Top Dividend Stocks In Global For January 2026

As global markets navigate a mixed start to 2026, with U.S. stocks experiencing slight declines and European indices reaching new highs, investors are keenly observing economic indicators such as rising home sales in the U.S. and manufacturing growth in China. In this environment, identifying strong dividend stocks can be an effective strategy for those seeking steady income streams, especially given the current geopolitical tensions influencing sectors like energy.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.15% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.61% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.38% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.20% | ★★★★★★ |

| NCD (TSE:4783) | 3.74% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.50% | ★★★★★★ |

Click here to see the full list of 1254 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zhejiang Jianye Chemical (SHSE:603948)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jianye Chemical Co., Ltd. is involved in the research, development, production, and sales of fine chemical products in China with a market cap of CN¥4.45 billion.

Operations: Zhejiang Jianye Chemical Co., Ltd. generates its revenue through the research, development, production, and sales of fine chemical products in China.

Dividend Yield: 3.4%

Zhejiang Jianye Chemical's dividend yield of 3.42% places it in the top 25% of dividend payers in China, yet its dividends have been volatile over the past five years. The company's payout ratio stands at a reasonable 74.1%, and cash flow coverage is strong at 46.7%, suggesting sustainability despite a history of unreliable payments. Recent earnings show net income growth to CNY 175.72 million, indicating potential for future stability if trends continue positively.

- Dive into the specifics of Zhejiang Jianye Chemical here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Zhejiang Jianye Chemical is trading behind its estimated value.

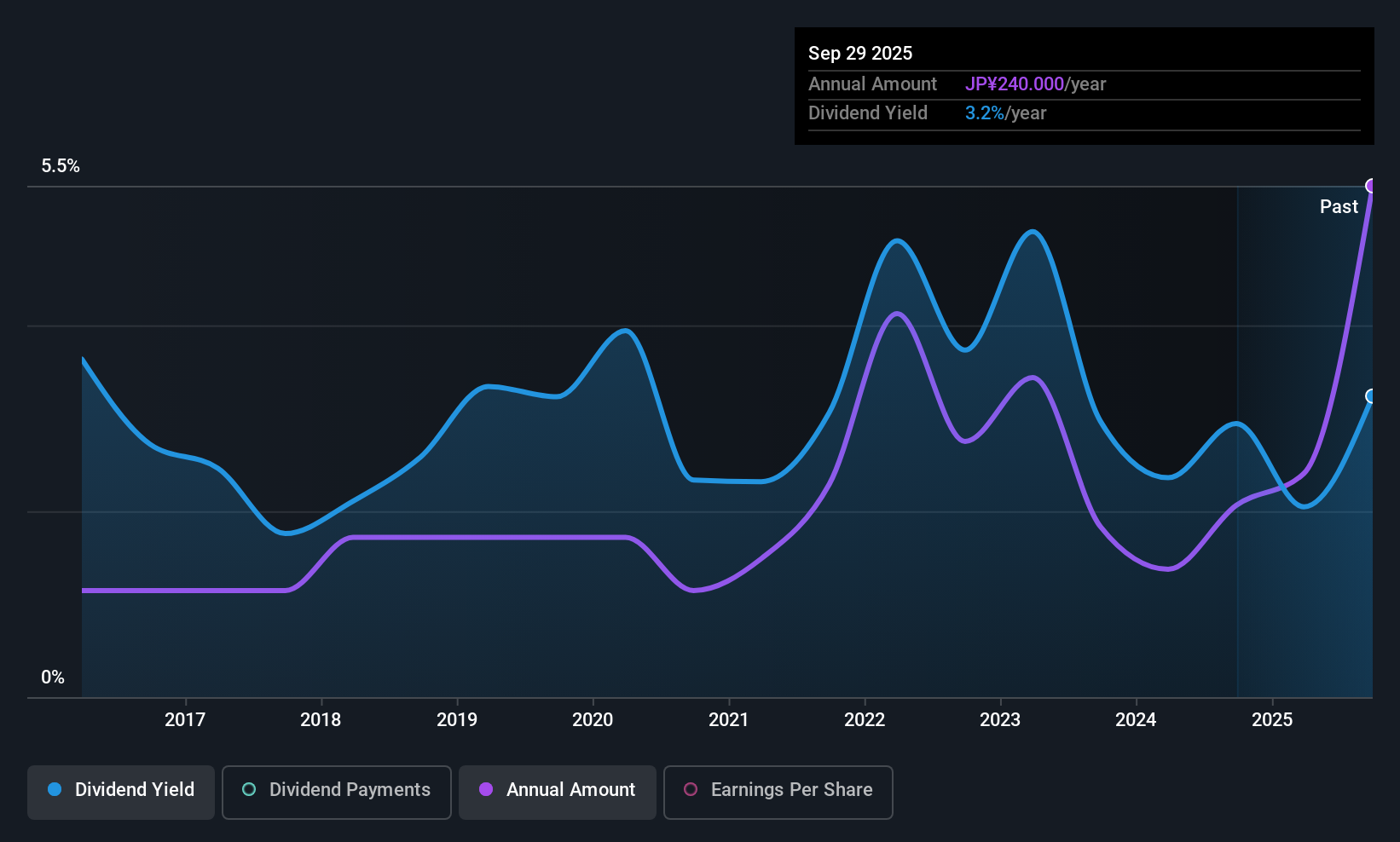

Nihon Seiko (TSE:5729)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nihon Seiko Co., Ltd. is a Japanese company that manufactures and sells antimony products and metal powders, with a market capitalization of ¥27.94 billion.

