Evaluating Ericsson (OM:ERIC B) Shares After Mixed Returns And Conflicting Valuation Signals

Intro

Telefonaktiebolaget LM Ericsson (OM:ERIC B) has drawn investor attention after recent share price moves, with the stock showing varied returns over the past week, month, past 3 months, and year to date.

See our latest analysis for Telefonaktiebolaget LM Ericsson.

Ericsson’s recent share price return has been mixed, with a 1 day move of 1.81% and a stronger 90 day share price return of 15.46%. The 3 year total shareholder return of 63.38% points to momentum that has built over a longer period.

If Ericsson’s recent moves have you thinking about where else growth or resilience might show up in tech, it could be a good moment to scan high growth tech and AI stocks for other ideas.

With Ericsson trading around SEK91.24, a 63.38% total return over three years, and an intrinsic value estimate indicating a sizeable discount, is there still a buying opportunity here or is the market already pricing in future growth?

Most Popular Narrative Narrative: 4.4% Overvalued

With Telefonaktiebolaget LM Ericsson last closing at SEK91.24 against a narrative fair value around SEK87.38, the story hinges on modest earnings progress and valuation multiples.

Upward target revisions toward the mid to high SEK 90s signal confidence that operational efficiencies and cost controls can sustain better profitability than previously assumed.

Some see 2027 valuation metrics as providing a floor for the shares, suggesting limited downside if Ericsson delivers against revised earnings trajectories.

Curious what keeps this valuation just above today’s price? The narrative leans on firmer margins, steady earnings and a higher future earnings multiple. Want the full picture behind those assumptions?

Result: Fair Value of $87.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear pressure points. Geopolitical tension around 5G equipment and intense pricing competition are both capable of quickly reshaping Ericsson’s earnings and valuation story.

Find out about the key risks to this Telefonaktiebolaget LM Ericsson narrative.

Another View: Earnings Multiple Signals Undervaluation

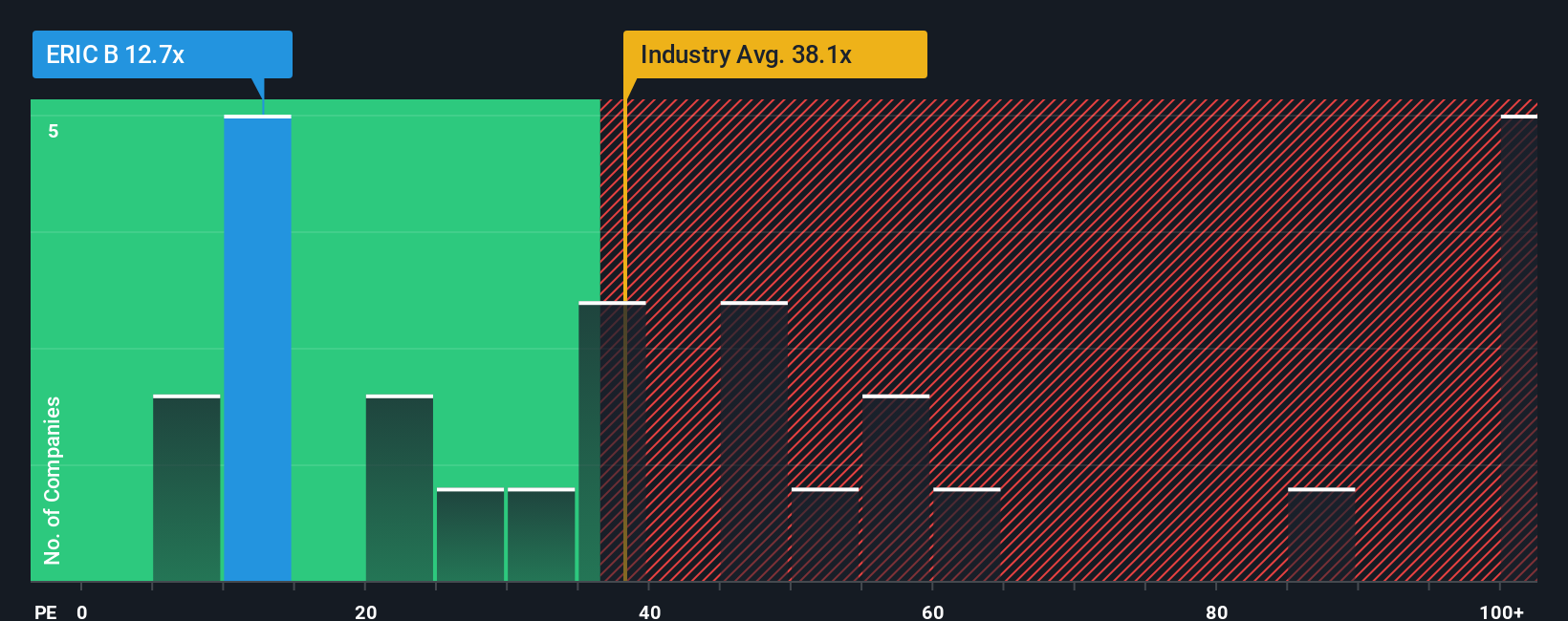

The narrative fair value suggests Ericsson is 4.4% overvalued at around SEK91, yet the earnings multiple tells a different story. The shares trade on a P/E of 12.3x versus 42.6x for peers and a fair ratio of 21.6x, which points to a sizeable valuation gap.

If that gap closed even part of the way toward the fair ratio, today’s pricing would look very different. The question for you is whether the earnings outlook and risks justify that discount or whether the market is being overly cautious.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Telefonaktiebolaget LM Ericsson Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can quickly build your own version of the story by starting with Do it your way.

A great starting point for your Telefonaktiebolaget LM Ericsson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ericsson has sharpened your interest, do not stop here. Widening your watchlist with targeted stock ideas can help you spot opportunities you might otherwise miss.

- Target potential value with these 886 undervalued stocks based on cash flows that highlight companies priced below what their cash flows suggest.

- Ride the next wave of tech by scanning these 26 AI penny stocks focused on businesses using artificial intelligence at the core of their models.

- Put income on your radar through these 12 dividend stocks with yields > 3% that focus on companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com