The multi-billion dollar sell-off is imminent! Index rebalancing caused a huge shock, and gold and silver prices declined for two consecutive days

The Zhitong Finance App learned that as investors are preparing for the upcoming annual rebalance of the commodity index — futures contracts worth several billion dollars may be sold in the next few days, gold and silver prices have declined for the second day in a row.

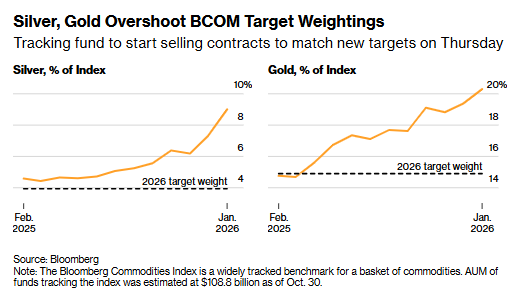

According to the data, the price of spot gold once fell below the 4,420 US dollar mark. The price of spot silver fell by nearly 1% on the previous trading day, and the price of spot silver fell by more than 3% to 76.11 US dollars per ounce. The price of platinum and palladium also continued the decline of the previous trading day. According to information, in order to match the latest weight after the index adjustment, passive tracking funds began selling precious metal futures on Thursday. This was a routine operation, but due to the sharp rise in gold and silver prices last year, this rebalancing had a particularly significant impact on the market.

Recently, market fluctuations have intensified, compounded by index rebalancing factors, and the selling pressure on silver is particularly significant. Citi estimates that this rebalance may trigger a sell-off of about 6.8 billion US dollars in silver futures, which is equivalent to 12% of the total number of outstanding silver futures contracts on the New York Mercantile Exchange (COMEX).

Citi estimates based on fund data tracking the Bloomberg Commodity Index and the S&P Goldman Sachs Commodity Index, and the scale of the outflow of gold futures will be similar to that of silver. This large-scale sell-off stemmed from a sharp rise in the weight of precious metals in the commodity benchmark index.

“I've been working on index rebalancing for many years and have never seen capital flows on this scale,” said Citigroup strategist Kenny Hu.

Despite short-term price pressure, after recording the best annual performance since 1979, there are no signs of a sharp correction in gold and silver prices. Throughout last year, international gold and silver prices set new historical records several times, supported by multiple favorable factors such as increased gold holdings by major central banks and continued inflows of gold ETF funds.

According to a report released by the World Gold Council on January 6, the net increase in gold holdings of global central banks reached 45 tons in November. According to data released by the People's Bank of China on Wednesday, the central bank of China has increased its gold holdings for 14 consecutive months, and official gold purchase demand continues to be an important pillar supporting the price of gold.

Furthermore, the tightening trade relationship between China and Japan, as well as incidents such as the US seizure of Venezuelan President Nicolas Maduro, have also recently provided support for gold prices. As of Wednesday's close, the weekly increase in international gold prices was about 3%.

Traders have now turned their attention to key US economic data such as the December non-farm payrolls report to be released on Friday. Weak data performance will reinforce market expectations for further interest rate cuts by the Federal Reserve, which is undoubtedly a major positive factor for precious metals that do not generate interest income.

Compared to gold, silver saw an even more impressive increase last year, with a cumulative increase of about 150% throughout the year. In October of last year, the silver market experienced a historic shortfall; at the same time, market concerns about a possible US import tariff policy further boosted the price of silver.

David Wilson, head of commodity strategy at BNP Paribas, said, “Index rebalancing may curb the upward space for gold and silver prices in the short term, but in the long run, silver still has stronger upward momentum.”