3 European Stocks That May Be Trading Below Fair Value By Up To 40.9%

As the pan-European STOXX Europe 600 Index reaches new highs, buoyed by an improving economic environment, investors are increasingly on the lookout for stocks that may be trading below their intrinsic value. In this context of robust market performance, identifying undervalued stocks requires careful analysis of fundamentals and market conditions to uncover opportunities where stock prices do not fully reflect a company's potential.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN132.80 | PLN258.95 | 48.7% |

| Streamwide (ENXTPA:ALSTW) | €73.20 | €142.74 | 48.7% |

| Recupero Etico Sostenibile (BIT:RES) | €6.66 | €12.93 | 48.5% |

| KB Components (OM:KBC) | SEK42.80 | SEK82.91 | 48.4% |

| Fodelia Oyj (HLSE:FODELIA) | €5.42 | €10.72 | 49.5% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.08 | 48.7% |

| Elekta (OM:EKTA B) | SEK58.10 | SEK114.27 | 49.2% |

| Dynavox Group (OM:DYVOX) | SEK103.70 | SEK203.92 | 49.1% |

| DEUTZ (XTRA:DEZ) | €9.535 | €18.95 | 49.7% |

| Boliden (OM:BOL) | SEK547.20 | SEK1091.07 | 49.8% |

Let's dive into some prime choices out of the screener.

Kempower Oyj (HLSE:KEMPOWR)

Overview: Kempower Oyj manufactures and sells electric vehicle charging equipment and solutions for various vehicles across the Nordics, Europe, North America, and internationally, with a market cap of €874.84 million.

Operations: The company generates revenue of €251.10 million from its electric vehicle charging equipment and solutions segment, serving cars, buses, trucks, boats, aviation, and machinery across multiple regions including the Nordics and North America.

