Why did Yuekang Pharmaceutical (688658.SH)'s net revenue drop three times in a row to the Weishi family's dividend of more than 400 million?

The biomedical sector of Hong Kong stocks ushered in an upward trend after a long absence.

The stock prices of leading companies such as BeiGene and Hanson Pharmaceuticals are rising steadily. During this golden window period, A-share science and technology innovation board pharmaceutical company Yuekang Pharmaceutical (688658.SH) quietly pressed the “acceleration button” to go public in Hong Kong.

(Source: Yuekang Pharmaceutical Company announcement)

At the end of 2025, Yuekang Pharmaceutical submitted a prospectus to the Hong Kong Stock Exchange to list on the main board under the “dual major listing” model, with CITIC Securities as the sole sponsor. This company, with a total market capitalization of about 12 billion yuan, is mired in the pain of transformation: revenue and net profit fell three times in a row in the first seven months of 2025; the core product Yuekang Flux fell sharply, and the share of cardiovascular business revenue fell from 61% to 39%.

Paradoxically, at a time when performance is under pressure and cash flow is tightening, the company's cumulative dividends still exceeded 890 million yuan in 2022 to 2024, and the controlling shareholder Yu Weishi Family received nearly half of the voting rights with 49.26%.

The trade-offs and ambitions behind this “A+H” sprint attracted widespread attention in the market. Now sprinting to Hong Kong stocks, Yuekang Pharmaceutical is trying to replenish blood through fund-raising and betting on innovative pipelines such as oligonucleotides and mRNA vaccines.

But is this “blood filling” journey a key step in transformation and breaking the game, or is it a helpless act under pressure from performance?

From generic drug leader to innovative transformation

The development trajectory of Yuekang Pharmaceutical is a microcosm of the transformation of China's pharmaceutical industry.

According to Tianyan Research, Yuekang Pharmaceutical Group Co., Ltd. (formerly known as Yuekang Pharmaceutical Group Co., Ltd.), founded in 2001, is a member of Anhui Hengshun Information Technology, located in Beijing. It is an enterprise mainly engaged in the pharmaceutical manufacturing industry.

Since its establishment in 2001, the company started with chemical generic drugs. With mature products such as Yuekangtong (ginkgo biloba extract injection) and Levik (omeprazole enteric capsules), the company quickly seized the hospital channel market. At its peak, cardiovascular products contributed more than 60% of revenue.

However, with the dual transformation of “normalization of collection” and “acceleration of innovation and transformation” in the pharmaceutical industry, the profit margins of generic drugs continued to be compressed, and Yuekang Pharmaceutical had to accelerate its breakthrough into the field of innovative drugs.

The company has built a “independent R&D + authorized introduction” dual-track production pipeline, covering 11 oligonucleotide drugs, 2 mRNA vaccines, 3 peptides, and 3 innovative traditional Chinese medicine drugs, covering core treatment fields such as cardiovascular metabolism, infectious diseases, and tumors.

Judging from the layout, Yuekang Pharmaceutical is trying to get on the cutting-edge technology circuit and avoid falling into the Red Sea competition of traditional innovative drugs.

Among them, the authorized introduction of innovative traditional Chinese medicine drugs YKYY001, YKYY002, and YKYY006 are expected to be approved for sale in the first quarter of 2026, and are expected to be the first batch of innovative products contributing to revenue.

However, the reality is that most innovation pipelines are still in the early stages of R&D, and there is still a long cycle until commercialization, making it difficult to hedge against the downward pressure on the generic drug business in the short term.

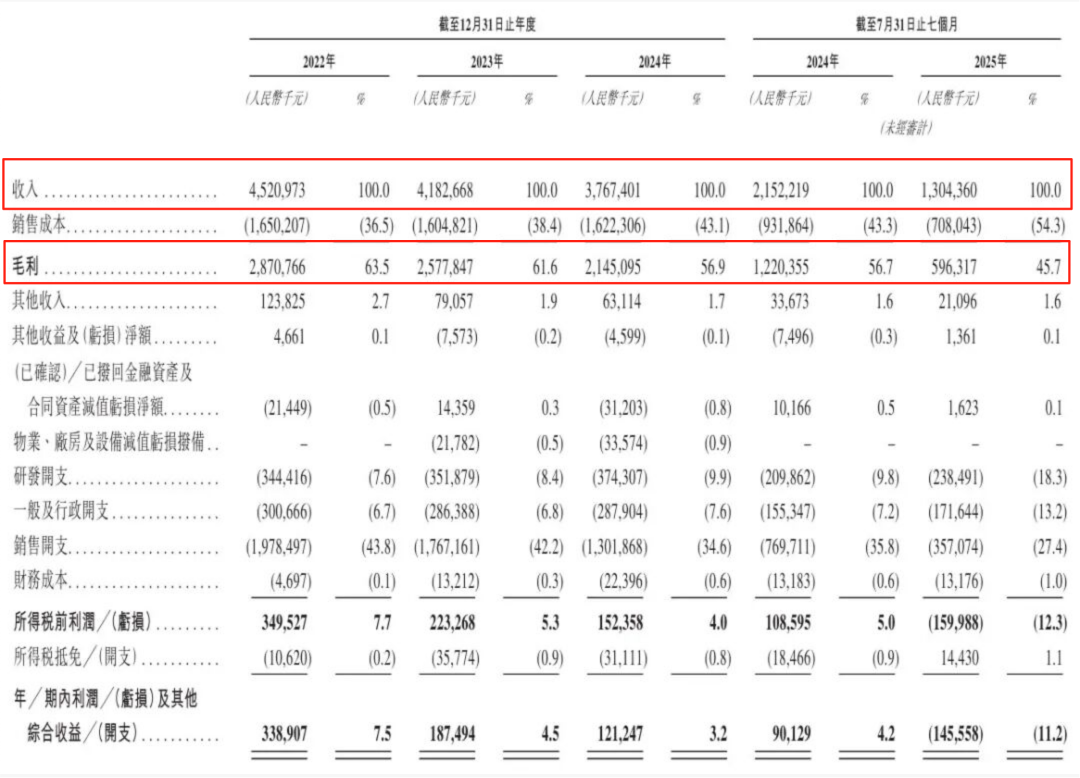

This dilemma of “old business is lagging behind, new business is far from being able to quench thirst” is the current core contradiction of Yuekang Pharmaceutical. In the first seven months of 2025, the company's R&D investment increased to 238 million yuan, and sales expenses reached 357 million yuan. However, innovation investment has not yet been converted into actual revenue, which further intensified profit pressure.

