Does Pfizer (PFE) Offer Long Term Value After A 36% Three Year Share Price Slide

- If you are wondering whether Pfizer's current share price offers good value, this article will walk through what the latest data suggests and how to think about it in practical terms.

- Pfizer's shares last closed at US$25.28, with a 1.5% return over the past 7 days, a 1.9% decline over 30 days, and returns of 0.4% year to date, 0.9% over 1 year, a 36.6% decline over 3 years, and a 12.5% decline over 5 years.

- Recent attention on Pfizer has focused on how its post pandemic positioning in pharmaceuticals and biotech fits into the wider sector and what that might imply for long term demand for its portfolio. Investors are weighing this context against the share price moves you see in the recent return numbers.

- Pfizer currently has a valuation score of 5/6, based on a framework that adds 1 point for each of 6 checks where the company appears undervalued. We will look at the approaches behind that score next, then finish with a way to tie these models together into a clearer view of what the stock might be worth to you.

Find out why Pfizer's 0.9% return over the last year is lagging behind its peers.

Approach 1: Pfizer Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company might be worth by projecting its future cash flows and then discounting them back to today using an appropriate rate. It is essentially asking what all those future dollars are worth in present terms.

For Pfizer, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is about US$9.9b. Analyst inputs and subsequent extrapolations project free cash flow of around US$16.4b in 2030, with a series of yearly projections in between that are discounted to reflect time and risk.

