A Look At Procore Technologies (PCOR) Valuation After Barclays Upgrade And CEO Transition

Procore Technologies (PCOR) drew fresh attention after a Barclays upgrade coincided with a 4.9% move in the share price, which was linked to confidence in new CEO Ajei Gopal and U.S. non residential construction.

See our latest analysis for Procore Technologies.

The Barclays upgrade comes after a period where the 1-year total shareholder return sits at a 2.23% loss, while the year-to-date share price return is 6.54% and the 3-year total shareholder return is 46.77%. This suggests momentum has picked up recently but remains mixed over longer periods.

If Procore’s move has you thinking about what else is happening in construction tech, it could be a good moment to scan high growth tech and AI stocks for other software driven growth stories.

With shares up in the short term but still carrying a 1 year loss, along with a value score of 1 and an intrinsic value estimate above the current US$74.62 price, is there a real opening here or is the market already baking in future growth?

Most Popular Narrative Narrative: 13.8% Undervalued

Procore Technologies' most followed narrative pegs fair value at US$86.53 per share versus the last close of US$74.62, framing the current move in a valuation gap that still looks meaningful on these assumptions.

Accelerating adoption of AI-powered solutions in construction, particularly Procore Helix and Agent Builder, is driving increased customer automation, data unification, and workflow efficiency. This positions Procore as an indispensable platform and is likely to boost future revenue growth and support higher pricing, positively impacting both top-line and margins.

Curious how that AI push feeds into the numbers? The narrative leans heavily on steady revenue expansion, rising margins and a rich future earnings multiple. Want the full playbook behind that US$86.53 fair value and the 8.4% discount rate that ties it all together?

Result: Fair Value of $86.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on construction activity holding up and North America remaining resilient, while slower digital adoption or cheaper rivals could pressure growth, pricing and margins.

Find out about the key risks to this Procore Technologies narrative.

Another View: Market Pricing Looks Full On Sales

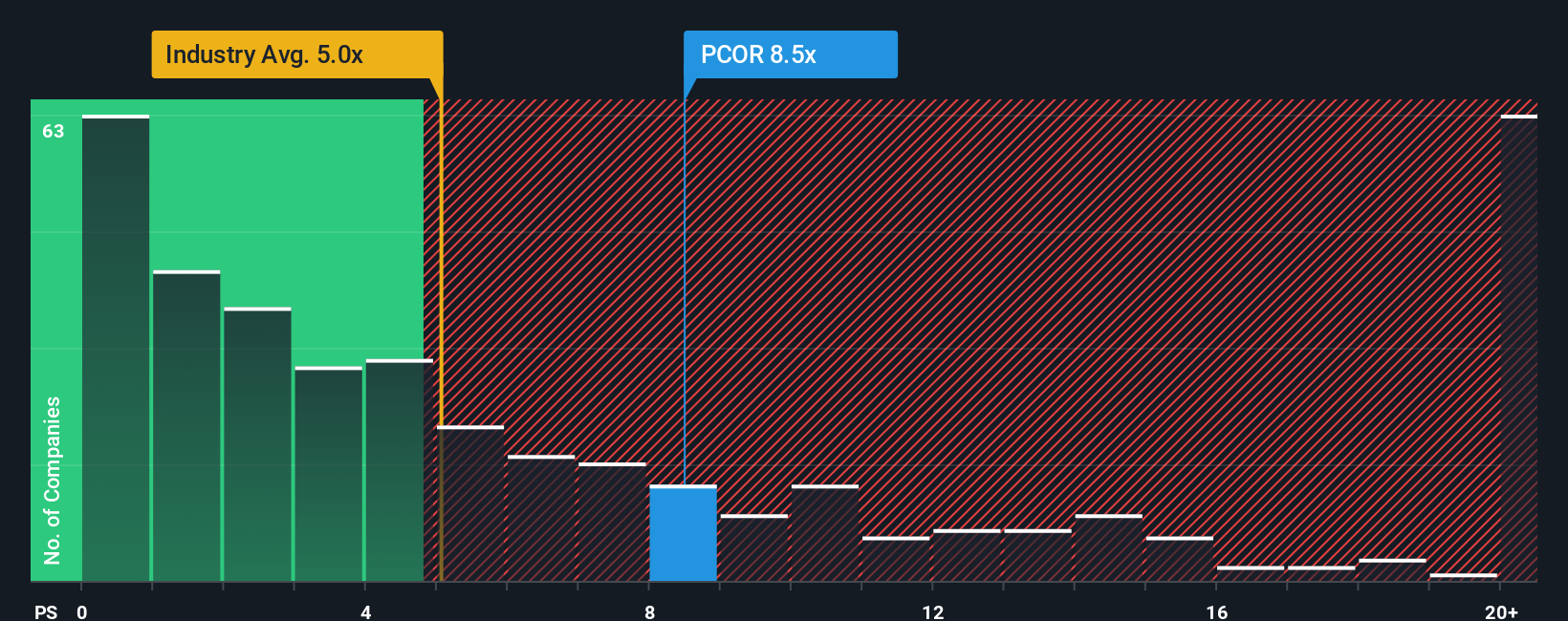

While the popular narrative sees Procore as 13.8% undervalued, our SWS fair ratio work using the P/S ratio points the other way. The stock trades at 9.1x sales, above a fair ratio of 7.4x and almost double the wider US Software industry at 4.8x, even though it is only roughly in line with peers at 9.7x. That kind of gap can limit upside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Procore Technologies Narrative

If you look at this and think the story feels off or want to shape your own view from the raw data, you can build a custom thesis in just a few minutes by starting with Do it your way.

A great starting point for your Procore Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Procore is on your radar, do not stop here. Widen your search and let a few high quality stock screens point you toward your next idea.

- Target potential mispricings by scanning these 887 undervalued stocks based on cash flows that line up strong cash flow expectations with current market prices.

- Tap into fast moving themes with these 26 AI penny stocks positioned around artificial intelligence and automation trends.

- Lock in potential portfolio income by reviewing these 12 dividend stocks with yields > 3% that already yield more than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com