Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA) Might Be Having Difficulty Using Its Capital Effectively

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Having said that, from a first glance at Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Loma Negra Compañía Industrial Argentina Sociedad Anónima:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.053 = AR$78b ÷ (AR$1.8t - AR$376b) (Based on the trailing twelve months to September 2025).

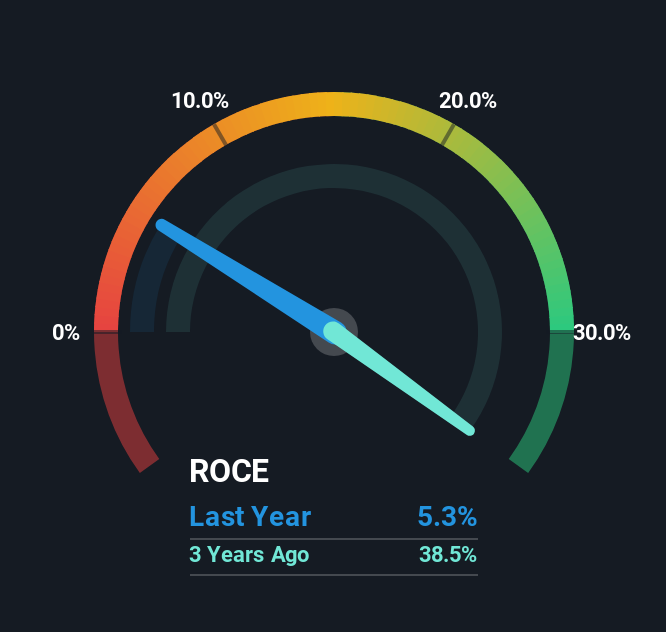

So, Loma Negra Compañía Industrial Argentina Sociedad Anónima has an ROCE of 5.3%. In absolute terms, that's a low return and it also under-performs the Basic Materials industry average of 12%.

See our latest analysis for Loma Negra Compañía Industrial Argentina Sociedad Anónima

Above you can see how the current ROCE for Loma Negra Compañía Industrial Argentina Sociedad Anónima compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Loma Negra Compañía Industrial Argentina Sociedad Anónima for free.

What Does the ROCE Trend For Loma Negra Compañía Industrial Argentina Sociedad Anónima Tell Us?

In terms of Loma Negra Compañía Industrial Argentina Sociedad Anónima's historical ROCE movements, the trend isn't fantastic. Over the last five years, returns on capital have decreased to 5.3% from 21% five years ago. Given the business is employing more capital while revenue has slipped, this is a bit concerning. This could mean that the business is losing its competitive advantage or market share, because while more money is being put into ventures, it's actually producing a lower return - "less bang for their buck" per se.

What We Can Learn From Loma Negra Compañía Industrial Argentina Sociedad Anónima's ROCE

In summary, we're somewhat concerned by Loma Negra Compañía Industrial Argentina Sociedad Anónima's diminishing returns on increasing amounts of capital. Yet despite these poor fundamentals, the stock has gained a huge 208% over the last five years, so investors appear very optimistic. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

One more thing, we've spotted 2 warning signs facing Loma Negra Compañía Industrial Argentina Sociedad Anónima that you might find interesting.

While Loma Negra Compañía Industrial Argentina Sociedad Anónima may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.