Performance pressure and dividend disputes

Yuekang Pharmaceutical's prospectus revealed many hidden concerns at the business level.

On the revenue side, the decline continued from 4,521 billion yuan to 3,767 billion yuan in 2024, and a sharp year-on-year decline of 39.4% to 1.304 billion yuan in the first seven months of 2025.

On the profit side, net profit fell from 339 million yuan in 2022 to 121 million yuan in 2024, and net loss of 146 million yuan for the first 7 months of 2025; gross margin also declined year by year from 63.5% to 45.7%, and profitability continued to weaken.

The stalling of core products is a key trigger.

As a former revenue pillar, Yuekangtong faced the double impact of increased market competition and policy adjustments. Prices and sales fell simultaneously, directly leading to a sharp contraction in cardiovascular business revenue.

However, the company's inventory turnover period was extended from 151.6 days in 2022 to 195.3 days in the first seven months of 2025, reflecting poor product sales and inventory backlogs.

What is more noteworthy is the worsening cash flow situation.

At the end of July 2025, the company's cash and cash equivalents fell to 875 million yuan, a decrease of 30% compared to the end of 2024; net cash flow from operating activities changed from positive to negative, recorded - $27.322 million, and hematopoietic capacity declined markedly.

However, against the backdrop of declining performance and tightening cash flow, Yuekang Pharmaceutical's dividend strategy has sparked market controversy.

In 2022 to 2024, the company distributed a total of 890 million yuan in dividends to shareholders, of which the 2023 dividend reached 495 million yuan, far exceeding the net profit of 187 million yuan for the year. Since the controlling shareholder Yu Weishi Family holds a total of 49.26% of the voting rights, nearly half of the dividends went into the family's pocket.

This “declining performance still generously dividends” operation has been questioned whether it harms the company's long-term development interests, especially during the critical transformation period where innovative research and development urgently requires capital investment.

Is going public in Hong Kong with financing to supplement the blood, or is it an increase in gambling?

Choosing to sprint to Hong Kong stocks at the end of 2025, Yuekang Pharmaceutical's core appeal was obvious, raising capital to supplement its blood.

According to the prospectus, the capital raised in this IPO will mainly be used for innovative drug research and development, construction of production facilities, and supplementary working capital, which directly points to the company's current financial pressure and transformation needs.

Looking at the industry environment, the recovery of the biomedical sector in Hong Kong stocks in 2025 provided a favorable listing window for Yuekang Pharmaceutical. With the optimization of the 18A rules for Hong Kong stocks and the restoration of innovative drug valuations, the market's acceptance of high-quality biomedical companies has increased markedly. The rising prices of companies such as BeiGene Shenzhou have also provided a reference for Yuekang Pharmaceutical's valuation and pricing.

In addition, listing in Hong Kong can also help Yuekang Pharmaceutical achieve two major goals:

The first is to broaden financing channels, reduce dependence on the A-share single market, and provide a stable source of funding for long-term R&D investment.

The second is to use the international platform of Hong Kong stocks to enhance brand influence and lay the foundation for future international cooperation for innovative drugs.

But this listed gambling game also harbors risks.

First, Hong Kong stock investors have a stricter valuation logic for innovative pharmaceutical companies. Yuekang Pharmaceutical's current innovation pipeline has yet to form a commercialization tier, growth in core products is weak, and there are still doubts about whether they can gain market recognition.

Second, the pharmaceutical industry has a large R&D investment, long cycle, and high risk. Even with successful fundraising, if innovative product development falls short of expectations or sales targets after launch, the company will still face the dilemma of continuing to put pressure on performance.

Finally, the difference in valuation between A shares and Hong Kong stocks and the differentiation in market liquidity may also lead to a “double listing but inverted valuation” situation.

On the path of transformation, opportunities and risks coexist

Yuekang Pharmaceutical's listing in Hong Kong. For investors, the core investment value of Yuekang Pharmaceutical lies in three points:

The first is whether the 3 innovative traditional Chinese medicine drugs that have entered the countdown to marketing can be successfully approved and released.

Second, can the development progress of cutting-edge pipelines such as oligonucleotides and mRNA exceed expectations.

The third is whether the company can effectively control sales expenses, improve the profit structure, and rebuild its ability to build blood.

From an industry perspective, Yuekang Pharmaceutical's transformation path is also a necessary path for many Chinese generic drug companies.

Under industry trends driven by normalization of collection and innovation, only companies that can continue to invest in R&D, build core technical barriers, and balance short-term performance with long-term development can stand out in the wave of transformation.

Yuekang Pharmaceutical's Hong Kong stock listing journey is about to begin.

But is the end of this journey really the dawn of innovation breaking the game, or a continuation of pressure on performance?

The answer may not be revealed until the day the innovation pipeline is actually commercialized.

This article is reprinted from the official account of “Nudao Business Review”, Zhitong Finance Editor: Jiang Yuanhua.