What PVH (PVH)'s Competition Jitters and Transition Plan Debate Means For Shareholders

- In early January 2026, PVH drew attention as an analyst report flagged weak constant-currency growth, low free cash flow margins, and declining returns on capital, while a separate downgrade cited intensifying competition and the company’s ongoing business transition.

- At the same time, PVH’s Calvin Klein and Tommy Hilfiger brands, along with its PVH+ Plan focused on cost discipline and a simpler operating model, were highlighted as key levers the company is using to reinforce its position despite these headwinds.

- We’ll now explore how concerns about rising competition and PVH’s business transition affect the company’s existing investment narrative and assumptions.

The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

PVH Investment Narrative Recap

To own PVH, you essentially need to believe that Calvin Klein and Tommy Hilfiger can keep earning their place in consumers’ wardrobes while the PVH+ cost and simplification plan steadily improves profitability. The recent caution on weak constant currency growth and declining returns, along with the downgrade on rising competition, reinforces that the main near term catalyst is execution on this transition, while the biggest current risk remains pressure on margins and returns rather than any single downgrade.

Against that backdrop, PVH’s reaffirmed 2025 guidance for low single digit revenue growth (with constant currency flat to slightly up) is the announcement that feels most relevant. It sits directly against the latest concerns about weak constant currency trends and intensifying competition, and puts even more focus on whether PVH can translate its brand strength and PVH+ initiatives into consistent earnings quality rather than one off swings.

Yet behind the power of Calvin Klein and Tommy Hilfiger, investors should be aware of the risk that...

Read the full narrative on PVH (it's free!)

PVH's narrative projects $9.4 billion revenue and $707.7 million earnings by 2028. This requires 2.3% yearly revenue growth and a $239.2 million earnings increase from $468.5 million today.

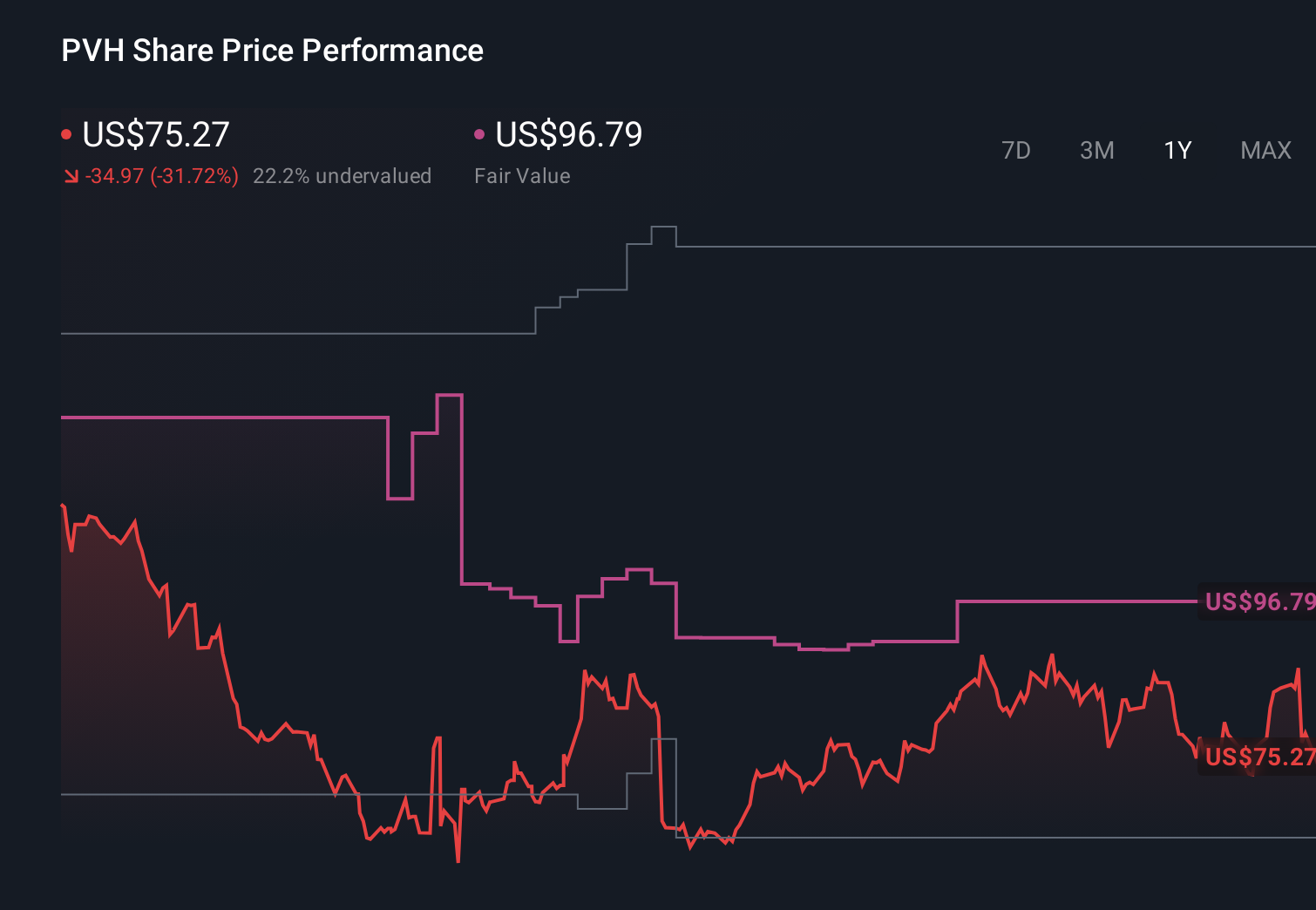

Uncover how PVH's forecasts yield a $96.79 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently see PVH’s fair value anywhere between US$67.10 and US$216.96, underscoring how far apart views can be. Set against this, the concerns about margin pressure and declining returns on capital make it even more important to compare these different perspectives before deciding how PVH might fit into your portfolio.

Explore 7 other fair value estimates on PVH - why the stock might be worth over 3x more than the current price!

Build Your Own PVH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PVH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PVH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PVH's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com