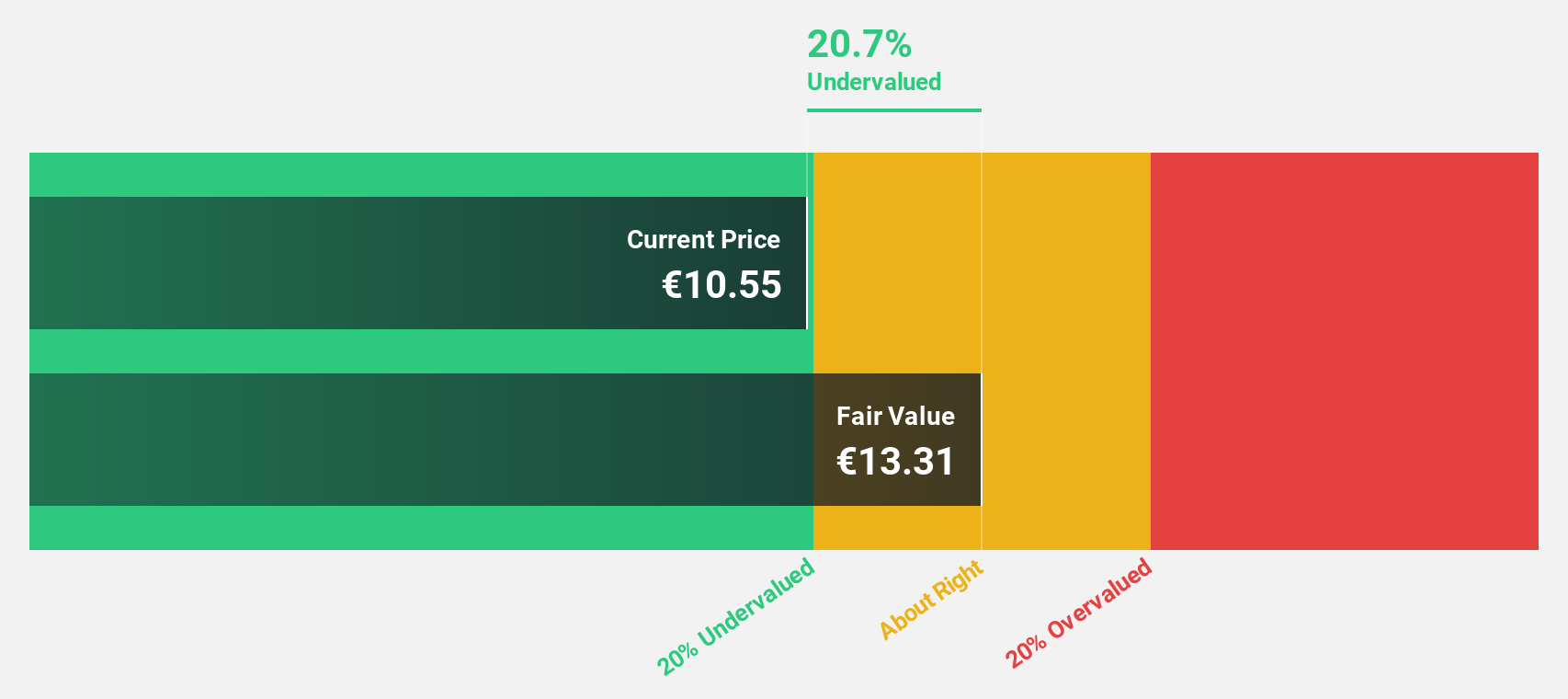

Estimated Discount To Fair Value: 23.6%

Kempower Oyj, trading at €15.79, is considered undervalued based on discounted cash flow analysis with a fair value estimate of €20.67, more than 20% higher than its current price. The company expects significant revenue growth between 10% to 21% for the latter half of 2025 and aims to become profitable within three years. Recent collaborations with Kalmar on DC charging solutions enhance its market position and potential future cash flows despite current net losses.

- Insights from our recent growth report point to a promising forecast for Kempower Oyj's business outlook.

- Click to explore a detailed breakdown of our findings in Kempower Oyj's balance sheet health report.

Asker Healthcare Group (OM:ASKER)

Overview: Asker Healthcare Group AB offers medical supplies, devices, equipment, and related solutions to support patient care with a market cap of SEK32.99 billion.

Operations: The company generates revenue from its segments as follows: West with SEK8.23 billion, Central with SEK2.92 billion, and North (including East) with SEK5.45 billion.

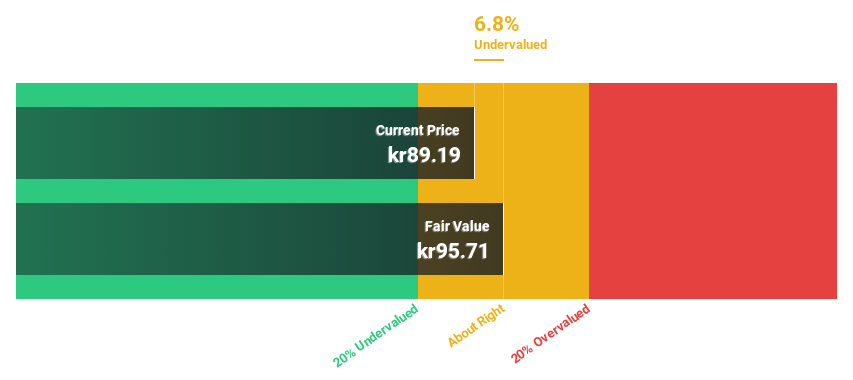

Estimated Discount To Fair Value: 40.9%

Asker Healthcare Group, trading at SEK 86.12, is significantly undervalued with a fair value estimate of SEK 145.81, over 20% higher than its current price. Despite high debt levels, earnings are forecast to grow annually by 25.27%, outpacing the Swedish market's growth rate of 13.2%. Recent board changes and strong Q3 results—with sales rising to SEK 4.13 billion—highlight operational resilience and potential for future cash flow improvements.

- The analysis detailed in our Asker Healthcare Group growth report hints at robust future financial performance.

- Get an in-depth perspective on Asker Healthcare Group's balance sheet by reading our health report here.

AUTO1 Group (XTRA:AG1)

Overview: AUTO1 Group SE is a technology company that operates a digital platform for buying and selling used cars online across Germany, France, Italy, and other international markets, with a market cap of €6.09 billion.

Operations: The company generates its revenue through two main segments: Retail, which accounts for €1.62 billion, and Merchant, contributing €6.12 billion.

