Playboy, Inc.'s (NASDAQ:PLBY) 26% Share Price Plunge Could Signal Some Risk

Playboy, Inc. (NASDAQ:PLBY) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 35% in the last year.

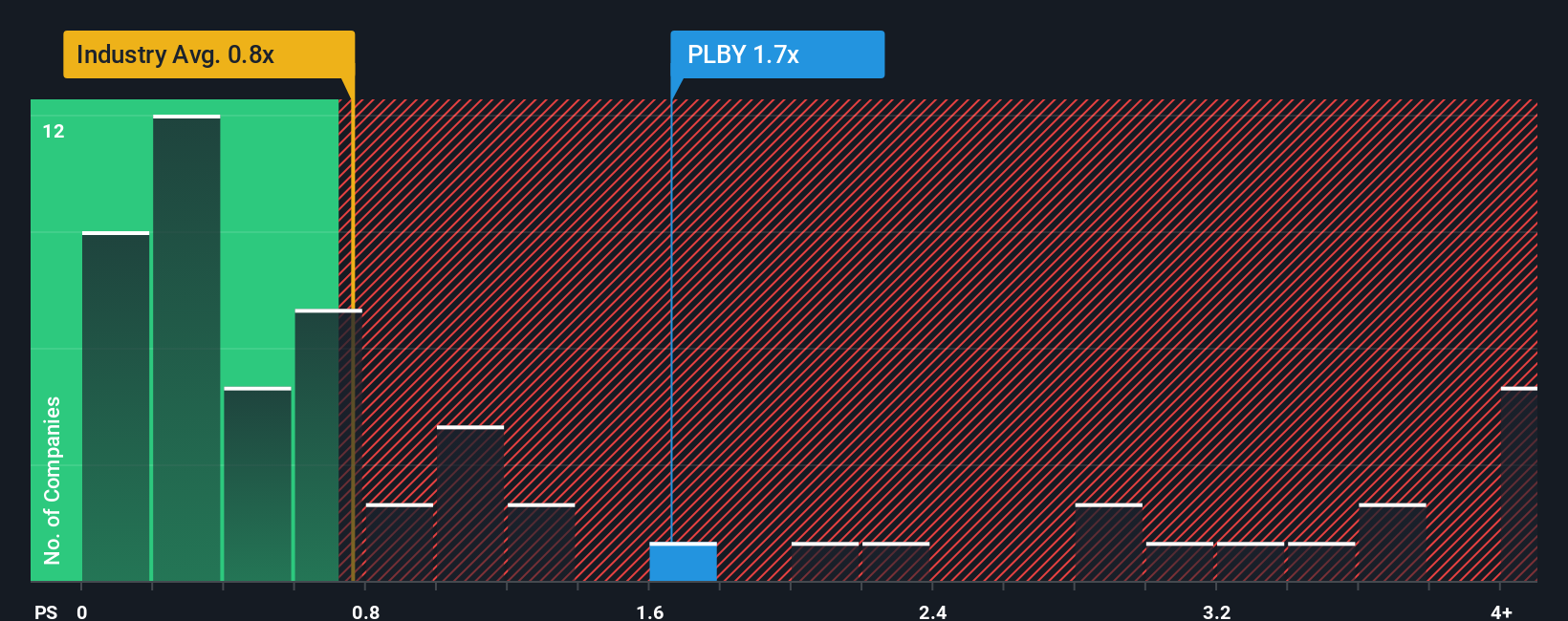

In spite of the heavy fall in price, when almost half of the companies in the United States' Luxury industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider Playboy as a stock probably not worth researching with its 1.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Playboy

What Does Playboy's Recent Performance Look Like?

Playboy could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Playboy's future stacks up against the industry? In that case, our free report is a great place to start.How Is Playboy's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Playboy's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 32%. The last three years don't look nice either as the company has shrunk revenue by 49% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.3% as estimated by the three analysts watching the company. With the industry predicted to deliver 5.6% growth , the company is positioned for a comparable revenue result.

In light of this, it's curious that Playboy's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Playboy's P/S?

Playboy's P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting Playboy's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Playboy that you need to be mindful of.

If these risks are making you reconsider your opinion on Playboy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.