January 2026's Global Stocks Estimated To Be Priced Below Their True Worth

As global markets navigate a mixed start to 2026, with U.S. stocks experiencing slight declines and European indices reaching new highs, investors are keenly observing economic indicators such as rising pending home sales in the U.S. and easing inflation in Europe. In this climate of fluctuating indices and economic shifts, identifying undervalued stocks can be a strategic move for investors seeking opportunities that may be priced below their intrinsic worth amidst these evolving market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.06 | CN¥37.96 | 49.8% |

| WuXi XDC Cayman (SEHK:2268) | HK$68.50 | HK$135.26 | 49.4% |

| PeptiDream (TSE:4587) | ¥1744.50 | ¥3449.07 | 49.4% |

| Kuraray (TSE:3405) | ¥1600.50 | ¥3160.99 | 49.4% |

| Fodelia Oyj (HLSE:FODELIA) | €5.42 | €10.72 | 49.5% |

| DEUTZ (XTRA:DEZ) | €9.535 | €18.95 | 49.7% |

| CURVES HOLDINGS (TSE:7085) | ¥793.00 | ¥1577.74 | 49.7% |

| Contec.Co.Ltd (KOSDAQ:A451760) | ₩14490.00 | ₩28687.94 | 49.5% |

| Boliden (OM:BOL) | SEK547.20 | SEK1091.07 | 49.8% |

| Aidma Holdings (TSE:7373) | ¥3165.00 | ¥6305.80 | 49.8% |

Let's review some notable picks from our screened stocks.

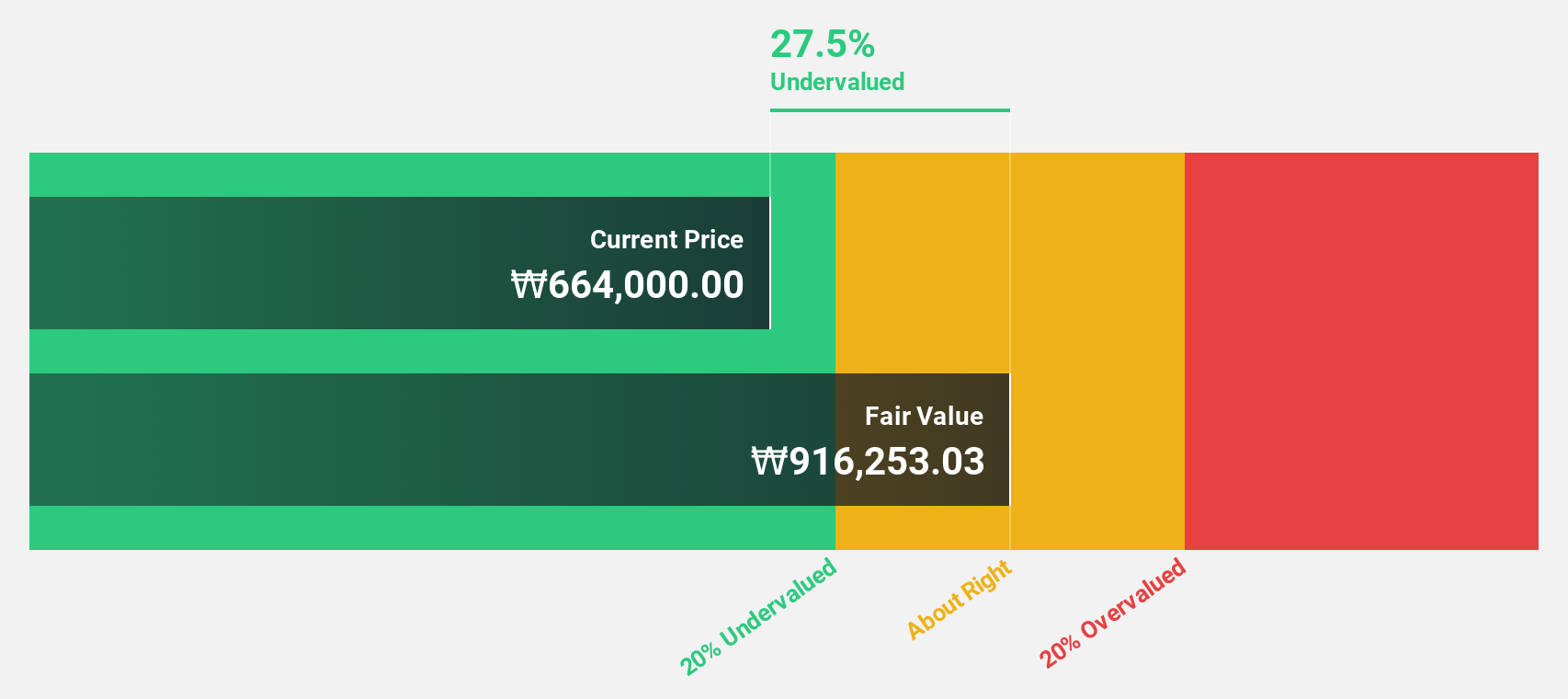

PharmaResearch (KOSDAQ:A214450)

Overview: PharmaResearch Co., Ltd., along with its subsidiaries, operates as a biopharmaceutical company mainly in South Korea, with a market cap of approximately ₩4.49 trillion.