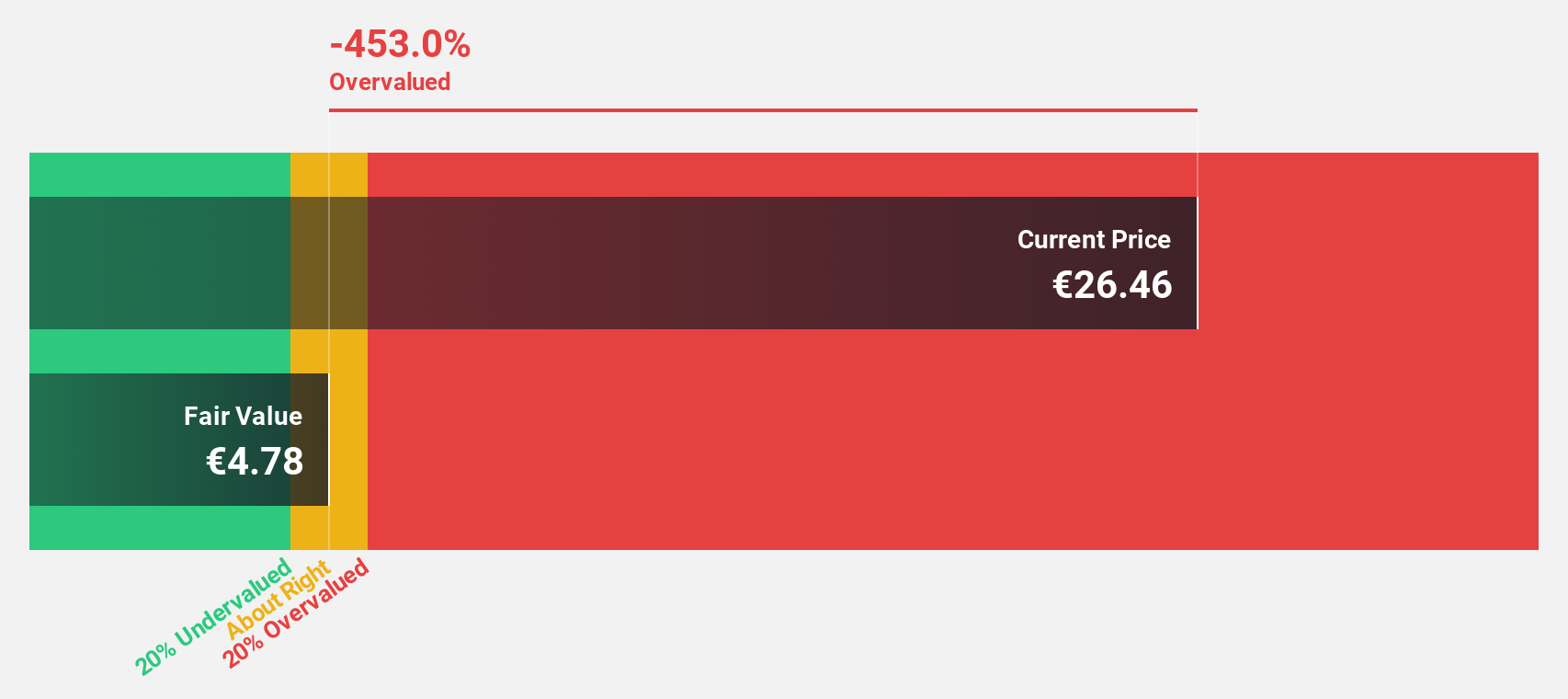

Estimated Discount To Fair Value: 39.1%

AUTO1 Group is trading at €27.64, significantly undervalued compared to its fair value estimate of €45.35. Recent enhancements, such as the AI-powered AUTO1 Car Audit Technology, improve operational efficiency and transparency in vehicle refurbishment. The upsizing of inventory asset-backed securitisations to finance up to €1.6 billion supports growth ambitions despite high debt levels not fully covered by operating cash flow. Earnings are expected to grow 31.4% annually, surpassing market averages in Germany.

- In light of our recent growth report, it seems possible that AUTO1 Group's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of AUTO1 Group.

Where To Now?

- Discover the full array of 201 Undervalued European Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com