks through those earnings and valuation assumptions step by step, including how projected cash flows get discounted at just under 8%.

Result: Fair Value of A$5.72 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could be knocked off course if gold prices weaken or if rising all in site costs continue to squeeze margins and free cash flow.

Find out about the key risks to this Perseus Mining narrative.

Another View: What Earnings Ratios Are Signalling

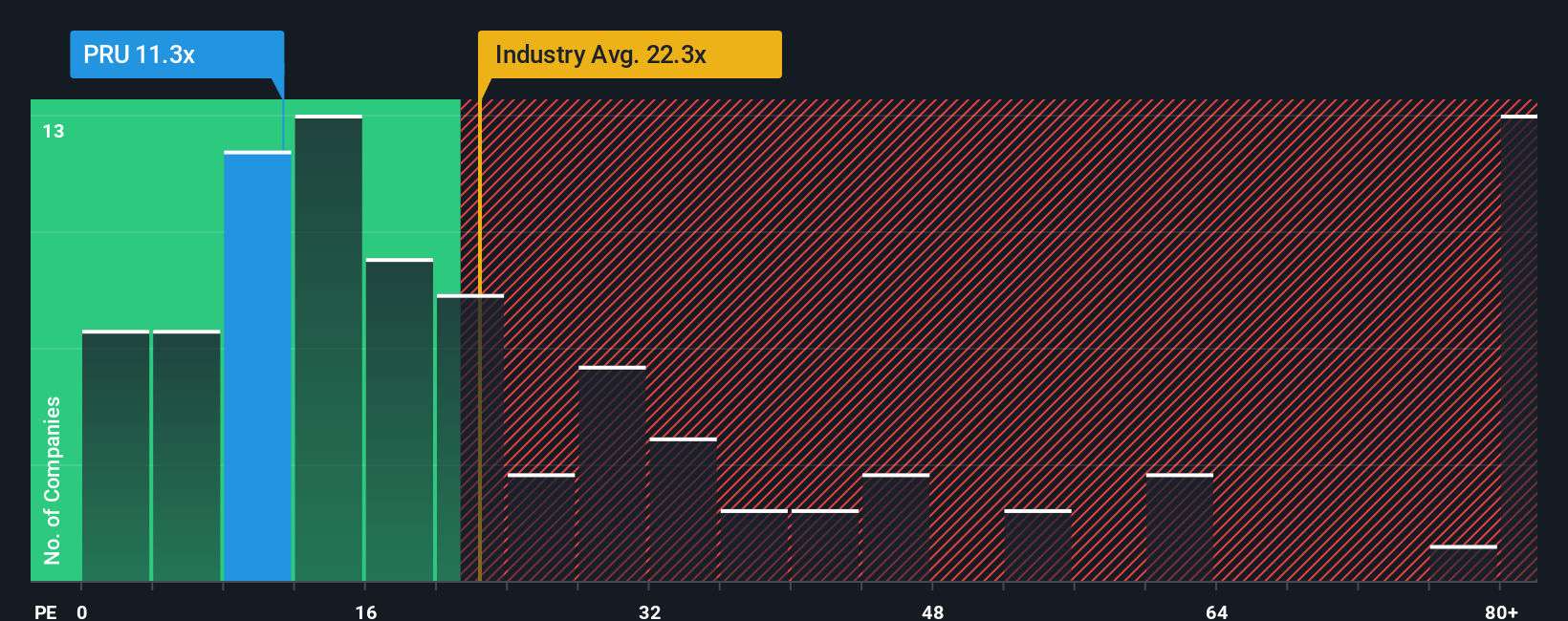

While the most followed narrative sees Perseus Mining as around 1% overvalued at A$5.72, the earnings multiple paints a different picture. At a P/E of 14.1x, the shares sit well below the Australian Metals and Mining industry at 24x and peers at 64.8x.

Our fair ratio for Perseus is 23.7x, which is well above where the market is currently pricing it. That gap suggests investors are either being cautious about future earnings, or the current price leaves room for sentiment to shift closer to that fair ratio over time. Which side of that debate do you find more convincing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Perseus Mining Narrative

If you look at the numbers and arrive at a different conclusion or simply prefer to test your own assumptions, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Perseus Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investment idea?

If Perseus has caught your attention, do not stop there. Use the Simply Wall St Screener to quickly spot other opportunities that fit what you are looking for.

- Target income potential by checking out these 12 dividend stocks with yields > 3% that focus on companies sharing more of their earnings with shareholders.

- Tap into growth themes by scanning these 26 AI penny stocks that are tied to advances in artificial intelligence across different industries.

- Hunt for value by reviewing these 886 undervalued stocks based on cash flows that trade below their estimated worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com