Assessing Paychex (PAYX) Valuation After Q1 2025 Beat And New AI Tools Launch

Paychex (PAYX) is back in focus after reporting better than expected total revenue growth for the first quarter of fiscal 2025 and rolling out new AI powered tools, including Paychex Flex Engage and Recruiting Copilot.

See our latest analysis for Paychex.

At a share price of US$111.63, Paychex has seen momentum cool over the past quarter, with a 90 day share price return of 10.85% and a 1 year total shareholder return of 17.91%. This suggests the recent AI product news is arriving after a tougher period for holders, yet within a longer record of positive five year total shareholder return of 43.53%.

If you are looking beyond Paychex for other tech driven opportunities in your portfolio, this could be a useful moment to scan high growth tech and AI stocks as a next step.

With Paychex trading at US$111.63 and sitting at a discount to some published value estimates, while recent returns have cooled, the central question is whether this represents a genuine entry point or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 8.6% Undervalued

With Paychex last closing at US$111.63 against a narrative fair value of about US$122, the current setup hinges on how future growth and margins play out.

The analysts have a consensus price target of $146.583 for Paychex based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $122.0.

Curious what underpins that higher value range? The narrative focuses on steady revenue expansion, firm margins, and a future earnings multiple that assumes continued strength. Want to see exactly how those building blocks stack up over the next few years?

Result: Fair Value of $122.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still a few watchpoints, including how smoothly Paycor is integrated and whether softer client demand or labor trends limit the expected earnings trajectory.

Find out about the key risks to this Paychex narrative.

Another View: What The P/E Ratio Is Saying

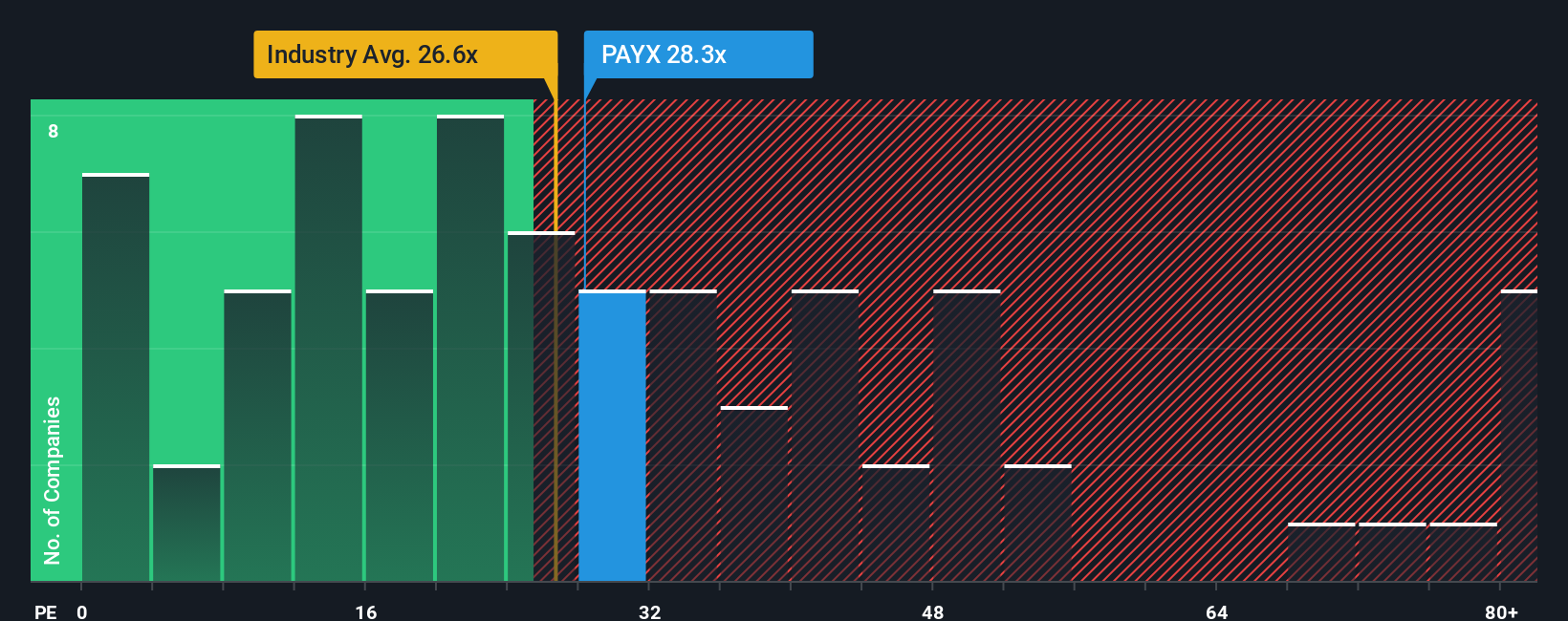

Our fair value work points to Paychex as undervalued, yet its current P/E of 25.1x sits slightly above the US Professional Services industry at 24.8x and below the peer average of 26.9x. The fair ratio sits higher again at 29.6x. That mix hints at limited downside if sentiment cools, but also raises questions about how quickly the market might move toward that higher fair ratio.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Paychex Narrative

If you look at these assumptions and think you would weigh the data differently, you can pull the numbers, test your own view, and Do it your way in just a few minutes.

A great starting point for your Paychex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more stock ideas?

If you stop with Paychex, you might miss other setups that fit your style, so use this moment to widen your watchlist while the data is fresh.

- Target potential high growers early by checking out these 3550 penny stocks with strong financials that already show stronger fundamentals than most would expect at their size.

- Explore machine learning and automation by scanning these 26 AI penny stocks that sit at the intersection of software, data and real world use cases.

- Look for potentially mispriced opportunities by reviewing these 886 undervalued stocks based on cash flows where current prices can be compared with what cash flows may suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com