Operations: Nihon Seiko Co., Ltd. generates revenue primarily from its Antimony Business, which accounts for ¥25.93 billion, and its Metal Powder Business, contributing ¥9.25 billion.

Dividend Yield: 3.1%

Nihon Seiko's dividend yield of 3.07% falls below the top 25% in Japan, and its dividend history is marked by instability despite a decade-long growth trend. The company's payout ratios are low, with earnings coverage at 12.8% and cash flow coverage at 36.9%, indicating sustainable payments despite past volatility. Trading significantly below estimated fair value, Nihon Seiko offers potential value but requires consideration of its non-cash earnings quality and unstable dividend track record.

- Navigate through the intricacies of Nihon Seiko with our comprehensive dividend report here.

- According our valuation report, there's an indication that Nihon Seiko's share price might be on the cheaper side.

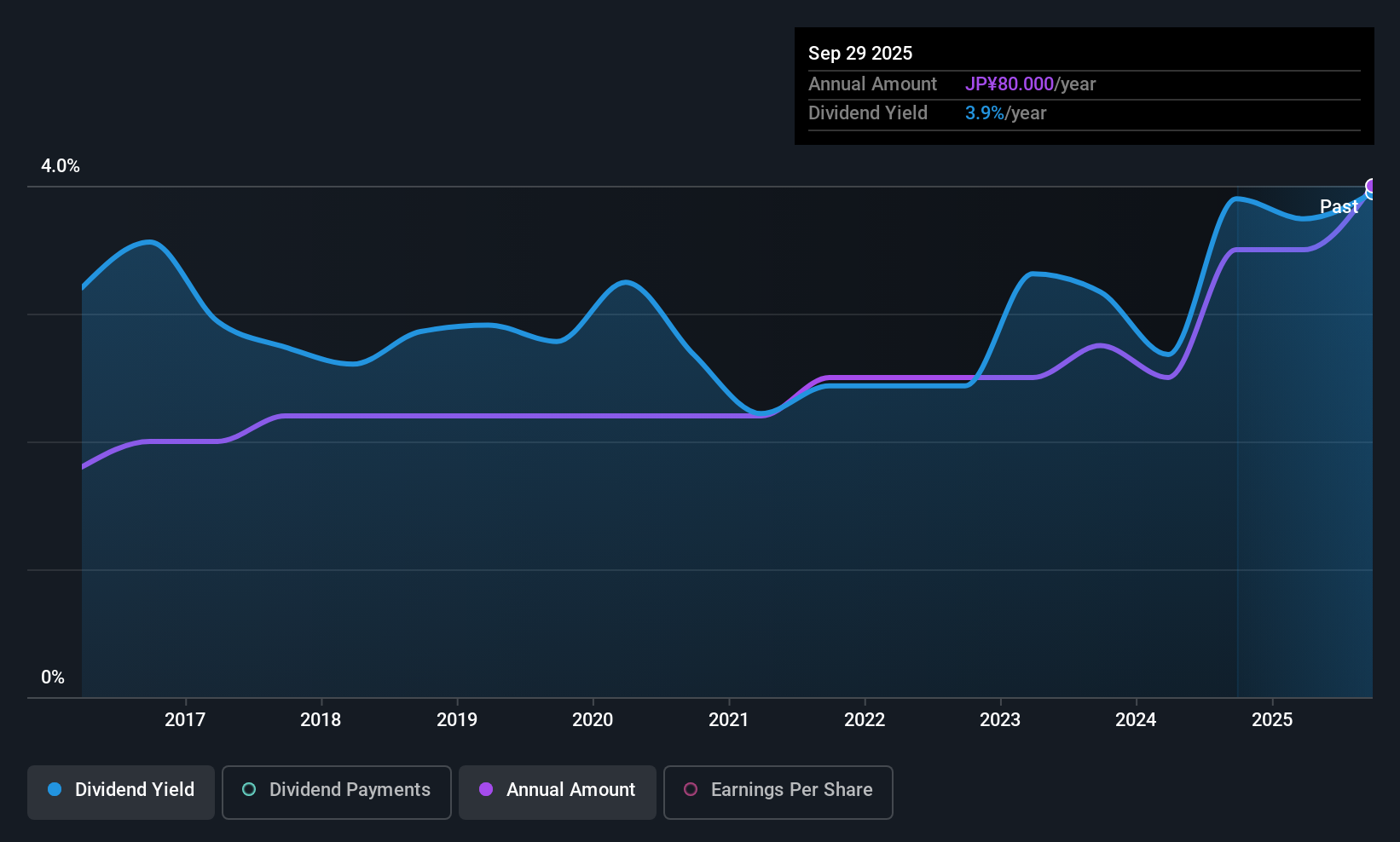

KVK (TSE:6484)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KVK Corporation, with a market cap of ¥20.60 billion, operates in Japan, China, and the Philippines where it manufactures, processes, sells, and installs water faucets.

Operations: KVK Corporation generates revenue from the manufacturing, processing, sales, and installation of water faucets across its operations in Japan, China, and the Philippines.

Dividend Yield: 3.1%

KVK's dividend yield of 3.11% is below the top 25% in Japan, with a history of volatility despite growth over the past decade. The payout ratio is low at 13.6%, suggesting strong earnings coverage, while cash flow coverage stands at a reasonable 70.6%. With a price-to-earnings ratio of 8.8x, KVK trades below the market average, presenting potential value but requires careful consideration due to its unstable dividend track record and payment volatility.

- Click to explore a detailed breakdown of our findings in KVK's dividend report.

- Our expertly prepared valuation report KVK implies its share price may be too high.

Key Takeaways

- Reveal the 1254 hidden gems among our Top Global Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com