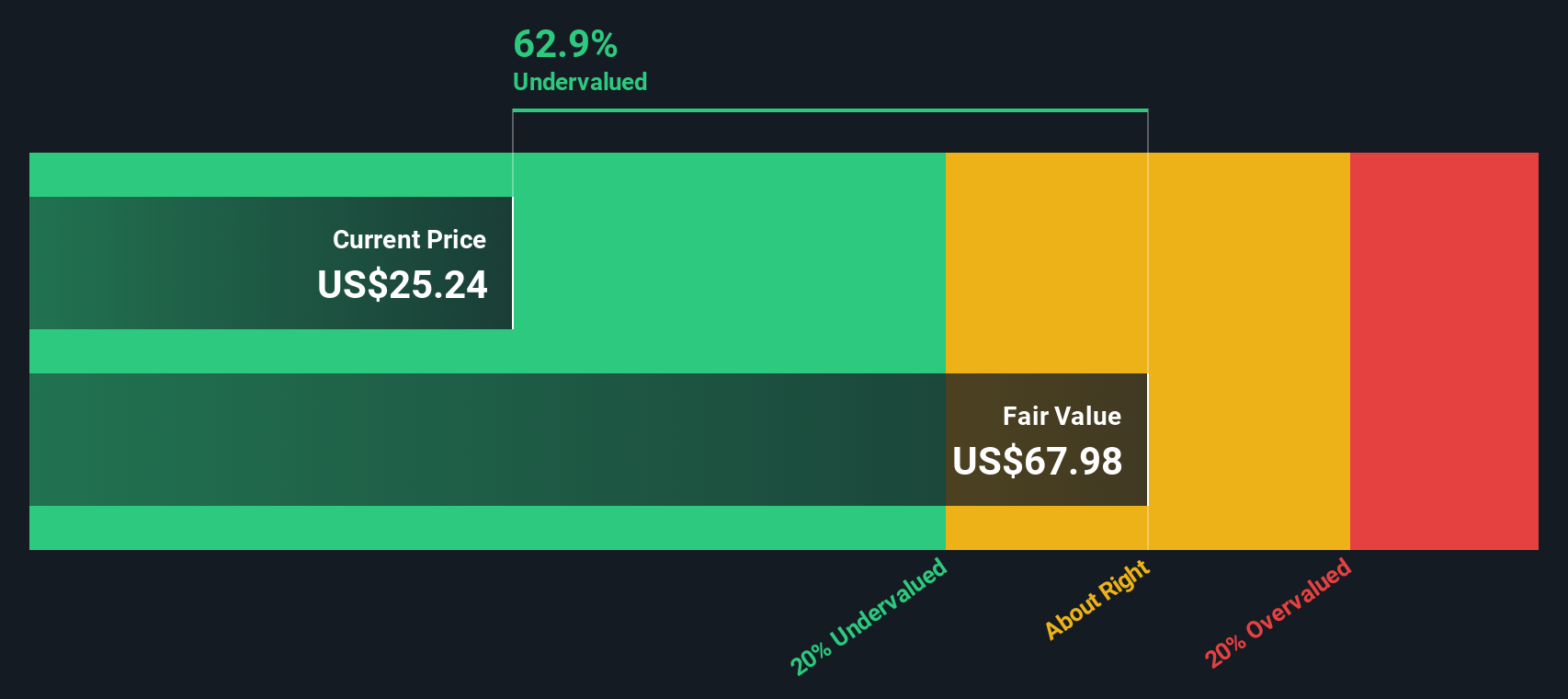

Putting those cash flows together, the DCF model arrives at an estimated intrinsic value of US$62.95 per share. Compared with the recent share price of US$25.28, this suggests an intrinsic discount of 59.8%. This indicates that, under this specific model and its assumptions, the shares are trading well below the model’s estimate of value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pfizer is undervalued by 59.8%. Track this in your watchlist or portfolio, or discover 884 more undervalued stocks based on cash flows.