Operations: The company's revenue primarily comes from its Pharmaceuticals segment, totaling ₩496.03 billion.

Estimated Discount To Fair Value: 46.8%

PharmaResearch is trading at ₩462,500, significantly below its estimated fair value of ₩869,931.34, indicating it is undervalued by over 46%. Despite recent share price volatility, earnings are expected to grow at 28.01% annually over the next three years. Revenue growth is forecasted to outpace the Korean market average with a 25.5% annual increase. Recent dividend affirmations and participation in multiple corporate events highlight ongoing investor engagement and confidence in future performance.

- Our comprehensive growth report raises the possibility that PharmaResearch is poised for substantial financial growth.

- Get an in-depth perspective on PharmaResearch's balance sheet by reading our health report here.

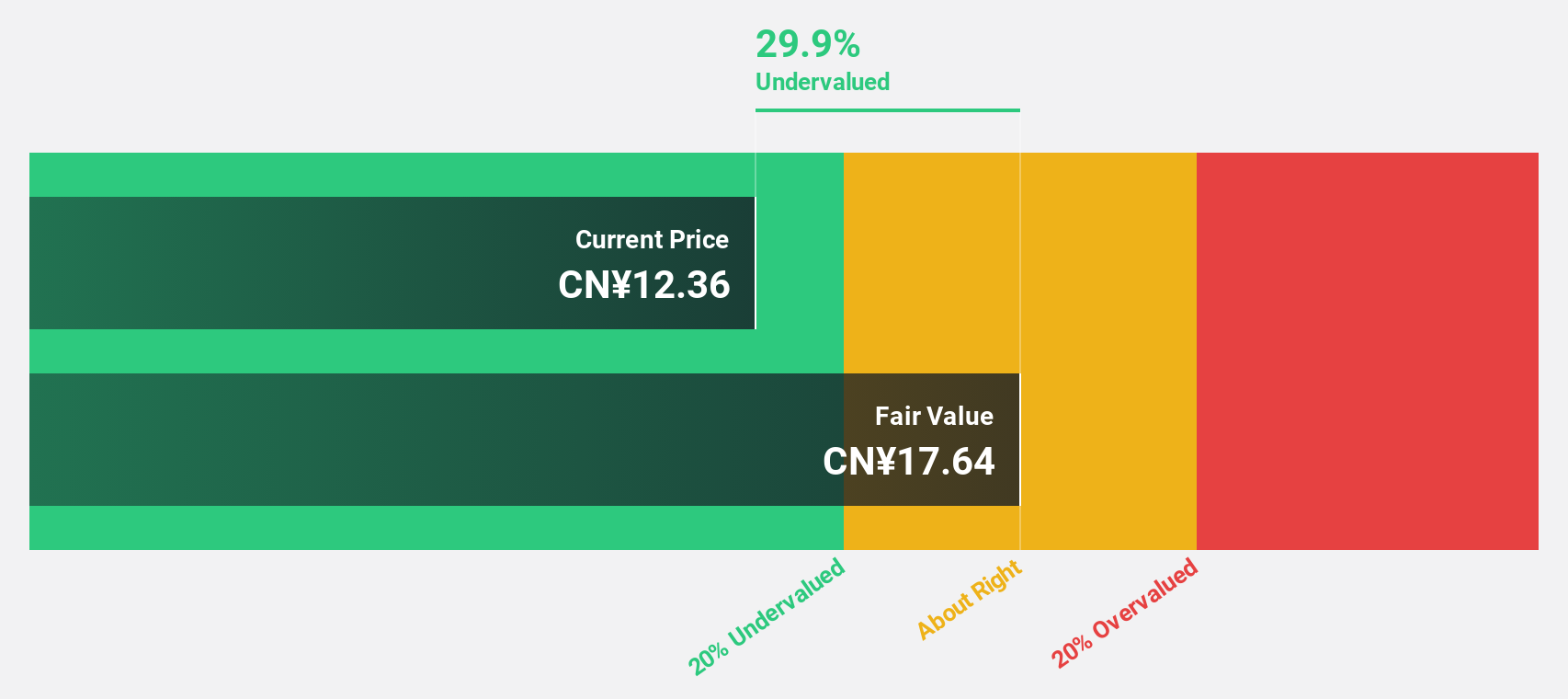

Zhejiang Century Huatong GroupLtd (SZSE:002602)

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and artificial intelligence cloud data sectors both in China and internationally, with a market cap of CN¥133.60 billion.

Operations: The company's revenue is derived from its operations in auto parts, Internet games, and artificial intelligence cloud data sectors.

Estimated Discount To Fair Value: 49.8%

Zhejiang Century Huatong Group Ltd is trading at CN¥19.06, significantly below its estimated fair value of CN¥37.96, suggesting it is undervalued by over 49%. The company has announced a share repurchase program worth up to CN¥600 million, indicating strong cash flow management and shareholder value focus. Despite recent share price volatility and large one-off items affecting earnings quality, profits are forecasted to grow significantly faster than the Chinese market average.

