S&P Global Warns: AI competition and defense spending are both accelerating, and global copper resources may face a 10-million-ton gap

The Zhitong Finance App learned that according to a recent study by S&P Global, the AI competition and surging defense spending will exacerbate the expected shortage of copper, and it is difficult for producers to expand production capacity.

Demand growth is accelerating while mine supply is facing structural constraints, increasing the risk that copper will become a bottleneck in economic growth and technology expansion, S&P Global wrote in a mining-backed report released on Thursday.

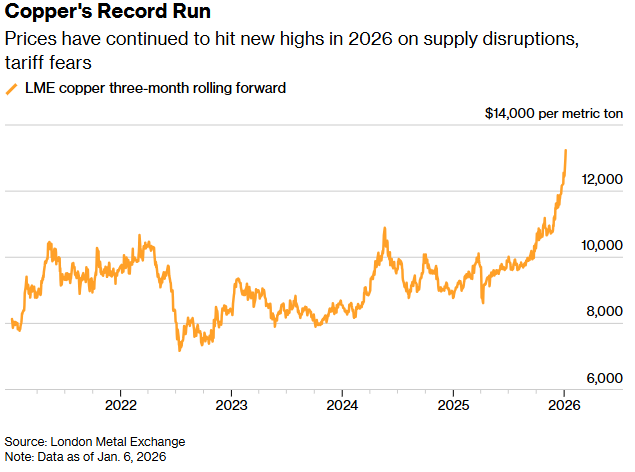

On the London Stock Exchange, the price of copper has soared to a record high of more than $13,000 per ton due to a series of mine shutdowns and traders hoarding metal in the US before the Trump administration may impose tariffs. Although copper flowing into US warehouses has left prices above levels supported by basic consumption, new areas of demand indicate a tighter long-term market.

“Three years ago, artificial intelligence and data centers weren't even considered,” Aurian De La Noue, head of global energy transition and critical metals consulting at S&P, said in an interview. “This study shows that the world was already moving towards a supply deficit even before considering these new growth vectors.”

Copper prices rose to record

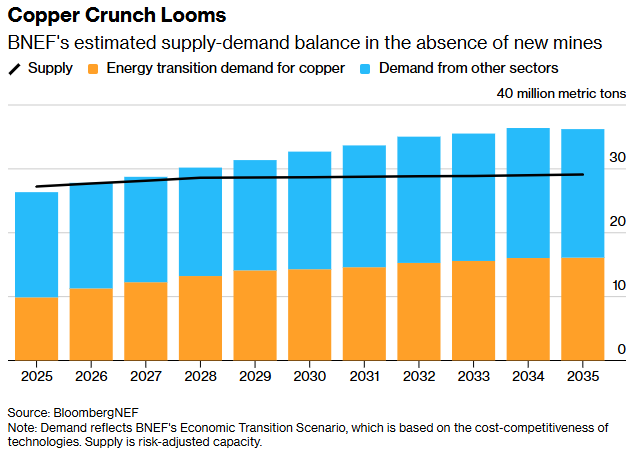

S&P Global expects global copper demand to grow 50% from current levels to 42 million tons by 2040. While traditional sources such as buildings, appliances, transportation, and power generation continue to account for the majority of copper demand, the largest share of growth comes from energy transition uses, including electric vehicles, renewable energy, batteries, and grid expansion.

New sources of demand are also expanding in scale. As the world's installed data center capacity nearly quadruples by 2040, copper consumption associated with data centers and artificial intelligence infrastructure is expected to skyrocket.

The study found that by 2040, demand from artificial intelligence, data centers, and global defense spending could increase consumption by 4 million tons combined.

S&P Global has also identified another potential source of demand: humanoid robots. Research shows that although the technology is still in its early stages, if 1 billion humanoid robots were put into operation by 2040, it would require around 1.6 million tons of copper per year, or about 6% of current consumption.

However, global copper production is expected to peak at around 33 million tons in 2030 due to declining ore quality from existing mines and new projects facing significant hurdles in licensing, financing, and construction.

The study found that even taking into account the significant increase in recycled copper (which is expected to double to more than 10 million tons during the same period), there will still be a gap of 10 million tons at that time.

To be sure, this supply deficit is largely hypothetical because consumption is limited by supply. As prices rise, copper may be replaced in certain products, and supply expansion projects may become more profitable.

Estimating the balance between supply and demand in the absence of new mining

Supply challenges have become more complex due to long development cycles, rising costs, and highly concentrated supply chains, making the market increasingly vulnerable in the face of accelerated demand, according to S&P.

Extremely high prices are a good thing for the industry. However, Daniel Yergin (Daniel Yergin), co-chair of the study and global vice chairman of S&P, said there is no guarantee that prices will remain at these levels. “We are reluctant to assert that this proves that prices are now at a stable higher level,” Ye Jin said in an interview.

The study received financial support from mining giants BHP Billiton Group, Rio Tinto Group, traders such as Torque and Gongwo, and even Google.