3 Stocks That Might Be Priced Below Their True Value

As the U.S. stock market navigates a period of volatility, marked by recent highs followed by declines in major indices like the S&P 500 and Dow Jones Industrial Average, investors are keenly observing opportunities that may arise from these fluctuations. In such an environment, identifying stocks that might be priced below their true value can be crucial for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VTEX (VTEX) | $3.64 | $7.06 | 48.5% |

| Sea (SE) | $139.24 | $274.79 | 49.3% |

| MGM Resorts International (MGM) | $34.12 | $67.98 | 49.8% |

| Huntington Bancshares (HBAN) | $18.14 | $36.10 | 49.7% |

| Heritage Financial (HFWA) | $23.88 | $46.53 | 48.7% |

| Hecla Mining (HL) | $21.37 | $41.37 | 48.3% |

| Freshworks (FRSH) | $11.93 | $23.64 | 49.5% |

| Fifth Third Bancorp (FITB) | $49.17 | $95.23 | 48.4% |

| Fidelity National Information Services (FIS) | $66.73 | $131.06 | 49.1% |

| CNB Financial (CCNE) | $25.87 | $50.74 | 49% |

Let's explore several standout options from the results in the screener.

DoorDash (DASH)

Overview: DoorDash, Inc. operates a commerce platform connecting merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of approximately $98.86 billion.

Operations: The company's revenue is primarily generated from its Internet Information Providers segment, which accounts for $12.64 billion.

Estimated Discount To Fair Value: 37.3%

DoorDash is trading at US$230.52, significantly below its estimated fair value of US$367.81, suggesting it may be undervalued based on cash flows. The company has recently become profitable and earnings are projected to grow over 31% annually, outpacing the U.S. market average. Recent partnerships with OpenAI and major brands like UFC enhance its market reach, potentially supporting future revenue growth despite forecasts indicating slower revenue expansion than desired for a high-growth stock.

- Our comprehensive growth report raises the possibility that DoorDash is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of DoorDash stock in this financial health report.

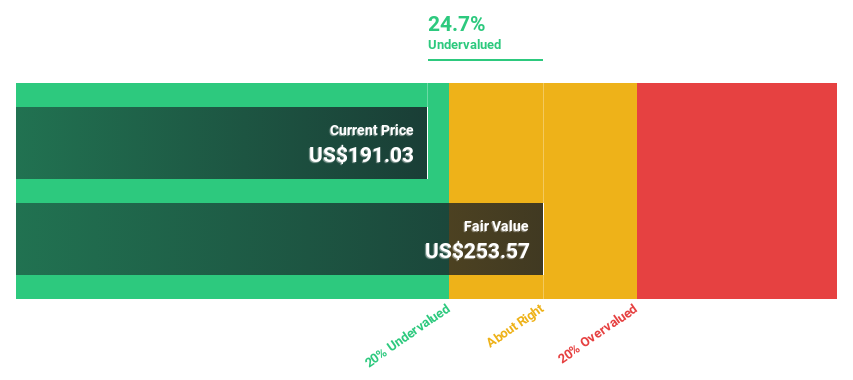

Palo Alto Networks (PANW)

Overview: Palo Alto Networks, Inc. is a cybersecurity solutions provider operating across the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan with a market cap of $135.16 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, which generated $9.56 billion.

Estimated Discount To Fair Value: 21.4%

Palo Alto Networks, trading at US$193.9, is valued 21.4% below its estimated fair value of US$246.83, indicating potential undervaluation based on cash flows. While earnings are expected to grow at 19.5% annually, surpassing the U.S. market average, recent insider selling could be a concern for investors. Strategic alliances with Google Cloud and IBM aim to enhance AI security capabilities and may bolster revenue growth prospects despite current profit margins being lower than last year.

- Our expertly prepared growth report on Palo Alto Networks implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Palo Alto Networks' balance sheet health report.

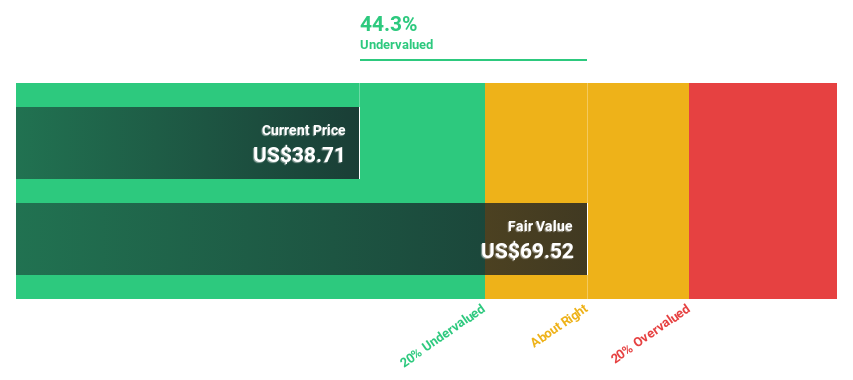

Citizens Financial Group (CFG)

Overview: Citizens Financial Group, Inc. is a bank holding company offering retail and commercial banking products and services to various customer segments in the United States, with a market cap of approximately $26.69 billion.

Operations: The company's revenue is primarily derived from Consumer Banking, which accounts for $5.79 billion, and Commercial Banking, contributing $2.43 billion.

Estimated Discount To Fair Value: 38.2%

Citizens Financial Group, trading at US$60.99, is significantly undervalued based on cash flows, with a fair value estimate of US$98.76. Earnings are projected to grow substantially at 21.66% annually, outpacing the broader U.S. market's growth rate of 16%. Recent earnings reports show improved net interest income and profitability year-over-year. The company also announced increased dividends and continued share buybacks, enhancing shareholder value despite a lower forecasted return on equity in three years.

- The growth report we've compiled suggests that Citizens Financial Group's future prospects could be on the up.

- Click here to discover the nuances of Citizens Financial Group with our detailed financial health report.

Taking Advantage

- Click here to access our complete index of 191 Undervalued US Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com