- Upon reviewing our latest growth report, Zhejiang Century Huatong GroupLtd's projected financial performance appears quite optimistic.

- Take a closer look at Zhejiang Century Huatong GroupLtd's balance sheet health here in our report.

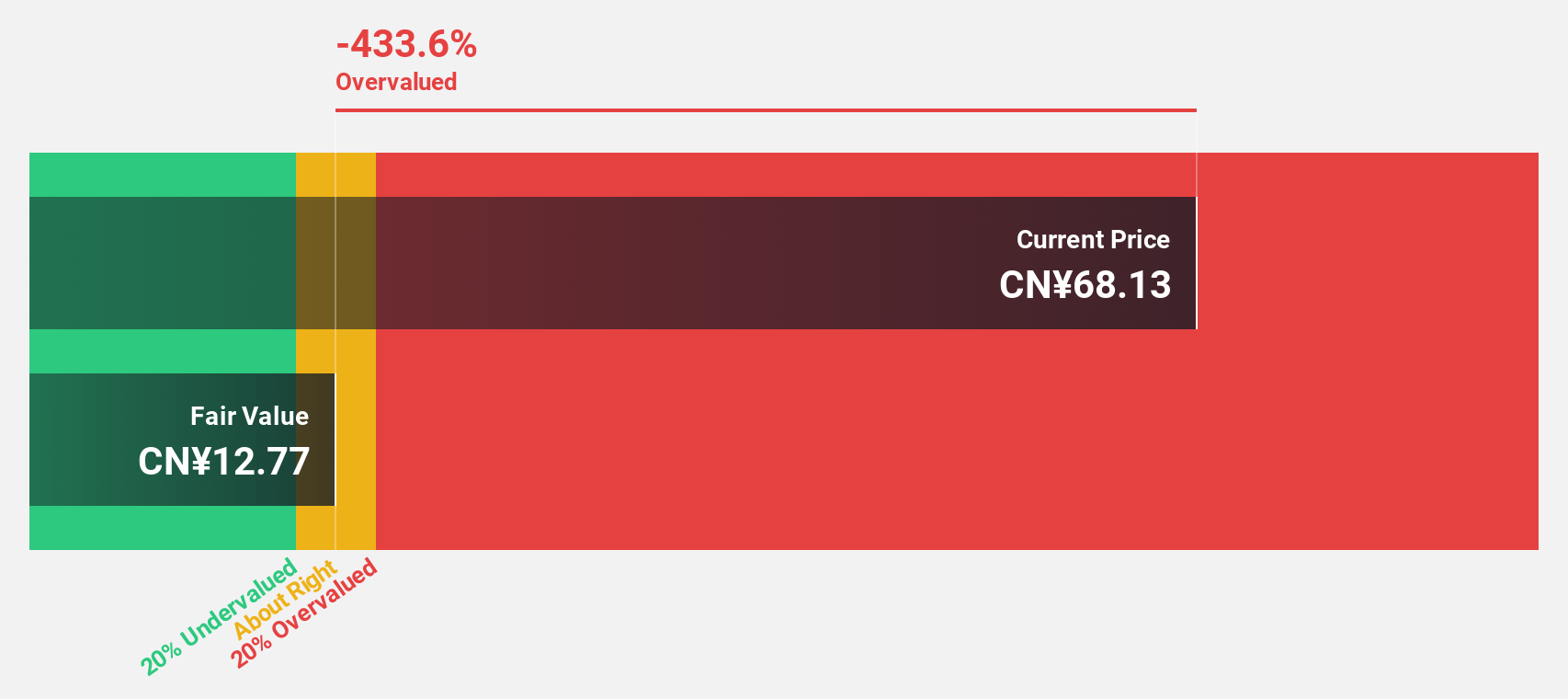

Huatu Cendes (SZSE:300492)

Overview: Huatu Cendes Co., Ltd. is an architectural design company offering professional design, consulting, and engineering services to various enterprises and government agencies in China, with a market cap of CN¥15.08 billion.

Operations: Huatu Cendes generates revenue through its architectural design, consulting, and engineering services provided to state-owned enterprises, private businesses, multinational corporations, and government agencies in China.

Estimated Discount To Fair Value: 18%

Huatu Cendes is trading at CN¥87.45, below its estimated fair value of CN¥106.7, reflecting undervaluation. Despite an unstable dividend history, earnings are projected to grow significantly at 41.3% annually, outpacing the Chinese market's 27.6%. Recent earnings for nine months show revenue of CN¥2.46 billion and net income of CN¥249.12 million, highlighting robust cash flow potential amidst evolving company bylaws and profit distribution plans.

- In light of our recent growth report, it seems possible that Huatu Cendes' financial performance will exceed current levels.

- Click here to discover the nuances of Huatu Cendes with our detailed financial health report.

Summing It All Up

- Click this link to deep-dive into the 482 companies within our Undervalued Global Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com