Assessing ARS Pharmaceuticals (SPRY) Valuation After China Approval Expands Neffy Allergy Market Reach

China approval puts ARS Pharmaceuticals in focus

ARS Pharmaceuticals (SPRY) is drawing attention after China’s National Medical Products Administration cleared its neffy 2 mg epinephrine nasal spray for emergency treatment of anaphylaxis in adults and children over 30 kg.

The product, to be sold as You Min Su in China, targets a market where food allergies are estimated to affect roughly 50 million to 100 million people. This development is prompting discussion about how access to this new geography might influence sentiment around the stock.

See our latest analysis for ARS Pharmaceuticals.

Despite the China approval, ARS Pharmaceuticals’ share price has been choppy, with a 30-day share price return of 11% but a year-to-date share price return decline of 3.39%, while the 3-year total shareholder return of 53.10% points to stronger longer term momentum.

If this type of catalyst driven move interests you, it could be worth scanning healthcare stocks to see which other healthcare names are catching attention right now.

With neffy now cleared in China, solid revenue growth, and a recent share price pullback, the key question is whether ARS Pharmaceuticals still trades at a discount or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 61.5% Undervalued

The most followed narrative places ARS Pharmaceuticals’ fair value at about US$28.83 per share versus a last close of US$11.10, framing a wide discount that hinges on how neffy scales globally.

Successful global rollout initiatives, with neffy launches in Germany and the UK and pending regulatory approvals in Canada, Australia, Japan, and China, create a catalyst for international revenue growth and milestone payments, diversifying and expanding overall revenue streams. Rapid removal of access barriers (93% payer coverage, reduced prior authorization requirements, high co-pay support adoption), combined with a robust DTC campaign, is improving market penetration, which is likely to drive further revenue growth and enhance net margins via operating leverage as sales increase.

Curious how this narrative gets from one allergy spray to that valuation gap? The core assumptions blend rapid revenue expansion, margin uplift, and a rich future earnings multiple, all discounted at a specific rate. Want to see exactly how those moving parts stack together?

Result: Fair Value of $28.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if neffy uptake slows after early DTC momentum, or if new allergy treatments compress pricing and future margins.

Find out about the key risks to this ARS Pharmaceuticals narrative.

Another View: Market Ratios Paint A Different Picture

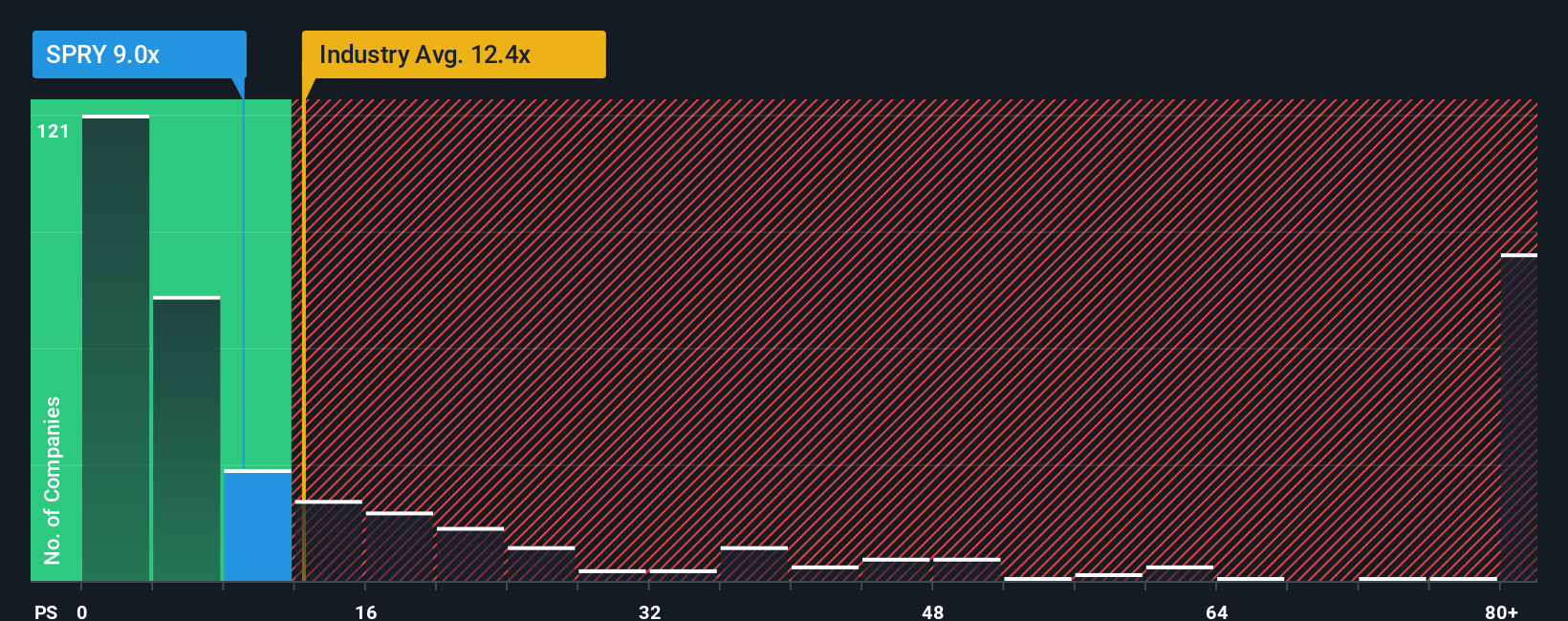

The narrative fair value implies a wide discount, but the current P/S ratio of 7.7x is higher than direct peers at 6.5x and below the broader US Biotechs group at 11.7x. Our fair ratio of 11.4x suggests room for sentiment to shift while also highlighting clear valuation risk if growth expectations soften.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ARS Pharmaceuticals Narrative

If you see the numbers differently or prefer to test your own assumptions against the data, you can build a custom view in minutes, starting with Do it your way.

A great starting point for your ARS Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready For Your Next Investment Idea?

If you stop with just one stock, you could miss opportunities sitting in plain sight. Take a few minutes to scan other ideas that fit your style.

- Target potential mispricings by checking out these 886 undervalued stocks based on cash flows that currently screen as attractive based on their cash flows.

- Ride major technology shifts by reviewing these 26 AI penny stocks that are tied to artificial intelligence themes.

- Boost your income focus by scanning these 12 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com