Approach 2: Pfizer Price vs Earnings

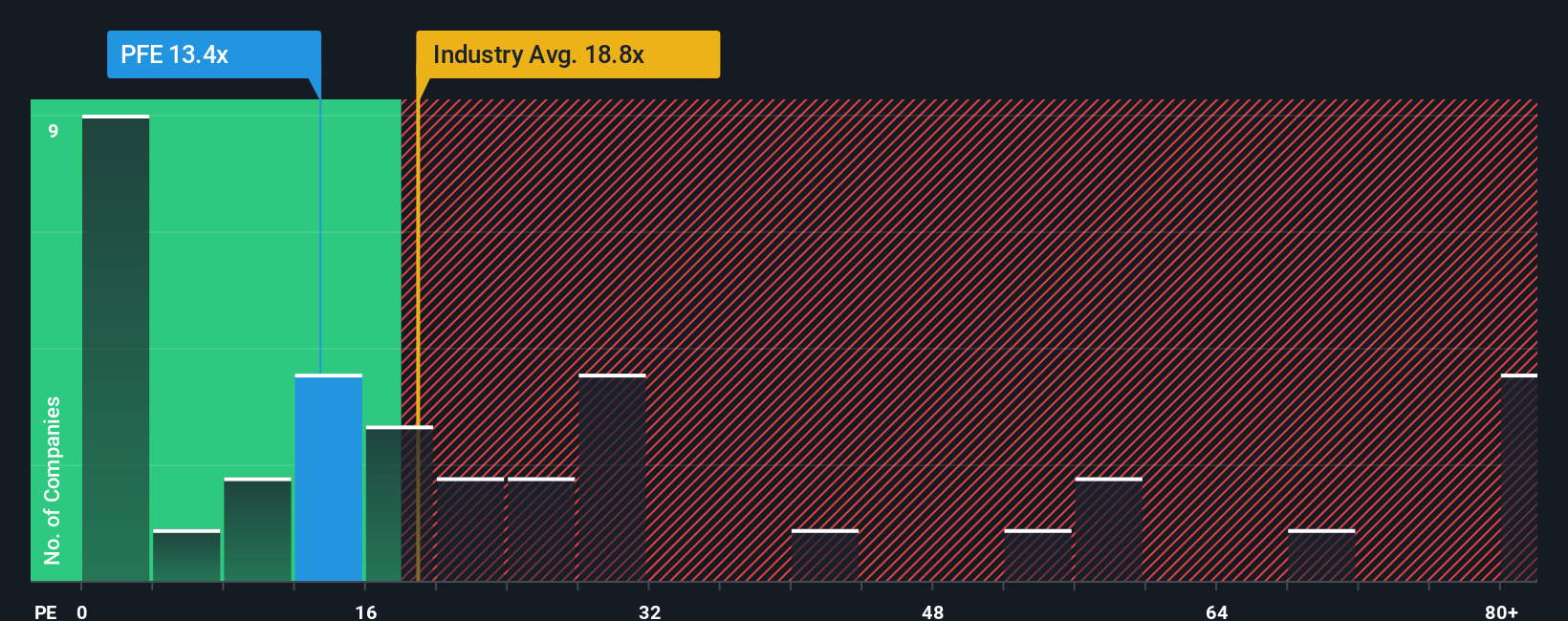

For profitable companies like Pfizer, the P/E ratio is a straightforward way to relate what you pay for each share to the earnings that support it. It gives you a quick sense of how many dollars of price you are paying for one dollar of earnings.

What counts as a "normal" P/E usually reflects how quickly earnings are expected to grow and how risky those earnings are. Higher growth or lower perceived risk can justify a higher multiple, while slower growth or higher risk can point to a lower one.

Pfizer currently trades on a P/E of 14.67x. That sits below the Pharmaceuticals industry average of 19.90x and also below the peer average of 18.52x. Simply Wall St’s Fair Ratio for Pfizer is 24.04x, which is its estimate of an appropriate P/E given factors like earnings growth, industry, profit margin, market cap and company specific risks.

The Fair Ratio goes further than a simple industry or peer comparison because it is tailored to Pfizer’s own profile rather than assuming all companies in the group deserve roughly the same multiple. Compared with the current 14.67x P/E, the Fair Ratio of 24.04x points to Pfizer trading below that model based view of fair value.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pfizer Narrative

Earlier we mentioned that there is an even better way to understand valuation. On Simply Wall St you can use Narratives, which let you write the story you believe about Pfizer, translate that story into specific forecasts for revenue, earnings and margins, and link those forecasts to a fair value. You can then see in the Community page how different views range from someone who sees Pfizer as worth about US$24 per share because of ongoing pricing and patent pressures, to another who sees closer to US$36 on the back of obesity drugs, oncology and margins. Each Narrative updates as new news or earnings arrive and helps you compare that fair value to today’s price to decide whether the stock looks expensive, cheap or about right for you.

For Pfizer however we will make it really easy for you with previews of two leading Pfizer Narratives:

These sit on opposite sides of the debate, so you can see how different assumptions about growth, margins and the sector feed into very different fair values.

Fair value in this Narrative: US$29.08 per share

Implied discount to this fair value at US$25.28: about 13.1% below the Narrative fair value

Revenue growth assumption: 2.93% annual decline

- Sees Pfizer leaning into obesity drugs, oncology and higher margin biologics to offset patent expiries and industry pressures over time.

- Assumes margins improve as digital tools, automation and portfolio reshaping lift efficiency, even while headline revenue drifts lower.

- Takes the view that by 2028, earnings and a P/E of about 17.4x can support a fair value around US$29, provided current plans and pipeline progress stay on track.

Fair value in this Narrative: US$24.00 per share

Implied premium to this fair value at US$25.28: about 5.3% above the Narrative fair value

Revenue growth assumption: 4.21% annual decline

- Focuses on drug price negotiations, patent expiries and rising competition as ongoing headwinds for Pfizer’s revenue and pricing power.

- Assumes that new products and deals will not fully offset the revenue hit from older drugs losing exclusivity, even if margins improve somewhat.

- Anchors on a lower fair value of US$24 with a P/E closer to 14.2x, implying the current share price already reflects much of what this view expects.

Taken together, these Narratives frame a reasonable question for you as an investor: do you lean closer to the obesity and oncology driven upside case, or the tighter pricing and patent pressure case, or somewhere in between based on your own expectations for Pfizer’s portfolio and the wider sector over the next few years?

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for Pfizer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com