The Bull Case For adidas (XTRA:ADS) Could Change Following Bank of America’s Rare Sell Rating

- In the past few days, Bank of America issued a rare sell rating on adidas, citing slowing growth trends and intensifying competition from brands such as Nike, On, Asics and Puma.

- The downgrade raises questions about whether shifting consumer preferences and fading casualization trends could challenge adidas’ existing brand and product momentum.

- Next, we will examine how Bank of America’s concerns about slowing growth and competition may influence adidas’ broader investment narrative.

Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

adidas Investment Narrative Recap

To own adidas, you generally need to believe the brand can keep converting its global reach, product innovation and direct-to-consumer push into resilient demand, even as fashion cycles shift. Bank of America’s sell rating puts a sharper spotlight on competitive intensity and fading casualization, but it does not fundamentally alter the near term catalyst of product and channel execution; instead, it reinforces that the biggest risk right now is losing share and pricing power in key markets like the U.S.

The recent 2025 guidance upgrade, with currency neutral revenue for the adidas brand expected to grow around 9% and operating profit targeted at about €2.0 billion, sits in clear tension with Bank of America’s more cautious view. For investors, that contrast brings the focus squarely onto whether adidas’ product pipeline and regional growth, especially in emerging markets and performance categories, can offset rising competition and fashion risk in mature markets.

However, investors should also be aware that intensifying competition could quietly erode adidas’ pricing power and margin resilience over time, especially if...

Read the full narrative on adidas (it's free!)

adidas' narrative projects €31.1 billion revenue and €2.5 billion earnings by 2028. This requires 8.2% yearly revenue growth and about a €1.3 billion earnings increase from €1.2 billion today.

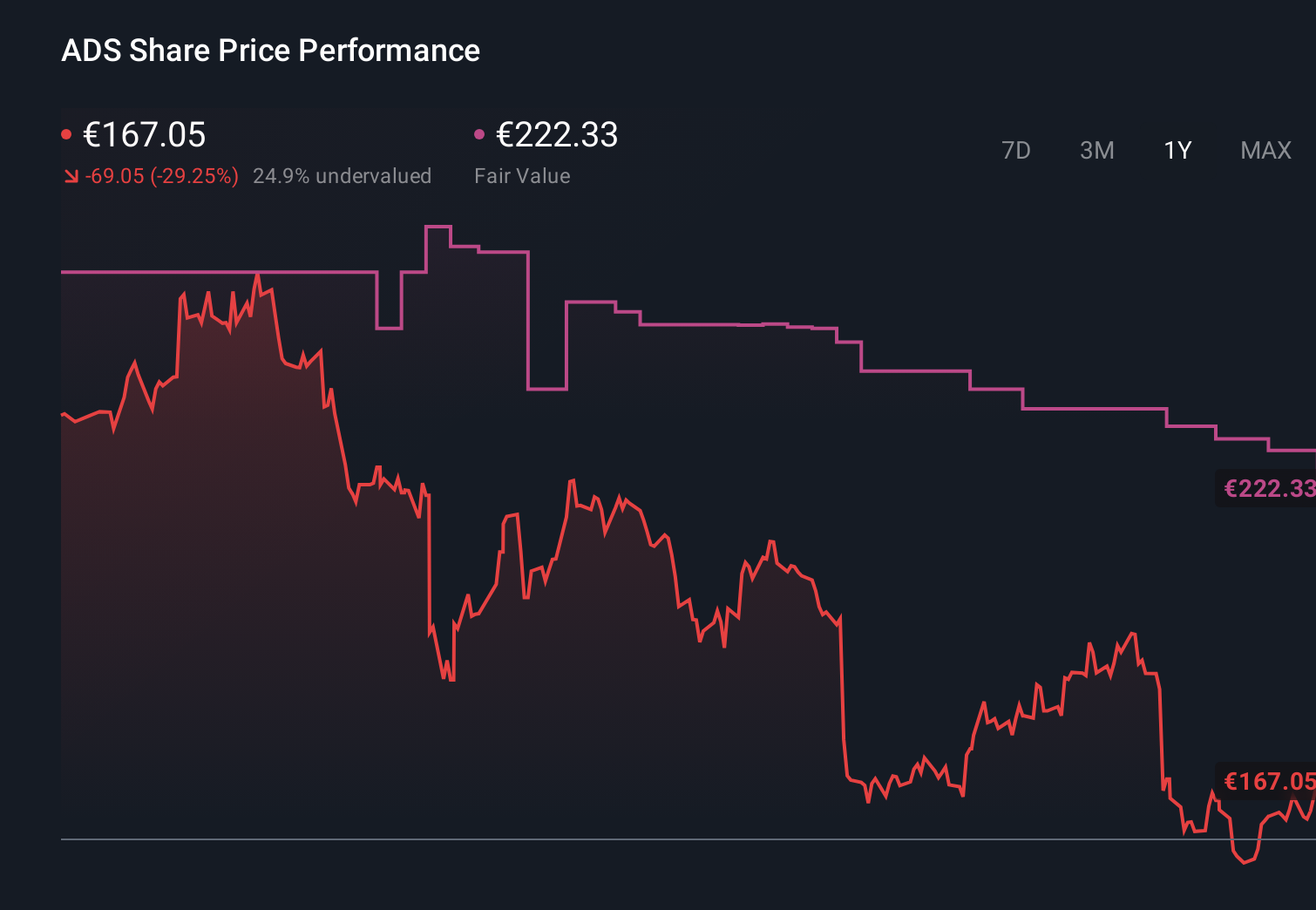

Uncover how adidas' forecasts yield a €223.57 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community currently place adidas’ fair value between €187.96 and €235.35, reflecting a wide spread of individual expectations. Set against Bank of America’s sell rating and concerns over intensifying competition, this range underlines how differently investors can interpret the same risks and prompts you to weigh several viewpoints before forming your own.

Explore 8 other fair value estimates on adidas - why the stock might be worth as much as 46% more than the current price!

Build Your Own adidas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your adidas research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free adidas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate adidas' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com